Author: Charles Agle

Mentor: Dr. William Yu

Dr. Ronald E McNair Academic High School

Abstract

The paper presents an overview of the outlook of baby boomers’ retirement savings for both present and soon-to-be retirees. As the entire baby boom generation will have reached retirement age within the next couple of years, concerns arise about the economic stability of the vast majority of baby boomers. A simulation is run to analyze the ratio of retirement income and spending, along with various other figures, to help estimate the economic situation for median baby boomers. The simulation utilizes fixed income via equity, fixed income via interest rates, and Social Security as the main sources of income in retirement. The paper also addresses the different types of retirement accounts and plans as well as are being used today.

Introduction

This paper aims to assess whether the cohort of median baby boomers has enough savings to ensure economic stability throughout their retirement. “Retirement income security in the United States has traditionally been based on the so-called three-legged stool: Social Security, private pensions, and other personal savings (Gale 1997).” These three pillars give an overview of how a retiree or aspiring retiree may save. Many baby boomers will be unable to maintain their standard of living throughout retirement and are likely to be reliant on Social Security. It was found that ⅓ of young baby boomers will rely on Social Security for 90% of their retirement income (Picchi & Sherter, 2024). Since Social Security is meant to typically account for 40% of retirement income, it is clear that many baby boomers are or will have some sort of financial difficulty in the future. Since baby boomers are one of the largest generations ever, their retirement deeply affects the economy. This paper hopes to explore the issues that baby boomers may face during retirement and provide insight into issues regarding fulfilling retirement income.

I chose the median net worth of baby boomers for the express reason that there are large outliers. According to the Federal Reserve Survey of Consumer Finances, the difference in median net worth between those in the 20th-40th percentile and those in the 60th-80th percentile is $245,000 (Survey of Consumer Finances (SCF), n.d.). As the gap between the wealthiest and poorest retirees is massive, using other statistical measures, such as mean, provides skewed data. As medians are resistant to outliers, they are a far better representation of the overall population.

The first leg of the three-legged stool is Social Security. Social Security is a government-funded program that provides a fixed monthly payment. As the number of people currently about to retire or already retired is larger than in previous generations, the question of whether Social Security could handle the extra weight has arisen. It is generally accepted that a replacement rate of around 70% is a sufficient amount of income for retirement. Social Security benefits typically account for a replacement rate of around 40% (Biggs & Springstead, 2008). Overall, Americans are now living longer than previous generations. “In the United States, for example, life expectancy at age 65 increased from 11.9 years in 1900– 1902 to 19.1 years in 2010, and for age 80 from 5.3 to 9.1 years during the same period” (He. Et al). This increase in life expectancy is likely not something baby boomers expected when planning for retirement. The second leg of the three-legged stool is defined benefit (DBs) plans. DBs are plans where the employer pays out a certain sum of money to the employee. Social Security is considered to be akin to DBs as they both provide a stable income for life. Though DBs are very favorable to the employee as there is little to no risk taken on their part, employers tend to see DBs in a different light. Since the employer assumes the risk, DBs are normally only offered by larger corporations that have the means to properly execute these plans. Employers are required to pay out large sums of money to many former employees who no longer produce revenue; therefore, DBs tend to be viewed in a negative light by employers. (What Are Defined Benefit Retirement Plans?, n.d.). For that reason, companies have been less inclined to offer them.

The third leg of the three-legged stool is defined contribution (DC) plans, which allow employees to contribute to specialized accounts such as 401 (k). The employer may offer to match the employee’s contribution as a means to incentivize this form of retirement planning. The accounts in which the contributions are made tend to be investment accounts where the employee can invest their money as they please. In general, contributions and earnings are not taxed until they are distributed. The value of the account will change according to how much is contributed and the value of the investments made within the account (Retirement Plans Definitions | Internal Revenue Service, 2025). Companies may take a certain portion of one’s paycheck and directly contribute it to the account. The employee primarily assumes the risk of DCs, as it is predominantly their money being invested. Employees who have DCs must be careful about how they store their money. If the money in these accounts does not grow at a rate that keeps up with inflation, the employee risks losing purchasing power. On the other hand, if the employee places their money in investment vehicles that are too risky, then there is the chance of them losing the money in those accounts. To make the most of DC, it takes both education and time. Many people are not properly trained to invest their money and lack the time to research and make the smartest financial investments.

Methodology

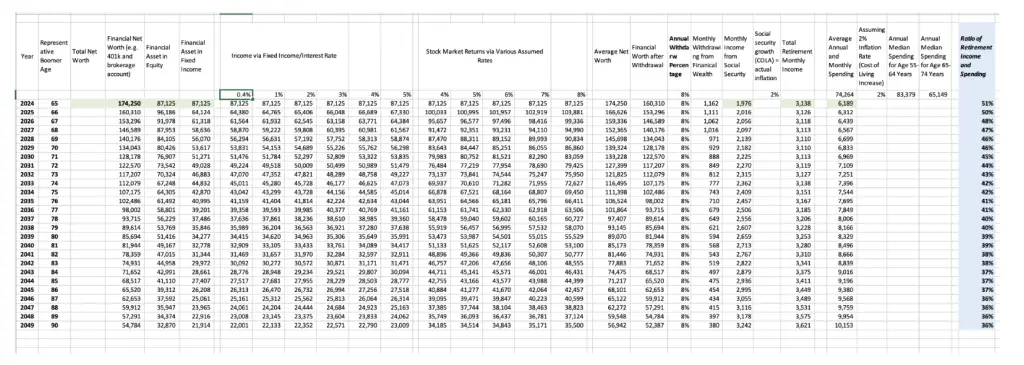

Using a simulation on Excel based on various figures and formulas, I was able to determine whether retired baby boomers had enough savings to last their retirement. Using the 4% rule, I was able to get a rough estimate of how much a person should be spending during their retirement. The 4% rule states that retirees should withdraw 4% of their retirement savings to last the entirety of their retirement (Williams & Kawashima, 2025). Through the simulation, I evaluated whether the 4% rule is feasible and allows for enough wealth to be maintained throughout retirement. According to the Federal Reserve Survey of Consumer Finance, the median financial net worth for a family of retired baby boomers is $410,000, and 42.5 percent of the family’s net worth is financial. The financial net worth of the family can then be calculated to be $174,250 (Survey of Consumer Finances (SCF), n.d.). The figures used for the simulation assume the partners of baby boomers. For the sake of the simulation, the financial net worth will be split into two different types of investments: financial assets in equity (Stocks, shares, securities, etc.), as well as financial assets in fixed income (Savings accounts, Bonds, CDs, Munis, etc). Based on Figure 2, it is shown that Financial assets in fixed income tend to yield an interest rate that is generally in the range of .4-6%

National Rates and Rate Caps

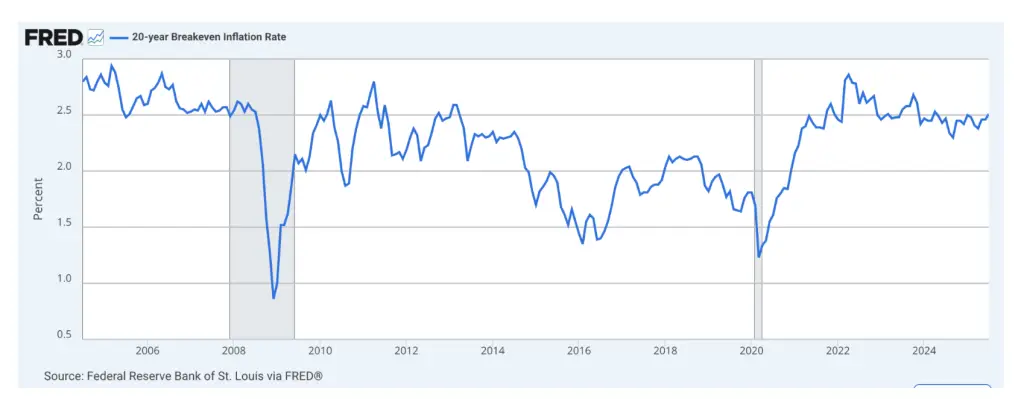

As shown by Figure 2 below, inflation over the past two decades has remained between 2% and 3%; the simulation will assume a 2.5% annual inflation rate.

Source: Federal Reserve Bank of St. Louis via FRED.

According to the Social Security Administration, the estimated monthly benefit at the beginning of 2025 was $1976 (What Is the Average Monthly Benefit for a Retired Worker?, 2025). The 2.5% COLA (Cost of Living Adjustment) has benefits to around 68 million Social Security beneficiaries in January 2025 (Cost-Of-Living Adjustment (COLA) Information | News, n.d.). This adjustment allows Social Security to keep up with inflation. This is how Social Security combats the effects of inflation on money that does not grow.

The simulation will split the median financial net worth 50-50 between financial assets in equity and financial assets in fixed income. As financial assets in equity tend to be riskier than fixed income, they offer significantly higher returns and, overall, can lead to continued wealth growth well into retirement. Retirees are able to utilize their retirement accounts, such as 401 (k) and Roth IRAs, to grow their money in equity. These accounts tend to offer subsidies to retirees, which make them very appealing and useful. 401 (k) accounts have pre-tax dollars originally contributed to them, and employers may also match contributions to these accounts as an extra incentive. Your tax is determined by the amount that you withdraw (401(k) Plan Overview | Internal Revenue Service, 2025). This is beneficial as it allows for your money to grow and only gets taxed when you withdraw it, allowing for the amount of taxes to be minimized. The amount of tax a retiree pays, based on the amount withdrawn, is beneficial to the retiree as it allows them to be strategic in their withdrawals and optimize the amount paid in taxes. In addition to 401 (k), IRAs are extremely beneficial in regard to retirement savings. There are several types of IRAs that retirees may take advantage of. Though their benefits differ, they all tend to use pre-tax dollars as initial contributions, and the earnings are then taxed. As retirees tend to be in far lower tax brackets during retirement, the tax they pay is heavily offset (Which IRA’s Are Right for You?, n.d.).

Using figures provided by Robert J Shiller, an economist for the Yale School of Management, the average stock return based on the S&P 500, accounting for taxes, over the past 20 years is approximately 6% (Shiller, n.d.). The 6% is the real amount that retirees are able to utilize. Even though the return from the S&P 500 is roughly 8% this number is a nominal amount which does not account for taxes and other fees that impact the amount withdrawn. 6% is the amount that baby boomers will be able to utilize during retirement. For the sake of the simulation, we will assume a 2% margin of error, so the simulation will account for financial assets in equity by averaging returns from 4% to 8%. To calculate the returns from fixed income via interest and financial assets in equity, the simulation uses the simple interest formula P*(1+interest rate). The principle would be $81,750 for each, since their financial net worth is being put equally into both types of vessels. The principle is how much money the retirees have after the cost of living is subtracted. The average monthly spend is calculated by using the 4% rule and adjusting it for inflation; however, since we are assessing the families of baby boomers, we will use 8% instead to account for two people. The average life span is currently 75.8 years for males and 81.1 years for females (FastStats – Life Expectancy, 2025). The simulation, however, assumes a 90-year life span to account for cases where retirees may live longer than the average life span, and the simulation will still provide results for persons who will pass away before this age. The average annual spending is calculated by averaging the median annual spending for persons aged 55-64 and 65-74, which comes out to roughly $74,000.

Conclusion/Future Use

Based on the simulation, it is shown that overall, retired families of baby boomers will be unable to bridge the gap between the ratio of retirement income and spending. As previously stated in the introduction, a 70% replacement rate is generally considered sufficient for retirement. It is essential to note that the simulation has several limitations, as outlined in the limitations section of the paper. Retired baby boomers should aim for the Ratio of retirement income and spending to be 100% as this illustrates that their spending needs in relation to income are fully met.

As shown by Figure 3, the simulation predicts that families of retired baby boomers have limited economic resources to sustain them for the remainder of their retirement. As previously stated, since the simulation accounts for families of baby boomers, the 4% rule is doubled, and instead the monthly withdrawal becomes 8%. The ratio of retirement income and spending is around 50% at the beginning of retirement, and by the age of 90, it drops to 36%. This shows a clear deficit, especially later in retirement, where the ratio of retirement income and spending progressively gets further from the prescribed 70%.

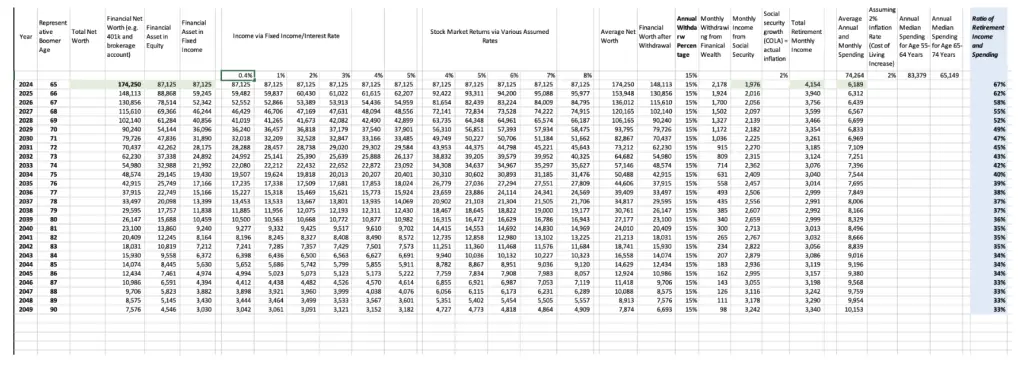

Though the 4% rule is what is the general recommendation for retirees, it is unrealistic to assume that all baby boomers are or will be able to abide by it. Especially later in life, when the cost of living may increase due to increasing costs for medicine and care. The simulation was run again, but instead of 8% the simulation assumed a withdrawal rate of 15%. 15% is an extreme circumstance where baby boomers are withdrawn far above the recommended amount. This can help encapsulate any situations where baby boomers have costs that are unforeseen and therefore would have otherwise been unaccounted for.

Based on Figure 4, running the simulation again with the increases in the cost of living proves that Baby Boomers will still face difficulties in bridging the gap of ratio of retirement income and spending. At the beginning, the ratio is 67% but then a steep drop to 33% occurs, further proving the economic strain baby boomers will likely undertake. At the beginning, the simulation predicted a scenario where baby boomers were able to roughly keep up with the prescribed ratio of retirement income and spending; however, as time went on, the drop in the ratio signaled that, in the long term, staying near that 70% was not feasible. A potential solution to help bridge this gap is to begin saving earlier. Starting to invest at a young age allows the principal to grow over a long period of time. That principle has the possibility to grow exponentially over time, and when the principle is increased, more growth is possible. This paper can be used as a reference and a general outline of the retirement prospects for current retirees and those who plan to retire in the near future. The simulation provides a rough outline of how one’s retirement savings could be broken up and the potential yields of these accounts. The paper could also be utilized in educating the reader on the different types of retirement plans and aiding future retirees in planning for themselves and their loved ones. The simulation provides various predictions which retirees may find interesting, such as the ratio of retirement income and spending, monthly spending increases with inflation, etc.

Limitations

It is important to note that there are several factors limiting the accuracy of the results from the simulation. Everyone has different financial situations and varying levels of financial literacy. The report from the Global Financial Literacy Center utilized the 2021 TIAA GFLEC Personal Finance Index to compare the literacy of Gen Z to other generations, such as the Silent Generation and Baby Boom Generation. Approximately 40% of Baby Boomers were unable to answer more than 50% of the questions provided by TIAA-GFLEC correctly. These results indicate that financial literacy levels remain low even throughout adulthood (Yakoboski et al., n.d.). Some families of Baby Boomers may be receiving assistance from family, friends, etc. This makes it impossible to generalize results to all boomers, as their financial situations and support systems can vary greatly from family to family. In addition, the simulation assumes that the families will invest their money in a specific way with specific accounts. However, this may not be the status quo for many Baby Boomers, and their perception of how to properly save can also vary greatly. Some families may be more risk-averse than others based on personality, environment, upbringing, etc., causing their mindset in how to invest to change. For instance, boomers born right after World War 2 and boomers born in the 60’s may have different mindsets based on how they grew up and the economic environment of the time. The simulation predicts retired Baby Boomers can maintain their standard of living, assuming several investing principles are used and that people follow the four percent rule. However, emergencies and surprise purchases are possible, and there are expenditures that the simulation is unable to predict and therefore account for. It is also impossible to perfectly predict how markets and interest rates will vary over time. Though in the long run things tend to even out, there is always the possibility that unforeseen crises will affect the markets. As many facets of the economy are related, a major change to one sector could have consequences for another, causing a domino effect. The simulation is unable to account for major shifts in markets and interest rates, meaning that the results are not certain but rather a rough estimate under proper conditions.

References

Biggs, A. G., & Springstead, G. R. (2008, October 2). Alternate Measures of Replacement Rates for Social Security Benefits and Retirement Income. Social Security Administration. Retrieved July 29, 2025, from https://www.ssa.gov/policy/docs/ssb/v68n2/v68n2p1.html

Choi, J. (2011, October 6). Retirement Security of the Baby Boomers: the Role of Financial Literacy and Planning. Nation Bureau of Economic Research. Retrieved July 30, 2025, from https://www.nber.org/bah/retirement-security-baby-boomers-role-financial-literacy-and-planning

Cost-of-Living Adjustment (COLA) Information | News. (n.d.). SSA. Retrieved August 21, 2025, from https://www.ssa.gov/cola/

FastStats – Life Expectancy. (2025, June 5). CDC. Retrieved August 24, 2025, from https://www.cdc.gov/nchs/fastats/life-expectancy.htm

401(k) plan overview | Internal Revenue Service. (2025, August 3). IRS. Retrieved August 23, 2025, from https://www.irs.gov/retirement-plans/plan-sponsor/401k-plan-overview

Gale, W. G. (1997, June 1). The Aging of America: Will the Baby Boom Be Ready for Retirement? Brookings. Retrieved July 28, 2025, from https://www.brookings.edu/articles/the-aging-of-america-will-the-baby-boom-be-ready-for-retirement/

He, W., Goodkind, D., & Kowal, P. (2016, March). An Aging World. US Census Bureau. Retrieved July 30, 2025, from https://www.census.gov/content/dam/Census/library/publications/2016/demo/p95-16-1.pdf

National Rates and Rate Caps – August 2025. (2025, August 18). FDIC. Retrieved August 24, 2025, from https://www.fdic.gov/national-rates-and-rate-caps

Picchi, A., & Sherter, A. (2024, April 18). Baby boomers are hitting “peak 65.” Two-thirds don’t have nearly enough saved for retirement. CBS News. Retrieved August 29, 2025, from https://www.cbsnews.com/news/retirement-baby-boomers-peak-65-financial-crisis

Retirement plans definitions | Internal Revenue Service. (2025, July 31). IRS. Retrieved August 21, 2025, from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-plans-definiti ons

Shiller, R. J. (n.d.). ONLINE DATA ROBERT SHILLER. Online Data – Robert Shiller. Retrieved September 7, 2025, from http://www.econ.yale.edu/~shiller/data.htm

Survey of Consumer Finances (SCF). (n.d.). Federal Reserve Board. Retrieved August 21, 2025, from https://www.federalreserve.gov/econres/scfindex.htm

20-year Breakeven Inflation Rate. (2025, August 1). Federal Reserve Bank of St. Louis. Retrieved August 15, 2025, from https://fred.stlouisfed.org/series/T20YIEM

What are defined benefit retirement plans? (n.d.). Tax Policy Center. Retrieved August 17, 2025, from https://taxpolicycenter.org/briefing-book/what-are-defined-benefit-retirement-plans

What is the average monthly benefit for a retired worker? (2025, January 2). SSA. Retrieved August 21, 2025, from https://www.ssa.gov/faqs/en/questions/KA-01903.html

Which IRA’s are right for you? (n.d.). Fidelity. Retrieved August 12, 2025, from https://www.fidelity.com/retirement-ira/ira-comparison15

Williams, R., & Kawashima, C. (2025, April 15). Spending in Retirement: Beyond the 4% Rule. Charles Schwab. Retrieved August 21, 2025, from https://www.schwab.com/learn/story/beyond-4-rule-how-much-can-you-spend-retirement

Yakoboski, P. J., Lusardi, A., & Hasler, A. (n.d.). Financial Literacy and Well-Being In a Five Generation America. Global Financial Literacy Excellence Center. Retrieved August 16, 2025, from https://gflec.org/initiatives/financial-literacy-and-well-being-in-a-five-generation-america

About the author

Charles Agle

Miles is currently a senior at Dr. Ronald E McNair Academic High School interested in economics. He is currently the captain of the varsity soccer team and a soccer referee at the grassroots level. He also is a UN NGO representative for AccessabilityAtlas.