Author: Hyunyeob (Ian) Yun

Wilbraham Monson Academy

September, 2020

Abstract

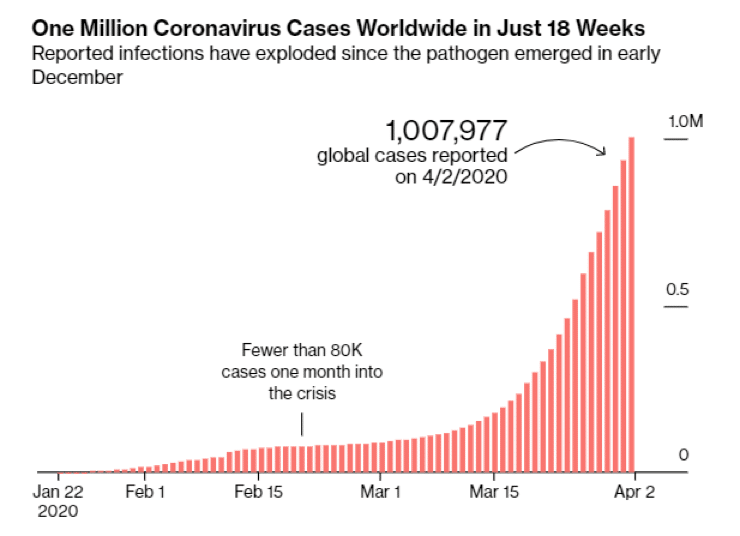

The COVID-19 epidemic has been spreading at a speed which is 1,000 times faster than SARS, covering the world. Since the first infection of the COVID-19 was confirmed in China on December 31 of 2019, the total number of global cases has exceeded 1 million as of early April 2020 and surpassed 4 million a month later.

To prevent the spread of COVID-19, most nations implemented lockdown measures including border closings, movement restrictions, stay at home orders, closing schools, and business restrictions and prohibitions. This has led to unprecedented social and economic impact on the global community.

As a neighboring country of China, South Korea has experienced the spread of COVID-19 in a particularly intense way and earlier than most other countries, reached a peak from February to April. However, Korea has contained COVID-19 effectively without a lockdown and movement restriction measures, maintaining the normal life pattern and business operation, which was backed by taking active steps including massive testing on a large scale, public disclosure of the relevant information, and social distancing campaign. These efforts consequently have made South Korea evaluated as a successful case in response to COVID-19.

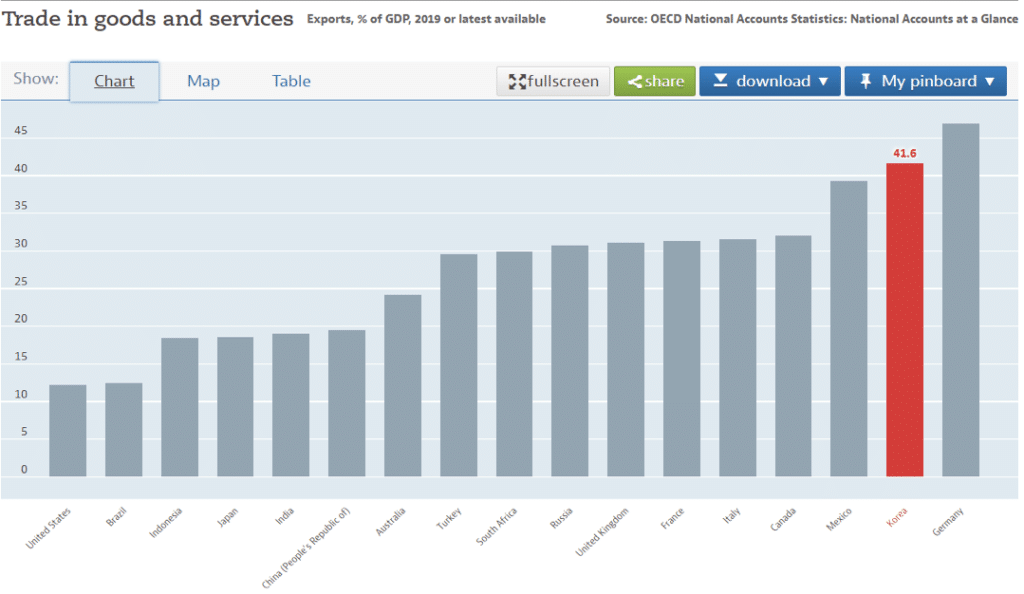

South Korea is particularly sensitive to severe economic blows, since it has a high dependency on exports and is deeply engaged in the global supply chain. Due to factory closings and lockdown measures in many trading nations, the production and supply of goods has been hit severely, while the sales of corporations have been drastically diminished due to movement restrictions and reducing purchasing powers caused by sharp rise of unemployment in the global markets. South Korean economy suffering was from both supply and demand

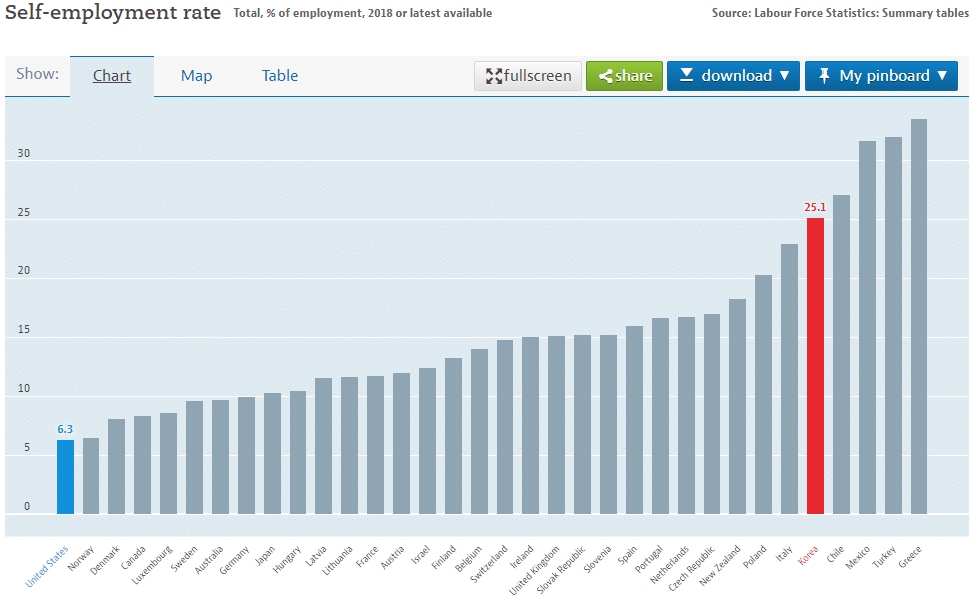

Besides, since South Korea has a very high percentage of self-employed business among the OECD member nations, the economic impact resulting from collapsing self-employed business had an enormous negative influence on the overall economy of Korean society. The lack of resilience or self sufficiency among self-employed businesses in South Korea caused this phenomenon, whose economy in scale is relatively lower than other OECD nations.

Based on these structural characteristics of South Korean economy, the research is to look into the impact given to the overall Korean economy-mainly manufacturing, aviation business as key industry, self-employed business, and start-ups from February to April when COVID-19 hit Korea the hardest, and contemplate the direction which the South Korean government and enterprises should move toward to tide over the difficulties of the post-COVID-19 era.

Introduction

As the coronavirus (hereinafter called as “COVID-19”) has been spreading at a speed, 1,000 times faster than SARS to cover all over the world including Europe & US within only two months after the outbreak in China, the WHO finally came to declare COVID-19 a pandemic. As of April 30, the total number of the infected patients confirmed reached to more than 3,000,000. It took only 4 months to infect 1 million people all over the world after its first outbreak in China.

A total of 151 countries and territories have imposed bans on people coming from South Korea, which has had a significant impact to the South Korean Economy. Since the first patient of the COVID-19 was confirmed on January 20th 2020, South Korea’s total infections turned out around 10,700 as of April 30, which was the 35th rank, following US, Spain, Italy, France, Germany, UK, Turkey, Iran, Russia, China, Brazil, Canada, Belgium, Netherlands, India, Switzerland, Peru, Portugal, Ecuador, Ireland, Sweden, Saudi Arabia, Israel, Austria, Mexico, Singapore, Pakistan, Chile, Japan, Poland, Romania, Belarus, Qatar, and UAE. To prevent the spread of the COVID-19, most nations implemented lockdown measures including border closings, movement restrictions, stay at home orders, closing the school, and business restriction and prohibitions, which has eventually given unprecedented social and economic impacts to the global community.

All prominent political and economic leaders have characterized the current economic crisis by COVID-19 with one voice as follows:

• It’s not limited to a regional crisis but has developed to be a worldwide crisis.

• It brings significant challenges to both the real economy and financial economy.

• It is expected that the usual monetary and fiscal measures have a limited effect on economic recovery.

• Putting an end to this pandemic quickly is the key to getting back to normal.

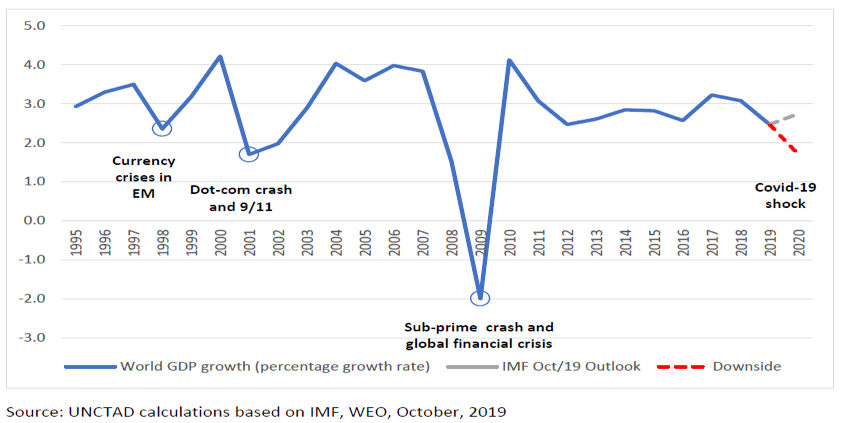

UNCTAD estimated that the shock of COVID-19 might trigger a recession in some countries and a deceleration of global annual growth to below 2.5 per cent – often taken as the recessionary threshold of the global economy, while OECD projected global growth could fall to 1.5% in 2020, almost half the 2.9% rate it had forecasted before the outbreak.

It’s somewhat undeniable the world is on the brink of the deep global recession, which has never been experienced. In this regard, Morgan Stanley lowered its first-quarter US GDP forecast to -3.4% from -2.4% and its second-quarter US GDP forecast to -38% from -30%.

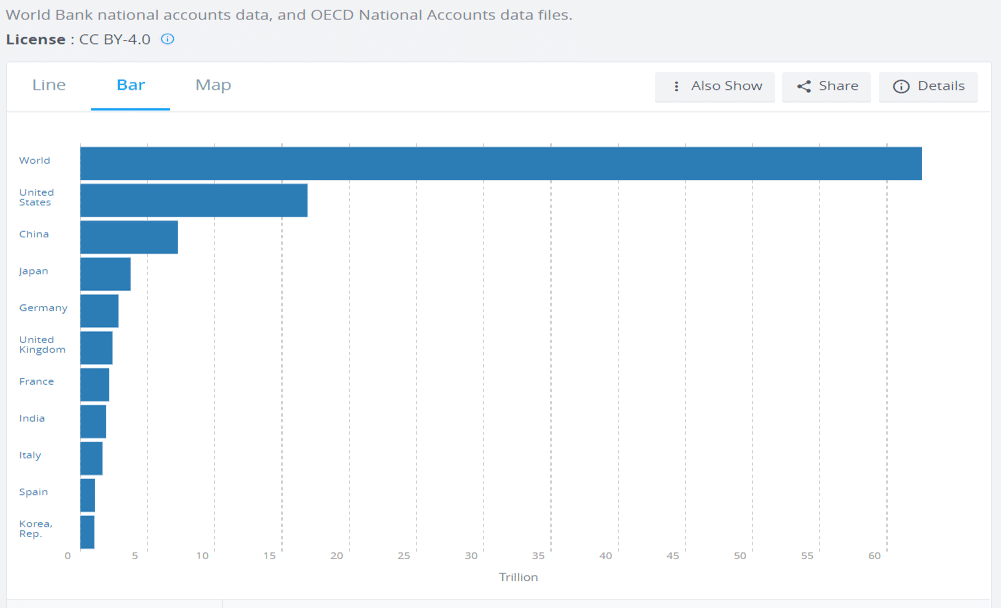

Fitch, the credit rating agency, expected world economic activity to decline by 1.9%, eurozone GDP to fall by 4.2% and the U.K.’s GDP to decline 3.9% this year. It is viewed that the South Korean economy heavily depends on trade due to the small domestic market. According to OECD data, Korea’s dependency on exports was 41.6% of GDP in 2019, which was the second highest dependency ratio followed by 46.9% of Germany among G20 countries. Such a heavy dependency on overseas markets tends to make the national economy more easily exposed to risk, whenever overseas markets have any economic turbulence.

Especially, leading industries of the South Korean economy such as automobile and electronics have exquisite global supply chains from China as well as other countries. As the Korean economy has intricately connected with other global partners, the current epidemic issue greatly imposed impact on Korean markets.

Another feature of the South Korean economy is the high ratio of self-employed business like restaurant, cafe and grocery, which is 25.1%. It’s much higher than other OECD member countries. Since movement restrictions and fear of infection at places like restaurant, café, and small shops make people stop visiting them to buy goods, it is assumed that the current situation is causing fatal damage to these self-employed business owners.

Additionally, the South Korean government has adopted a fiscal policy of increasing spending on social welfare since 2018, which inevitably increased the burden on government expenditure. Furthermore, the current economic crisis struck by the outbreak of COVID-19 is bringing up additional public expenditure on a large scale to prevent the national economy from plunging, which would give a negative impact on the South Korean government’s financial soundness. The Korean government’s budget was 475 trillion won (US$387 billion) in 2019, and is projected to be dramatically increased up to around 560 trillion won(US$456 billion) in 2020 with revised supplementary budget on several occasions due to COVID-19.

Therefore, this research will review the impact and damage on the South Korean economy by COVID-19 during the last three months, from February to April, in relative economic sectors. It will also provide a base to consider the risk by a pandemic as a critical variable, which is expected to occur more frequently in the future, especially in planning the company strategy as well as adopting the measures for national finance soundness.

1. The growth of Korean economy wrecked by COVID-19

Comparing this crisis with the previous economic crisis that South Korea has experienced, the current situation has quite different and much more serious characteristics. The Asian Financial Crisis in 1998 was limited to a few Asian nations, and in South Korea the economy recovered quite fast, helped by a jump in exports; while the financial crisis in 2008 South Korea was relatively unaffected. When Severe Acute Respiratory Syndrome (SARS) occurred in 2003 and the Middle East Respiratory Syndrome (MERS) did in 2015, those diseases spread into South Korea and resulted in local market slowdown and temporary stagnation of the domestic economy. But in both cases, the economic impacts remained relatively short. Such a ‘V-shaped’ economic recovery, which has been shown in past contagious disease cases, won’t be easily applied this time.

The economic crisis struck by COVID-19, in which the financial and real economy is collapsing simultaneously, has led to a deeper and more serious crisis. Korea will suffer both a supply and a demand crisis. As the lockdown in overseas markets including US and Europe is resulting in the sharp rise of unemployment, it naturally leads to a reduction in the purchasing power; accordingly the demand is radically decreasing all over the world, which badly impacts South Korean exports.

Experts such as the IMF and EIU (Economist Intelligence Unit), view the global economy as having stepped into a recession already. If the vicious circle-“breakdown of supply chains and diminishing consumption ⇒ decrease in sales ⇒ bankruptcy of company ⇒ restructuring ⇒ job loss ⇒ decline of demand and consumption”-occurs, global consumption declines could develop into longer structural problems from temporary phenomenon. Furthermore, economic activities in both US & EU occupying 50% of the world consumption has been paralyzed, which leads to a drastic shrinkage of demand in the global market.

The real economy is usually based on traffic and transaction, which was destroyed by the fear of COVID-19 infection in a short time. The South Korea Customs Service announced total exports from April 1 to April 20 amounted to US$21.7 billion, which is a 26.9% reduction from the same period of last year. The daily average export ended up at US$1.5 billion, which is 16.8% reduction from the same period of last year.

COVID-19 first hit China, Korea, Japan and then went over to the US and Europe. Infectious disease naturally makes the regional economy in a downturn, which eventually shrinks the export of that region. The more Korean economy depends on other countries, the worse Korean economic situation is getting because the diminished market demand of those countries results in lessening the volume of export from South Korea.Those regions are the major trading partners of South Korea. According to the South Korea International Trade Association, last year the Korean exports to US, China, Japan and Europe were US$307.13 billion, accounting for 56.6% of total exports, US$542.23billion. Especially, the exports to China, the epicenter of the COVID-19, were US$136.22billion, a quarter of total South Korean exports.

Regarding the supply crisis, the damage from the Chinese supply chain gave the biggest shock to the world. Chinese factories which cover one-third of the world’s manufacturing, stopped for several months and the supply chain has been struck heavily. Enterprises in other countries regret they have heavily depended on China for intermediate production, the origin of COVID-19. Hubei Province, where Wuhan city is located, has played a major role as factories of automobiles, electronics and pharmaceuticals. Until the outbreak, 60% of the top 500 global companies in terms of annual revenue, operated the manufacturing facilities in Hubei Province.

Until now most major multinational enterprises have grown up by producing their goods in China or by exporting the intermediate inputs to Chinese companies. This recently unprecedented disruption, however, has proven the more dependent a company is on Chinese markets, the more risks a company has. Apple, the largest company in the world in terms of aggregate value of listed stock, reduced its production in China by 50% as COVID-19 crisis accelerated.

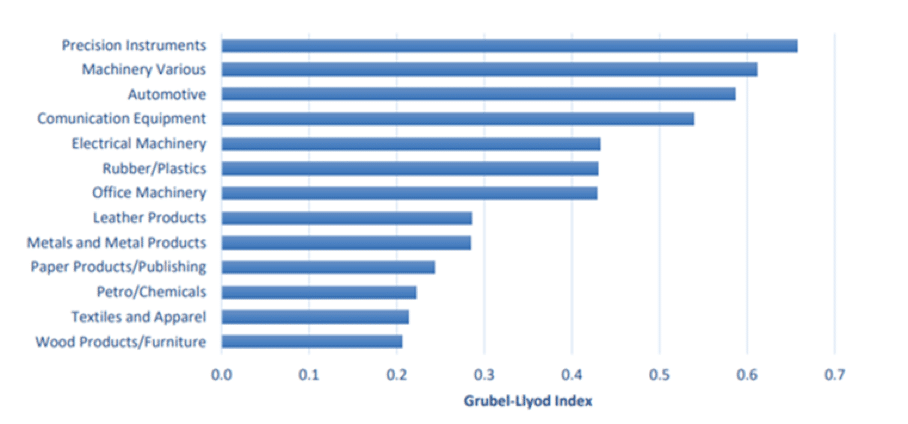

The United Nations Conference on Trade and Development (UNCTAD) explained the impact made by the Chinese supply chain as: “A reduction in Chinese supply of intermediate inputs can affect the productive capacity and therefore the exports of any given country depending on how reliant its industries are on Chinese suppliers. For example, some European auto manufacturers may face the shortage of critical components for their operations, companies in Japan may find it difficult to obtain parts necessary for the assembly of digital cameras, and so on. For many companies, the limited use of inventories brought by a lean and just-in-time manufacturing process would result in shortages that will impact their production capabilities and overall exports. Overall, the most impacted economies will be the European Union (machinery, automotive, and chemicals), the United States (machinery, automotive, and precision instruments), Japan (machinery and automotive), the Republic of Korea (machinery and communication equipment), Taiwan Province of China (communication equipment and office machinery) and Viet Nam (communication equipment)”.

China Integration in Global Value Chains, by sector

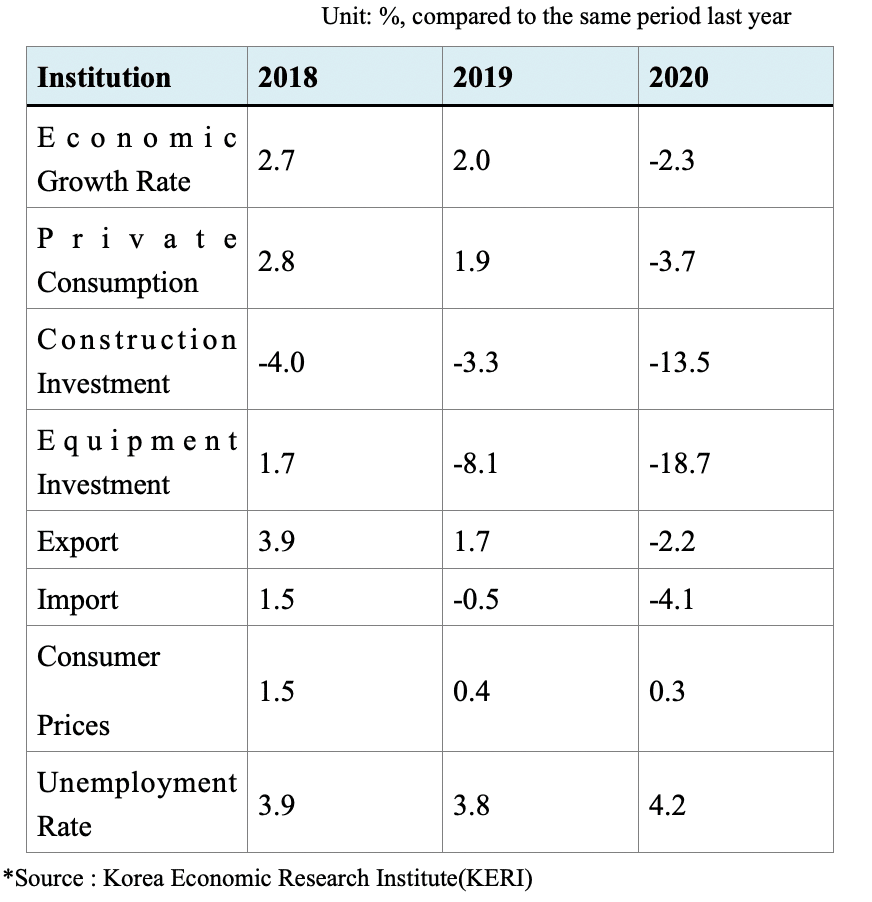

Besides China, the South Korean factories in other countries including the US, Europe, and India have had to stop to prevent the spread of COVID-19, and given the impact to supply of goods. In 2019, South Korea has barely managed to maintain 2% of growth rate mainly initiated by government expenditures, and its real economy has been in vulnerable status. Under such an economically poor situation, South Korea has been directly attacked by the COVID-19 outbreak.

According to Chinese National Bureau of Statistics, this year China’s first-quarter GDP shrank by 6.8 % from a year ago, the first decline since 1992, when official quarterly GDP records started. Industrial production also fell by 1.1% in March, after a 13.5% decline over January and February. As Korean economy heavily depends on China, the simultaneous recession between two economies can’t be avoided.

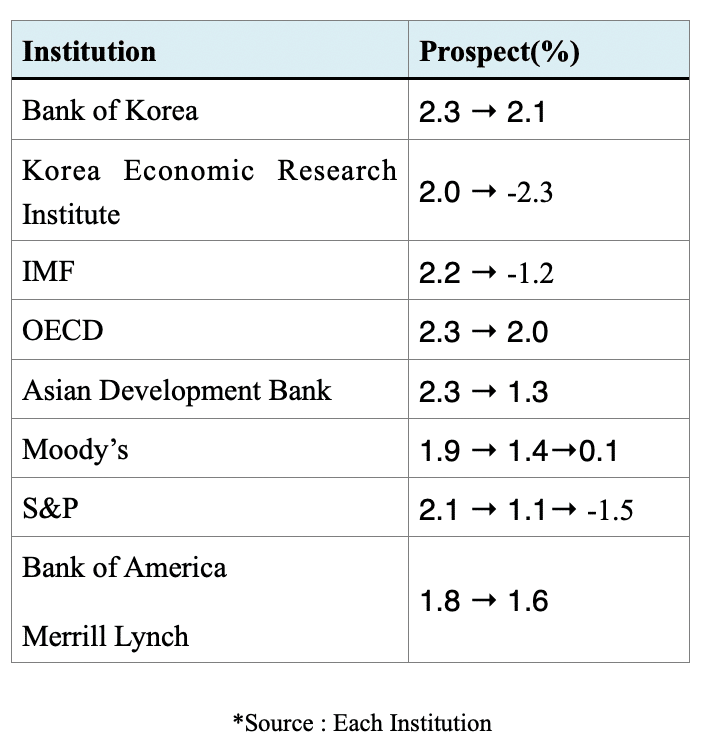

The International Monetary Fund (IMF) predicted that Chinese growth rate this year could be at around 1.2% and also revised South Korean growth rate from 2.2% to -1.2% because given South Korea’s high dependency on trading, the growth forecast is constrained by very weak external demand. Meanwhile, Korea Economic Research Institute (KERI) forecasted that the annual Korean economic growth this year would be -2.3%, the lowest level since the IMF financial crisis. It was the first time this institution forecasted negative growth. If the forecast on the growth of Korean Economy turns out to be correct, South Korea will experience the negative growth for the first time since the 2nd oil crisis (-1.6%) in 1980 and the Asian Financial crisis (-5.1%) in 1998.

To prevent the world economy from plunging infinitely, each nation has unveiled unprecedented fiscal policies. On March 24, the South Korean government doubled the rescue package to 100 trillion won ($80 billion) from the previous package of 50 trillion won. The new package provides a safety net for conglomerates as well as support for small and medium-sized enterprises and self-employed business. In addition to this, on April 22, the Korean government revealed plans for an additional 85 trillion won (US$68.8 billion). A fund of 40 trillion won will be given as aid to key industries, including the airline, auto, shipping, shipbuilding, machinery, telecommunications, and power industries. And 35 trillion won is to be used as financial support for small businesses as well as buying more corporate bonds, and 10 trillion won is to increase job security. It is unclear if this ‘Helicopter Money’ can save the economy. However, it is quite obvious government financial assistance to the withering corporates as well individuals are the only solution to help them survive till COVID 19 comes to a halt.

2. Manufactures hurt by the broken supply chain

As COVID-19 has shrunk the global demand and supply dramatically, South Korea is one the most vulnerable countries, given its heavy dependence on trade. Korea has grown to be a leading export-driven country with global supply chains, from one which had been dependent mainly on its domestic production lines. According to the South Korea International Trade Association, the ratio of Korean offshore production facilities have been expanded in the fields of smartphones, automobiles and consumer electronics, while the ratio of overseas manufacturing of American and Japanese firms has decreased since 2016 due to the reshoring policies, mainly driven by tax breaks and operation subsidies.

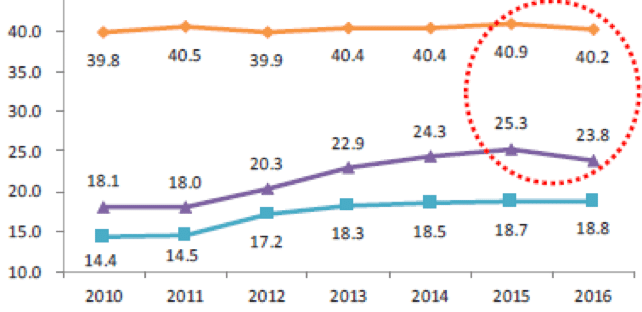

The Offshore Production Ratio of Korea/Japan/US

Source: Korea International Trade Association

Since the first patient of COVID-19 was confirmed last January in China, a large number of factories have been closed for three months but reopened as the spread of COVID-19 slowed down. During the shutdown periods in China, Korean Conglomerates such as LG Chem, SK Innovation, Hanwha Q CELLS that operated in China naturally closed their plants. Only a semiconductor factory of Samsung Electronics located in Xian held its production around 100% in January and February even when COVID-19 spread rapidly. As COVID-19 spread actively in Europe and the U.S. in March, Korean factories in those areas faced the shutdown of their plants, which eventually gave the significant blows to Korean leading industries such as electronics, automobiles, and chemicals.

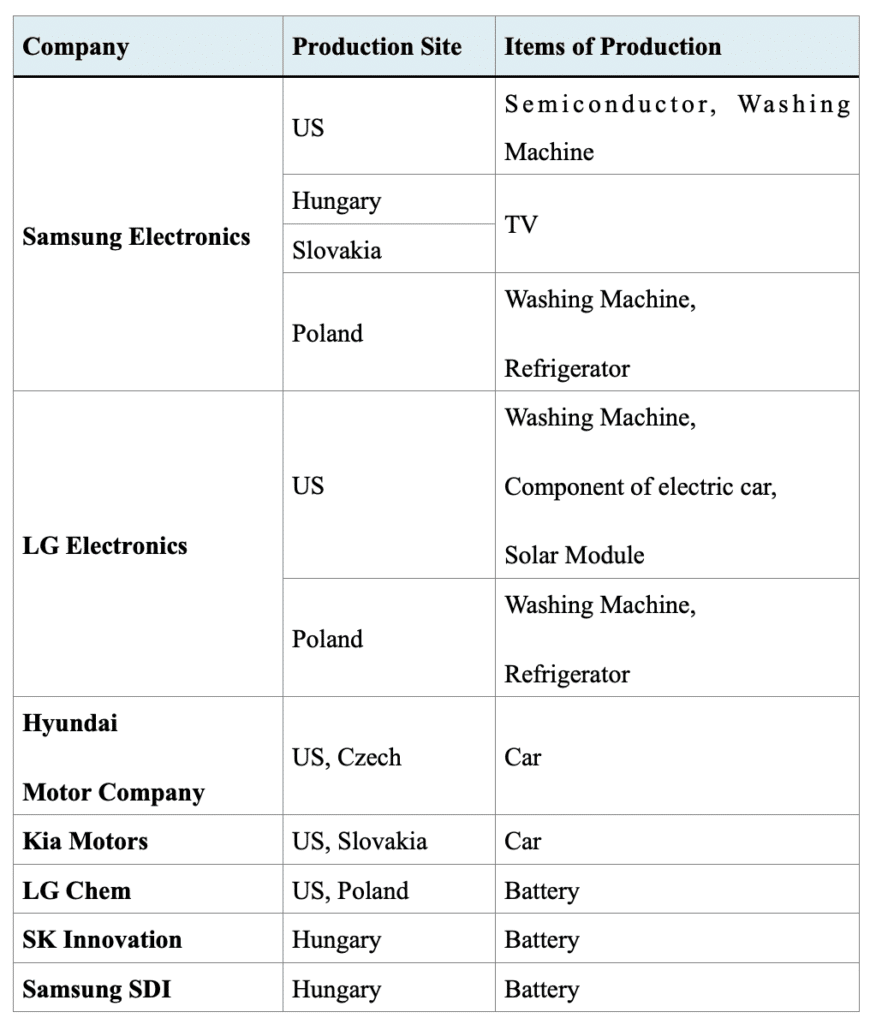

As soon as Eastern European countries joined the European Union in 2004, Korean companies set up the business models that goods are produced in Eastern European countries mostly to be sold in Western European countries. Since the Eastern European nations are geographically close to Western ones and access freely there, it leads naturally to lower the production and transportation cost. According to the Korea Trade Investment Promotion Agency, around 160 out of 210 South Korean production sites in Europe are concentrated in four Eastern European countries.

Source: Each Company’s Homepage

Samsung and LG faced “production cliffs,” which resulted from the current crisis in all manufacturing factories except South Korea and China in March and April. As the production shortfall in Indian factories followed by the production termination in the U.S. and Europe was experienced, South Korean automobile manufacturers faced severe difficulties both in production and sales. IHS Markit, a global market research institute predicted global auto production could fall by 1.4 million vehicles this year due to the “shutdown of factories“ in Europe and the U.S. In this regard, Korean leading auto companies, Hyundai Motor Company and KIA Motors, which together account for the world’s fifth biggest carmaker by sales, are experiencing severe turmoil, resulting in making the component manufacturers get into difficulties at the same time.

In addition to “the production cliffs,” the sales have a tendency of decline too. It is worried that Hyundai Motor Company, Samsung Electronics, LG Electronics, more than 50% of whose revenues come from Europe and the U.S., will have a fatal blow in their sales. In particular, Hyundai Motor Company, which sold 1.27 million autos, of which 710,000 were in the U.S. and 560,000 in Europe respectively, accounting for 51% of its total revenue. It is expected the administrative orders of governments for closing stores in Europe such as France and Italy will decrease the possibilities of auto sales due to the rapid reduction of national incomes in the European Nations.

Moreover, the sales of Hyundai Motor Company in China, where the official dealers temporarily closed their business due to COVID-19, declined to 1,007,000 cars which was a 97.4% drop from last year’s result, 38,017,000 cars. According to the Korea Automobile Manufacturers Association (KAMA), the exported automobiles in February were at the lowest levels since August 2003 with a 26.9% drop compared to the same period in 2019. It is one third of the highest sales record (304,774 cars) in December 2014.

Korean electronics producers such as Samsung Electronics, LG Electronics in major markets including North America and Europe were blocked to seek the viable niche. It was regrettable that the biggest electronics retailer such as Best Buy in the U.S. and MediaMarkt in Germany have closed their offline stores. Samsung Electronics and LG Electronics whose sales of consumer electronics in the U.S. and Europe contribute to almost 50% of their whole revenue of consumer electronics, faced the difficult situation that they could not sell goods even if they were eager to. Best Buy, which runs 1,009 stores nationwide in the U.S has shortened business hours and restricted the entrance of customers, which actually moved into the stage of practical closure. More than 50% of consumer electronics sales of Samsung Electronics and LG Electronics in the U.S. and Canada were generated through Best Buy in the field of offline market.

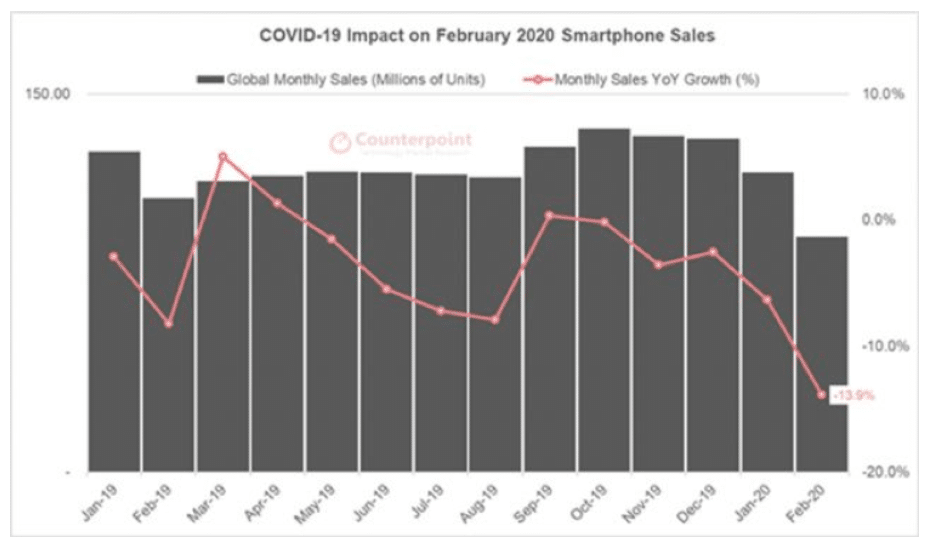

Samsung Electronics and LG Electronics in European markets have enhanced the offline sales networks through MediaMarkt alongside with the online sales networks such as Amazon to increase the European market shares. However, MediaMarkt has closed 850 stores in major European countries such as Germany, Spain, and Italy from the middle of March, and this did plenty of damage to these two Korean companies. Meanwhile, according to the Counterpoint Research, a global market research institute, sales of smartphones in February declined 14% compared to the same period of previous year, though the global drop of smartphone sales was less than expected. Perhaps in a sign of things to come, however, sales of smartphones in China, an origin country of outbreak, have declined almost 38%.

The reason for the sales dropping less than expected is the demand in the offline market has been switched to the online market, which made the sales in the online market grow steadily. Samsung Electronics which took the first place in the global market shares(21.9%) last February is relatively less impacted by COVID-19 than other competitors because the production lines are diversified to Vietnam, India and Korea, and the demand of Samsung smartphones had not been as high in China even before the outbreak. On the contrary, Apple which ranked 2nd place (14.4%) in global market shares faced the difficulty in global sales for almost two weeks in February due to the production and supply disruptions in China.

The semiconductor industry, a major leading export industry of Korea, seems to be impacted relatively less compared to other industries. The total export of Korean semiconductors in 2018 was US$126.7 billion, which broke through US$100 billion for the first time and occupied 20.9% of total Korean exports. The Korean Custom Service has recently released statistics of Korean import & export. According to it, the export of semiconductors has increased 20.3% from March 1 to March 20 compared to the same period of previous year, but the export results from April 1 to April 20 turned out to decrease 14.9% from the same period of last year. In 2019 the total export of semiconductors recorded US$93.9 billion, still occupying 17.3% of total Korean exports. It is clearly proven that semiconductors are an industry with considerable magnitude in South Korean exports. It shows, however, the sales of semiconductors increased slightly in March and gradually came to decline in April compared to the same period of last year.

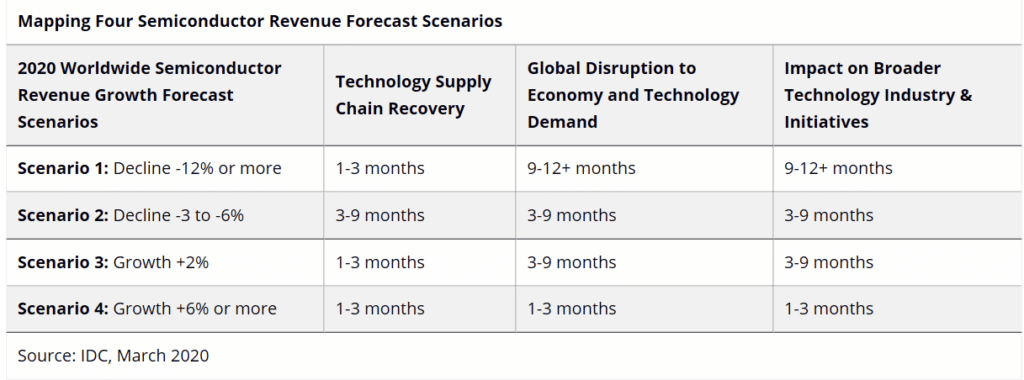

Timing is important. If the spread of COVID-19 in the global community slowed down in two months, the world economy could be on track for recovery, which would continuously spur the demand of semiconductors. But if the pandemic continued into the summer, a totally different scenario should be taken into account. Semiconductors would be eventually damaged by the reduction of demand for electronic devices such as smartphones and PCs by COVID-19. The International Data Corporation (IDC), a global provider of market intelligence, has recently published a report that global semiconductor sales this year would decline more than 12% at the worst, compared to previous year. In that case, the semiconductor industry, working as a prop of Korean economy, would be seriously damaged unlike the current status to eventually bring up the risk of Korean economy to be heavily shaken from the bottom.

For the post-COVID-19 measures, South Korean cooperates are expected comprehensively to review the supply chain strategy, which heavily depends on the suppliers abroad. After experiencing that more than 151 nations banned or restricted people coming from Korea and a large number of factories abroad were shut down by the local authorities, the enterprises have inevitably started to consider this constraint- that pandemic will rise more frequently in the future-in designing the future business strategy.

3. Aviation: the most impacted industry

Global aviation companies have reduced or terminated the major long distance lines. Simply speaking, Qantas Airways of Australia, announced a reduction of 90% of international flights as well as 60% of domestic flights. Consequently, the Qantas Airways explained almost 30,000 jobs would be challenged On March 16, CAPA, the Aviation Research Company in Australia, issued a statement that most airlines in the world would go bankrupt by the end of May without coordinated government and industry intervention. The total size of the international aviation industry is US$2.7 trillion with 65.5 million related jobs. The size of Korean aviation industry is US$47.6 billion occupying 3.4% GDP to create 838 thousand related Jobs.

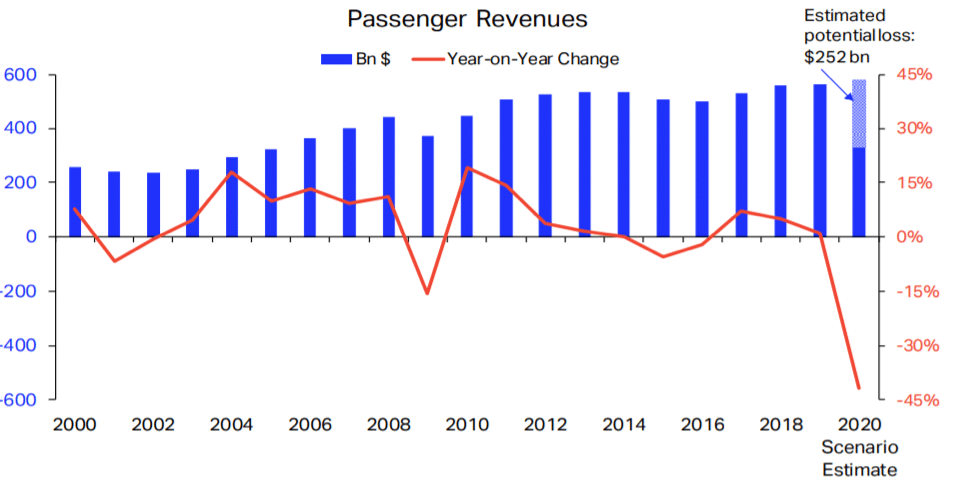

Moreover, the Airlines for America, whose members are American Airlines, United Airlines, Delta Air Lines, Southwest Airlines, anticipated that major airline companies could run out of money between June 30 and the end of the year. In this regard, this organization has asked the American government for financial support as much as US$50 billion and the tax reduction of tens of billions of USD. While the international aviation industries have been experiencing the devastating blow by the movement restrictions, the International Air Transport Association (IATA) forecasted passenger revenues would shrink 44% compared to 2019 to bring the damage of US$252 billion to the global aviation industry.

Source: IATA Economics, as of March 27, 2020

Nine South Korean airlines have their backs up against the wall due to the extremely serious demand difficulties related to COVID-19. As of April 20 a total of 151 countries and territories have imposed bans on people coming from Korea, which almost eliminates international flights for Korean aviation companies. Meanwhile, on April 2nd the Korean National Assembly Research Service released the report of “The Current Status of Financial Supports and Further Assignments for the Aviation Industry related to COVID-19.” This report explains on the basis of third week of March that passengers of international flights decreased 93.5% compared to last year and daily passengers in the Incheon International Airport shrunk 91.6% from 190 thousand people on March 16, 2019 to 16 thousand people on March 16, 2020. Korea Civil Aviation Association (KCA) announced the number of air passengers stood at 1.74 million in March. This is the first time that the figure has fallen below 2 million since such statistics began to be recorded from 1997. Additionally, this report states that until June 2020 the sales of Korean Aviation companies are estimated to drop around US$5.25 billion, and expresses the concern that eventually the companies could go bankrupt and the International Aviation Networks could collapse eventually, if this pandemic situation continues.

Due to the features of the aviation industry, the portion of fixed costs in the operation expense occupies 35% to 40%, which naturally makes the majority of the aviation industry manage to hold their business by wasting the cash reserves. Considering the operation expense and interest costs, South Korea’s leading air carriers-Korean Air Lines and Asiana Airlines are assumed to have monthly outflows of cash amounting to US$667 million and US$408 million respectively. At the same time, Jeju Air, a representative low cost carrier (hereinafter called as “ LCC”) has been experiencing the outflow of cash amounting to US$83 million monthly. These outflows are unsustainable without eventual revenue improvements and could lead to the collapse of the firms.

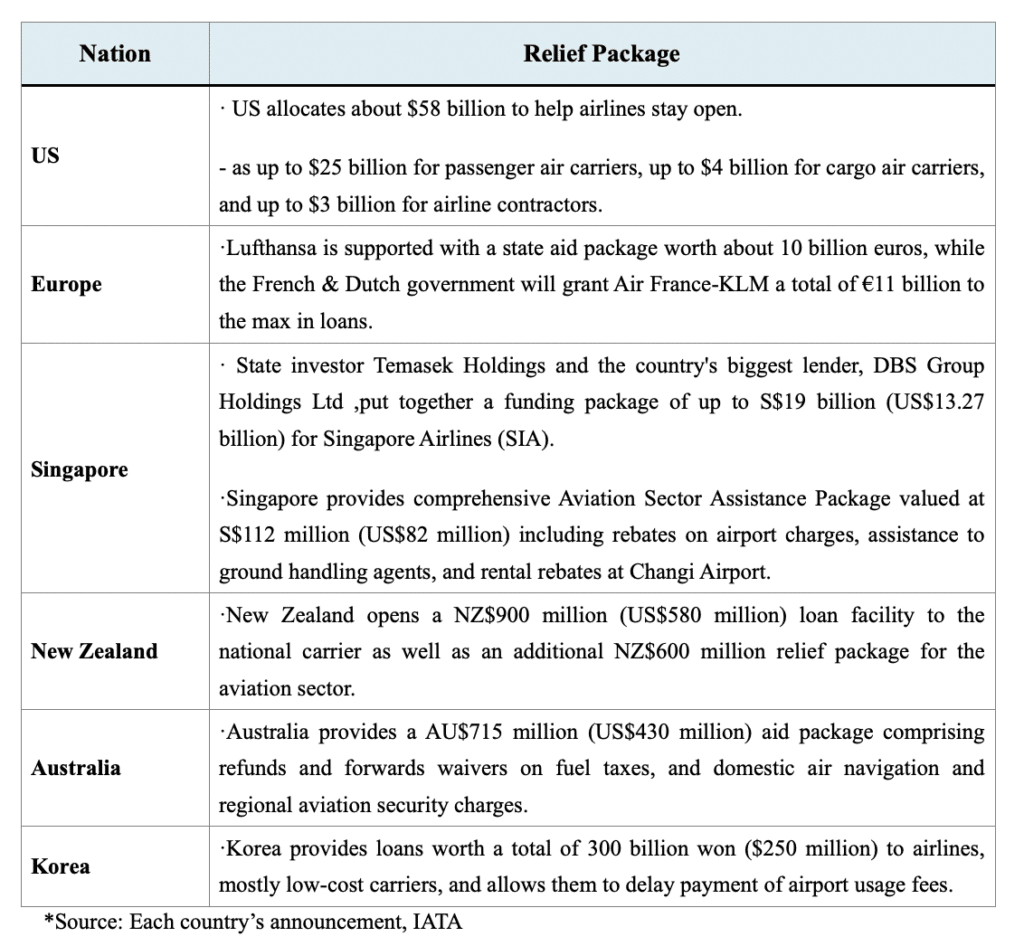

As the risk of collapse of global aviation industries are apparent, governments of developed countries have initiated emergency financial support on a massive scale. On the contrary, in February, Korean government announced to allow the national banks to lend the loans only to the LCC up to US$250 million, which is far from enough to revive the domestic aviation industry. As huge losses in the second quarter was expected for the aviation industry, the South Korean government was asked by the Korea Civil Aviation Association to roll out an upgraded support measure for air carriers.

On April 6, the Federation of Korean Industries published the research “The current status of diminishing cargos in aviation transportation and its implication.”, and pointed out that the production plants have been shutting down and aviation of passengers and cargoes have been decreased due to COVID-19. In this regard, this research states that Korean exporting companies are entirely bearing the damages from the increasing transportation costs and the delay of the shipments. Especially, since the high valued products mainly depend on the aviation transportation, it consequently brings out the critical consequence to the exports. For resolving the chaos of Korean exports and normalizing the aviation transportation networks, it is highly required to remove the entry restriction and provide the financial support for the aviation industries which might be in the bankruptcies in a chain.

Currently, Korean relief programs for the aviation industry have been criticized by relevant stakeholders such as the industry, the National Assembly, and experts in regard to the fact that that program could lower the financial burden of the aviation industry but the magnitude of the assistance is relatively low. On April 3, Korea Civil Aviation Association repeatedly asked for additional financial support by sending a petition to the Ministry of Transport and Construction, the Ministry of Economy and Finance, and other related government organizations, mentioning that the aviation industry could not survive solely on its own measures without wide-scale assistance from the governments. The aviation industry is the national strategic industry, which clearly has significant gravity to influence our economy and other industries. Therefore, it is strongly required that the government immediately takes more progressive and effective measures to relieve the aviation industry before it’s too late.

4. Withering self-employed business

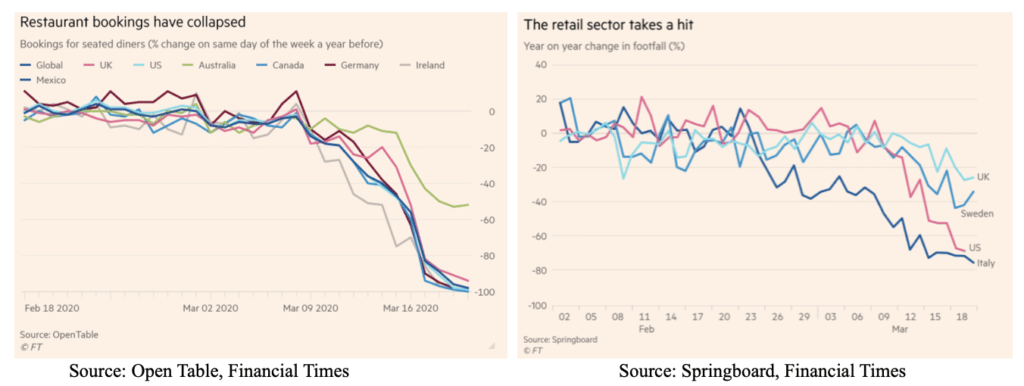

Due the spread of the COVID-19, “shut-down” and “stay inside” policies in the cities and countries all over the world have eventually put a halt to the business related to so called “human contact industries” such as restaurants, bars, grocery and small shops, and resulted in enormous economic impact on self-employed business or shopkeepers.

Meanwhile, South Korea has introduced the “Social Distancing Policy,” which restrains people from going out and gathering due to COVID-19 since March. And it has caused critical damage to the self-employed business in South Korea as other countries. Especially the ratio of self-employed businesses in South Korea is 25.1%, almost 4 times as high as that in America, 6.3%. In terms of self-employed business’s ratio, Korea ranked 5th in the OECD member countries. Therefore, the economic impact on the self-employed business is disseminating negative effects in overall Korean society. According to the Market Research Data published by the Korea Federation of Micro Enterprise on March 16, the moving population has decreased 80% in major domestic commercial districts, while the total sales declines of the self-employed business in Seoul were assumed to be US$ 250 million on a daily basis.

South Korea is the country where COVID-19 has started relatively earlier than other countries. It made the customers for businesses drastically drop since February, which consequently decreased 145 thousands of the entrepreneurs having employees such as restaurants, and on the contrary increased 149 thousands of the entrepreneurs having no employees to manage the business by themselves. It shows the entrepreneurs struggled to survive by minimizing or eliminating employment.

In February, the total cases filed up in the national courts including the Seoul Insolvency Court increased by 19.2% for individuals and 12.6% for the corporations as the restaurant business, lodging business, retail business, and small business owners were pushed to the limit due to the financial difficulties. The South Korean government announced the rescue package to cope with COVID-19, including programs for self-employed businesses. According to the aid plan, the size of support for small and medium-sized enterprises and self-employed business people was expanded to 58.3 trillion won.

The aid package included financial support for them to 12 trillion won, which would allow them to borrow money at the interest rate of around 1.5 percent from every financial institution in South Korea. A 5.5 trillion-won special loan guarantee program was also introduced and the rollover of debts could be done at all registered financial institutions. The amendment bill to the Restriction of Special Taxation Act has been passed to lower value added tax for the self-employed, whose annual revenue is from 66 million won to 88 million won. The number of beneficiaries is supposed to be around 1.16 million. Furthermore, the self-employed, whose annual revenue is below 48 million won, are exempt from VAT. To make the financial aids including loans and guarantees activate for self-employed businesses damaged by the COVID-19, it is urgently required to provide sufficient funds to those quickly.

5. Latent power of IT/Bio start-ups showing presence in the crisis

South Korea has now been recognized worldwide as a best practice of response system against COVID-19 with its leading testing abilities and innovative use of technology. The main reason South Korea has successfully coped with COVID-19 is contributed from the development and production of the test kits of COVID-19 in shortest manners and the “The Epidemiological Survey System of COVID-19”, which finds the movement of infected individuals to share the relevant information including the traces of patients, and prevents the transmission of infectious disease.

Once the society experiences the tremendous crisis, the new business opportunity can be created through discovering the potential capacity in exploring the solution to overcome the difficulties. South Korea has peeked into the new possibilities in emerging business sectors such as Bio and IT, while experiencing the significant damages by COVID-19 in various industries.

[Leading Testing Capacities]

South Korea has established the daily test capacity of COVID-19 up to 20,000 cases, and conducted aggressive disease diagnosis to effectively prevent the diffusion of the COVID-19. In establishing successfully such a biggest detection capacity of COVID-19 in the world, the development of the test kits using the RT-PCR technology which shortens the test time from one day to six hours and fast introduction of the mass production system are crucial. In introducing the test kits on right time, the biotech start-ups deserve the credits for it. The biotech start-ups such as KogeneBiotech, Seegene, SolGent, PCL, LabGenomics, Cancerrop and SD Biosensor participated swiftly into the development and production of test kits. Kogene Biotech instantly kicked off to develop the test kits on January 10 as soon as the information of the infected was reflected on the GISAIS, which stores the virus information collected by the WHO, and that reaction was 10 days earlier than the first patient was diagnosed on January 20 in Korea. Solgent also started to develop the test kit on January 17.

Without the innovator’s spirit of the start-ups, the situation South Korea is facing now would be totally different. Moreover, experts in the Korea Centers for Disease Control and Prevention have played an important role: they granted the use of new test kits to the start-ups within a week. It was four days before the first patient was diagnosed in Korea. An artificial intelligence-based big data system Seegene had in-house has enabled it to quickly develop a test kit in 2 weeks to timely respond to the spread of COVID-19. Without an in-house AI system, it would have taken more than 2 months to develop the test kit. When COVID-19 just broke out in China, Seegene predicted in mid-January an enormous volume of test kits would be needed, and entered upon development. As of April 13, 7.7 million units of Korean test kits have been exported to more than 100 countries in the world. Considering the total number of tests done for South Korean people was about 500,000 since the outbreak of COVID-19, the exported kits are more than 15 times of the units which have been used in Korea. South Korea has also introduced a “drive-through” testing system initiated by a Korean doctor for the first time in the world, which many countries benchmarked and eventually adopted.

At “drive-through” testing facilities, officials in white hazmat take fluid samples from the driver and passengers. It takes only 10 minutes and results are texted to the patient, usually. Meanwhile, a “walk-through” testing booth has been firstly applied in the airport. The Korean Intellectual Property Office supported to complete the process for the Korean patent of walk-through testing booth, and carried out the consultation for international patent application.

[Innovative Use of Technology]

South Korea has been operating a system to support epidemiological investigation of people infected with COVID-19. Additionally, individual companies created websites and cell phone applications which plot the locations where people have been infected by COVID-19, to make them avoid these areas easily. A warning notification is pushed to a user’s cell phone if they come within 100 meters of a place where a person infected by the virus has stayed. The system helps health authorities to immediately check various data such as surveillance camera footage and credit card transactions of confirmed COVID-19 patients to trace their movements. It has been developed on the basis of various “Smart City” technologies in cooperation with the Ministry of Science and ICT, the Ministry of Land, Infrastructure and Transport and the Korea Centers for Disease Control and Prevention.

As stated above, while there are startups finding new business opportunities amid the COVID-19 crisis, it is true there are also many startups or ventures facing financial difficulties like blockage of bank loans due to the weak financial guarantee and small revenue figures or failure of raising funds from investors. To resolve these problems, the Ministry of SMEs and Startups introduced the support programs for 8,400 start-ups and ventures on April 8. If successfully implemented, US$1.83 billion would be provided for the start-ups and ventures by the end of this year.

Meanwhile, IT technology companies in Silicon Valley in the US having Artificial Intelligence and remote technology are seeking out creating the business opportunities in resolving the current issues caused by the COVID-19 crisis.

Innovation is also happening in other areas. The users of Google Classroom has almost doubled in a month to 100 million from 50 million in the beginning of March as all the school shut down due to the COVID-19. And the number of users of the “Zoom” service, an American communications technology company, has increased 20 times from 10 million at the end of 2019 to 200 million last March. The “Untact business”, which has been operated partially in the education and some sectors, is expanding to all businesses as COVID-19 has spread out fast. The demands on online shopping have explosively increased and the real estates, recruitment, banking and exhibition business are also stepping into the new “Untact” era. For example, South Korean construction companies are considering applying more advanced technologies such as Artificial Reality and Virtual Reality to the cyber model house.

South Korea is viewed as being in a better position than following the IMF crisis in the end of 1990s. Even though South Korea has been significantly damaged economically due the COVID-19, it also found out that the new potentials for the growth such as COVID-19 test kits, the fusion of Biotechs & Information technology, and the transformation into Untact business are increasing. If the crisis of COVID-19 settles down soon, the key elements whether Korean companies including the start-ups could seize the tremendous opportunities or not will rely on the success of transformation into the new environment. Therefore, it is absolutely required for the companies to transform shortly to survive, and achieve the growth.

Conclusion

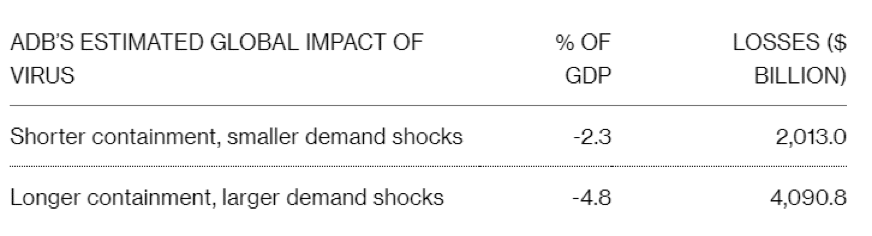

As COVID-19 is still in progress it is not easy to forecast the exact impacts on the global economy. However, based on the statistics so far, it seems that there are some similarities with the case of the Spanish flu. The COVID-19 Pandemic is giving significant impacts to the global community as the Spanish flu did 100 years ago. According to the analysis by Robert J. Barro, a professor of Economics at Harvard University, the Spanish flu eventually caused the death of 39 million people, 2% of the 1.8 billion global population heavily striking the whole world during 1918-1920. It is assumed that the global GDP at that time being composed of 43 major countries dropped 6%, while private consumption did 8% during that period. Asian Development Bank estimated that the global cost of COVID-19 might be as high as US$4.1 trillion or 4.8% of global GDP if COVID -19 keeps spreading longer.

According to the International Labor Organization (ILO), the COVID-19 crisis is expected to wipe out 6.7 percent of working hours globally in the second quarter of 2020 – equivalent to 195 million full-time workers. The Korean government should react to this risk with aggressive fiscal and financial policies to prevent the companies, small business owners, and self-employed business from getting into bankruptcy, in addition to supporting the wages for maintaining the employment. Being cautious of the financial soundness, it is critical to provide the maximum financial support in order to make the economy recover fast with resilience after the COVID-19 is over. The national debt ratio to the GDP in South Korea was around 10% until the mid of 1990, but now exceeds 40%. It is strongly required to focus all the assets in overcoming the crisis, while radically reducing the unnecessary spending as the financial soundness is essential to maintain the national credibility.

In an addition to the financial support, the South Korean government, which has so far given too much importance to pro-labor policies and introduced compulsive regulations excessively, should deregulate the anti-market policies and encourage the corporate investments by reforming the labor market and tax system. Furthermore, the government should refrain itself from intervening into the private sectors. Without these measures, enterprises could not revive even if the financial support from the government is provided. If COVID-19 calms down and it naturally leads to resolving the anxiety of people, the consumption and investment will be somewhat encouraged, which is expected to make the domestic markets stable. But, it is difficult to assure that South Korean economy, which has a high dependency on overseas markets and exports, could recover soon.

COVID-19 will not be able to stop globalization. Even though it will give meaningful change to the mainstream. Therefore, enterprises have only one choice to adopt themselves to the post COVID-19 environments if they want to survive. Korea should also lessen its over-dependence on Chinese economy, and look to make sweeping strategy changes including the reshoring policy of the high-tech industries which can utilize automated facilities. As evidence of such a move, we are already seeing that the new terminology “Untact” is talked about as an alternative business way in the COVID-19 era. From now on, breakthrough innovations beyond “Untact” would be needed continuously to respond to the pandemic era which is expected to ever last.

Mentor: Dr. Eric Golson, University Of Surrey

About the author