Author: Ishaan Marwaha

Spring Dale Senior School

October 1, 2021

Introduction

This paper will examine and evaluate the current condition of the Indian economy the problems encountered in the last 5 years, including the Covid-19 crisis 2020-21, demonetization in 2016 and the introduction of the Good and Service Tax (GST) in 2017. In 2014, the people of India, evidently dissatisfied with ten years of the Indian National Congress in power, elected the BJP to the Lok Sabha (House of Commons). Boasting a landslide victory, Mr. Narendra Modi became the 14th Prime minister of independent India. Although the pandemic opened the floodgates to an economic turmoil that was long in the making, the abysmal mismanagement and incompetence of the government have made this more complicated.

The paper will give you a detailed account of the policies and problems with the Indian economy since June 2016. The paper will focus on the impact of demonetization, the introduction of the Goods and Service Tax and the devastation caused by the Covid-19 pandemic. The paper shall also give attention to the impact on investment in the country (namely FII, Institutional and Retail) in similar context.

Looking at the historical developments, after the decline in economic growth in the wake of the global financial crisis in 2008, Indian economy started its recovery in March 2013, more than a year before the Modi government came to power. According to RBI’s annual report for FY21 released on May 27, the recovery cycle lasted until September 2016. After it became a secular decline in growth since the third quarter of 2016-17. While there is no official explanation for the deceleration in growth, many economists believe Modi government’s sudden decision to demonetize 86 per cent of India’s currency on November 8, 2016, was the trigger that set the economy on a downward spiral.

The demonetization was followed by the hurried implementation of a poorly designed GST. As the combined effect of demonetization and GST spread through the economy that was burdened with massive bad loans in the banking system, the GDP growth rate steadily fell from 8 per cent in FY 2017 to 4 per cent in FY 2020, before Covid further damaged growth. The result of the GST was a drop in per capita GDP, rise in unemployment, increase in poverty and a diminution in the size of India’s middle class. India’s per capita GDP has dropped to Rs 99,700; this was the level in 2016-17. On the unemployment front, India has performed even worse: against the norm of an unemployment rate of 2 to 3 per cent, the new norm in the unemployment rate was 6 to 7 per cent in the years leading up to Covid-19. The pandemic has made matters worse.

The pandemic had a further negative effect on economic development, according to the latest CMIE data, the unemployment rate is 14.5 per cent as of the end of May 2021 and the rural unemployment rate has crossed 7 per cent. This comes at a time when the labor force participation rate, which maps the proportion of people who are looking for a job, is falling. As growth has slowed, poverty has increased: according to Azim Premji University’s ‘State of Working India’ report, 2020, almost 230 million people have fallen back into poverty, against 270 million lifted out of poverty between 2000 and 2016. That’s not all. According to a new Pew Research Centre Report published before the second Covid wave surge, the Indian middle class has shrunk by almost 32 million people in 2020.

The consistent policy failures in demonetization and GST tax, exacerbated by the Covid-19 pandemic has meant a loss of jobs, lower wages, loss of savings, low consumer spending, lower business investment and lost capital. But these policies failures also mean slower growth prospects, rising poverty and shrinking middle class. The main indicators of a sound economy are weak and continued policy problems will have a further adverse impact on livelihoods. Surprisingly, while we are in the midst of a pandemic and talking mainly about how soon we will come out of it, there is little anxiety and concern about the economy’s huge underperformance, because of bad policies and mismanagement. [1]

Impact of Demonetization on the Indian Economy

Demonetization was a policy failure which has damaged the Indian economy. Demonetization is the act of stripping a currency unit of its status as legal tender. It occurs whenever there is a change of national currency in circulation from one unit to another. Normally the current form or forms of money are pulled from circulation and retired, often to be replaced with new notes or coins which are regularly used. Sometimes, a country completely replaces the old currency with new currency. Demonetization is a drastic intervention into the economy that involves removing the legal tender status of a currency. Demonetization has been used as a tool to stabilize the currency and fight inflation, to facilitate trade and access to markets, and to push informal economic activity into more transparency and away from black and gray markets; but that was not necessarily the case in India.

Demonetization across the globe

Demonetization has traditionally been used as a way to solve confidence problems about the currency. In the USA, the Coinage Act of 1873 demonetized silver as its legal tender, to fully adopt the gold standard. This move was made to ward off any disruptive inflation as significant as new silver deposits that were discovered in Western America. The circulation of various coins, including two-cent piece, three-cent piece, and half-dime was suspended. The removal of silver from being circulated in the economy led to the contraction of the money supply. In turn, it contributed to a downturn throughout the country. The Bland-Allison Act remonetized silver as a legal tender in 1878, to put an end to recession and political stress from farmers and silver miners. More recently, the government of Zimbabwe demonetized its dollar in 2015. It was a measure to fight the hyperinflation recorded at 231,000,000 per cent. It removed the Zimbabwean dollar from the country’s financial system. It fixed the Botswana pula, the U.S. dollar, and the South African rand as the country’s legal tender to stabilize the economy.[3] [4]

Demonetization in India

Demonetization was tried as a tool to modernize a developing economy that is cash-dependent and to fight crime and corruption involving counterfeiting and tax evasion. Accordingly, the Indian government demonetized the Rs 500 and Rs 1000 face-valued currency notes in 2016, the two most prominent denominations in its currency system. These notes accounted for 86% of the country’s circulating cash. With no indications, India’s Prime Minister Narendra Modi announced to the country’s citizens on 8th of November 2016, these notes would have no value with immediate effect. As an alternative arrangement, citizens could deposit or exchange these old notes for newly introduced Rs 2000 and Rs 500 bills by the end of the year.

Theoretically, the Indian demonetization solved a serious problem. India suffers from a large informal (underground) economy, which is estimated at 25% to 40% of the nation’s GDP. Individuals working informally pay little or no taxes because their incomes are unreported. Regardless of whether the underground activities are legal (cleaning, gardening, or selling groceries) or illegal (unlawful drug dealing, gambling, terrorism, arms trafficking, corruption, or money laundering), they enable tax avoidance, evasion, and fraud, which reduces government revenues. As a result, community betterment projects, such as infrastructure repairs and improvements, may go unfunded, and for those projects that are funded, underground tax evaders are able to freeload off the nation’s taxpayer base. This fact helps to explain why initial reactions by India’s taxpayers were often ones of pride because the government seemed to be striking openly at those who flaunted their wealth without paying nearly their share of taxes.

Stopping or slowing the growth of India’s illegal underground activities was a desired goal because they undermine the nation’s moral fabric, but as a matter of social fairness, the government’s intent was broader, aiming to expose both the legal and illegal layers of its informal economy. Currently, fewer than 4% (and perhaps as low as 1%) of India’s population pays taxes. By making the ₹500 and ₹1,000 notes illegal, Modi hoped India’s thriving informal economy would be legitimized. Individuals who exchanged excessive amounts of old notes would be required to explain their sources. Old currency notes that were held beyond the deadline would lose their value, and those who continued to use, transfer, receive, or even hold the old banknotes would be subject to fines of either ₹10,000 or five times the value of the banknotes. By promoting the use of checks, credit cards, and other forms of electronic payments, demonetization might make underground transactions more difficult to hide. And, if demonetization was able to broaden the nation’s tax base and increase government revenues, it held the potential to reduce Indian tax rates, which could increase domestic investments and spur meaningful growth.[2]

Demonetization also tackled an economic distortion that currently favors India’s low-productivity, informal sector. High-productivity sectors, such as those in which multinational firms and export-oriented domestic companies compete, are visible and, therefore, less able to escape taxes. By bringing the informal economy above ground and taxing it at reasonable rates, demonetization could bring symmetry to India’s tax-based incentive structure. As a result, relative underground returns should fall, supplying more capital to relatively high-productivity sectors and, thereby, stimulating the nation’s growth and development.

The rationale behind this herculean task was to crackdown on the black money in the shadow economy of India. The government also hoped demonetization would be an effective measure to combat counterfeit notes, and cash being used to fund illicit activities such as terrorism and drug trafficking. An adjunct motive the government had was to push the economy towards a cashless one. It was thought that the cash crunch caused due to this legislation would encourage individuals to adopt cashless transactions using mechanisms such as credit cards and online banking.

Provisions were made by the government for people to deposit cash they had in their homes into their bank accounts until the end of the year. Banks would only notify tax authorities when deposits above Rs 250,000 ($3,800) were made. This would aid the tax department in tracing individuals guilty of tax evasion due to hoarding of black money. People were also allowed to exchange their old notes for new ones at bank offices in the country. They could continue to withdraw cash of other denominations at ATMs. However, a cap of Rs 10,000 ($150) per day was placed in order to ensure that there was sufficient cash for everybody.

Impact of COVID-19 on the Indian Economy

The Indian Economy was significantly damaged by the Covid-19 pandemic. Losses from organized sectors amounted to an estimated nine trillion rupees in late March, projected to increase with the prolonging of the lockdown. Unsurprisingly, the most affected industries included services and manufacturing, specifically travel & tourism, financial services, mining and construction, with declining rates of up to 23 percent between April and June 2020. Towards the end of 2020, however, India saw some semblance of recovery across certain sectors. This was a result of easing restrictions, controlled infection rates and the festive season between October and November 2020. However, this did not last long.

Economic activity started to decline again from March 2021, as the country faced its second wave of the pandemic and a harsh lockdown. As a result, GDP forecasts were expected to fall, putting losses at over 38 billion U.S. dollars if local lockdowns continued till June 2021. Unprecedented numbers in terms of infections and deaths recorded across the country led to another set of lockdowns in some parts, burdening the healthcare system in the midst of government controversy. International aid in the form of oxygen cylinders, PPE kits, ventilators along with funding was being sent from various countries to what looked like a dire situation.

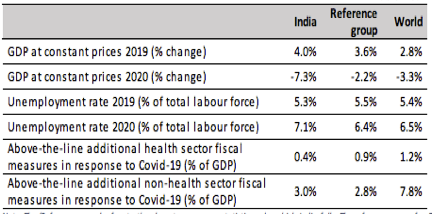

Overall, from April to June 2020, India’s GDP dropped by a massive 24.4%. According to the latest national income estimates, in the second quarter of the 2020-’21 financial year (July-September 2020), the economy contracted by a further 7.4%, with the third and fourth quarters (October 2020-March 2021) seeing only a weak recovery, with GDP rising 0.5% and 1.6%, respectively. This means that overall rate of contraction in India was (in real terms, adjusted for inflation) 7.3% for the whole 2020-21 financial year. While economies worldwide have been hit hard, India has suffered one of the largest contractions. During the 2020-’21 financial year, the rate of decline in GDP for the world was 3.3% and 2.2% for emerging market and developing economies. Table 1 summarizes macroeconomic indicators for India, along with a reference group of comparable countries and the world. The fact that India’s growth rate in 2019 was among the highest makes the drop due to Covid-19 even more noticeable.[10]

In the post-Independence period, India’s national income has declined only four times before 2020 – in 1958, 1966, 1973 and 1980 – with the largest drop being in 1980 (5.2%). This means that 2020-’21 is the worst year in terms of economic contraction in the country’s history and much worse than the overall contraction in the world. The contraction is solely responsible for reversing the trend of global inequality, which has now started to rise after three decades (Deaton, 2021; Ferreira, 2021).

Macroeconomic indicators:

Despite India being ahead of most countries in being able to implement work-from-home measures, specifically in white collar work, jobs and earning deficits, along with instability in prices was expected. The months of the lockdown resulted in the free fall of employment, which slowly stabilized after the economy steadied in most parts of the country. Segments including consumer retail expected to see sharp falls ranging between three and 23 percent depending on the market. For the big players across segments, this meant operating at less than full capacity; for small businesses, however, it depended on how long they could ride out the storm. Overall, the pandemic changed daily lifestyles drastically.

If we compare India’s unemployment rate in 2020 with other countries, India has performed relatively poorly – both in terms of the world average and compared with a set of reference group economies* (with similar per capita incomes to India’s). Unemployment rates were more muted within the reference group economies, and were also kept low by generous labor market policies to keep people in work.

Despite the scale of the pandemic, additional budgetary allocation to various social safety measures has been relatively low in India compared with other countries. Although India might look comparable to the reference group in non-health sector measures, the additional health sector fiscal measures are less than half those in the reference group. More worryingly, the Indian government’s announced allocation in the 2021 budget for such measures does not show an increase, once inflation is taken into account.

Income, expenditure, consumption, poverty and unemployment

While the macroeconomic statistics provide a snapshot of India’s economic position, they hide the large and unequal impacts on households and workers within the country. An estimated 230 million people have fallen into poverty during this crisis at the same time both wealth and income inequality has been on the rise in India. Estimates suggest that in 2020, the top 1% of the population held 42.5% of the total wealth, while the bottom 50% had only 2.5% of the total wealth. Post-pandemic, the number of poor in India is projected to have more than doubled and the number of people in the middle class to have fallen by a third.

During India’s first stringent national lockdown between April and May 2020, individual income dropped by approximately 40%. The bottom decile of households lost three months’ worth of income. Microdata from the largest private survey in India, the CMIE’s Consumer Pyramids Household Survey or CPHS, shows that per capita consumption spending dropped by more than GDP. GDP recovery did not follow the bounce back in consumption during periods of reduced social distancing. Mean per capita consumption spending continued to be over 20% lower after the first lockdown (in August 2020 compared to August 2019) and remained 15% lower year-on-year by the end of 2020.

Official poverty data are unavailable and the CPHS data come with a caveat of “top” and “bottom exclusions”. For example, official statistics show a rural headcount ratio of 35% in 2017-’18. But the CPHS data estimate it at 25%, which suggests exclusions at the lower end of the consumption distribution.

Despite these statistical concerns, CPHS does provide consumption numbers for a large sample of individuals, which can provide insights into changes in consumption levels arising from the pandemic. Table 2 reports the percentage of people who have monthly consumption expenditure below different cut-off values. The different cut-offs encompass the official poverty lines (which, in any case, have been considered too low by some commentators). Based on the latest CPHS

Essentially, expanding the money supply in the economy lowers interest rates enough for crucial investments in the economy to continue; this bypasses the otherwise impairing effects of rising borrowing costs at the time of recession and a cash crunch.

Globally, the case for deficit financing through private borrowing varies vastly for different countries. In the USA for example, there is plenty of private funding that has now been pushed to savings because of the economic slowdown. This, coupled with the fact that interest rates are slumped to near zero and the real interest rate is negative, provides an opportunity for the government to go on a borrowing spree without care despite the debt to GDP ratio climbing up. Essentially there is almost no cost of borrowing this money and high debt levels may be sustained because there is no inflationary pressure. In countries like India, however, the inherently weak fiscal situation of Indian banks and actual deficit levels aside, the question of inflation remains a big challenge. [7] [8] [9] [10]

Money Supply

India has been experiencing stubbornly high inflation, meaning that the average price level is structurally increasing. The CPI print for August 2020 came in at 6.7% (YoY), which means that in 2020 (with the exception of April) inflation had hovered above the 6% upper band inflation target range of the Reserve Bank of India (RBI). Core inflation rose despite an unprecedented -23.9% contraction of the economy in Q1. During an economic slowdown, lower demand for goods and services normally leads to lower price pressure, but the opposite is true for some goods in the COVID-19 crisis. This is due in part because money supply in the economy has been increasing at 20% annual rate. Monetary policy tried to bring cash in the hands of people and increase consumption following Covid 19. If inflation is not systematically controlled, we could be looking at much worse inflation numbers and a situation of hyperinflation in the long-term. The current situation also solves the dilemma of euphoria in the Indian equity markets. The bull run in the markets is being fueled by the immense amount cash which is being circulated in the economy, thus pushing the prices up. [28]

Impact of the GST on the Indian Economy

The Goods and Services Tax (GST) is a large project which aims to simplify the complex tax structure and enhance the economic growth of the country. GST is a comprehensive tax levy on manufacturing, sale and consumption of goods and services at a national level. The Goods and Services Tax Bill or GST Bill, also referred to as The Constitution (One Hundred and Twenty-Second Amendment) Bill, 2014, initiates a national Value Added Tax (VAT). GST will be an indirect tax at all the stages of production to bring about uniformity in the system. On bringing GST into practice, there was an amalgamation of many central and state taxes into a single tax. It would also enhance the position of India in both, domestic as well as international market by decomplicating existing systems. At the consumer level, GST reform removed the overall tax burden, which was estimated to be as high as 25-30%. A conclusive evaluation of the estimate is yet to be comprehended. Under this system, the consumer pays the final tax but an efficient input tax credit system ensures there is no cascading of taxes: tax on tax paid on inputs that go into manufacture of goods. In order to avoid the payment of multiple taxes such as excise duty and service tax at central level and VAT at the State level, GST would unify these taxes and create a uniform market throughout the country. Integration of various taxes into a GST system will bring about an effective cross-utilization of credits. GST aims to tax consumption, whereas the previous tax regime aimed to tax production.

Impact

The introduction of the GST meant the government forecasted the lowest economic growth rate of 6.5% for the financial year 2018, in the prior four years. Further, the central statistical organization has anticipated the negative growth (-3.3%) for the Indian manufacturing sector in the financial year 2017-18 as compared to FY 2016-17. In addition to above, a reduction was also been reported in the Indian Industrial Production. Moreover, the contribution of agricultural sector to the Indian GDP was reduced about 652.11 INR billion in the third quarter as compared to that of second quarter of the year 2017 . The Central Statistics Office has also predicted the negative impact of GST over the agriculture and farm sector. The GST has also influenced the Real Estate sector due to the enhancement in the cost of land, material and building. Further, the aviation sector had a yearly hit of Rs. 5700 crores. Of course there are some bright spots: with the implementation of GST on medicines, 1% tax has been reduced, resulting in cost reduction for the consumers. However, prices increase is expected over the diagnostics tests because of GST. Due to reduction of new work orders, and low activity, the service sector has been particularly affected by the GST. In July 2017, the output of service sector has been reported at lowest level in comparison to past four years. The Nikkei India Services Purchasing Managers’ Index (PMI), has indicated 45.9 for the service output in the month July 2017 which was lowest since 2013 September; this shows a start level of contraction.

On the other hand, the GST is a significant step in Indian taxation: One Nation, one market and one tax has proven popular. It has transformed the India into a single and unified market of 1.3 billion citizens. As per a survey, 50% enhancement has been reported in the base of indirect taxpayer. Further, automobile and real estate sector has expected the benefit due to the implementation of lower sales tax level in the GST. In line with above, the detailed impact of GST over the various sectors of economy has been as appended below.

Indian economy is classified in three sectors — Agriculture, Industry and Services. Agriculture sector includes Agriculture (Agriculture proper & Livestock), Forestry & Logging, Fishing and related activities. Industry includes ‘Mining & quarrying’, Manufacturing (Registered & Unregistered), Electricity, Gas, Water supply, and Construction. Services sector includes ‘Trade, hotels, transport, communication and services related to broadcasting’, ‘Financial, real estate & professional services’, ‘Public Administration, defense and other services’. Further, every global, international and nation developments have significantly influenced on the Indian economy. Subsequently, the Indian economy has also been influenced due to the implementation of GST. The impact of GST implementation has also been felt in different segments of Indian economy, as per the below.

Agriculture

Agriculture, the primary sector of Indian economy provides employment to large proportion of Indian workforce and economic activity. However, it was damaged most by the GST. The contribution of agriculture sector to the Indian GDP has reduced to 3245.21 INR Billion in the third quarter of 2017, from 3897.32 INR Billion in the second quarter of 2017. With the implementation of GST, the prices of various agricultural inputs have also increased due to enhancement in GST rates. Further, Central Statistics Office (CSO) has forecast about the negative impact of GST on agriculture and farm sector.

Manufacturing sector

According to RBI, the manufacturing sector of India had felt the adverse impact due to implementation of GST. RBI has also forecasted for unfavorable conditions regarding revival of Investment activity in manufacturing section due to implementation of GST. Further, a downfall has also been observed in the industrial production in India.

Real Estate

One of the most significant sectors of economy which had an adverse impact due to GST. With the implementation of GST, buyers will be paying 12% GST, which will be 3.5% more when compared to earlier taxes (4.5 percent Service Tax and around 4 percent of VAT). Further, the costs of land, material and building have also been increased due to GST.

Textile industry & handicraft

With the implementation of the GST India’s apparel export was reduced 39% in value terms in October 2017. Further, GST has given a boost to textile import. Additionally, handicrafts industry has been badly hit due to implementation of GST. Earlier, handicraft was exempted from tax in more than 15 Indian states. However, 8 Indian states were imposing 5% VAT on handicraft items. At present, Handicraft has been bought within the GST tax slab of 12% and 18%.

Aviation sector and Banking Sector

Due to implementation of GST, the aviation industry may experience the yearly reduction in revenue of Rs. 5,700 crores (as reported by domestic airlines to Finance Minister). Further, GST has also severely influenced the Indian Banking Sector.

Pharmaceutical Industry

The Pharmaceutical industry has benefitted. Previously, medicines were taxed at about 13%, but fortunately only 12% GST has been introduced on medicines including ayurvedic. It may result in cost reduction for consumers. However, prices on diagnostics tests are expected to rise due to GST.

Service sector

India’s services sector covers a wide variety of activities such as trade, hotel and restaurants, transport, storage and communication, financing, insurance, real estate, business services, community, social and personal services, and services associated with construction. GST has had a mixed impact on service sector. It is beneficial in some areas, but at the same time it is creating hurdle in ease of doing business. It is beneficial in items like seamless flow of credit, avoidance of double taxation but has increased a lot of compliance burden. Due to reduction of new work orders, and low activity, the service sector has felt the downturn particularly harshly, after the implementation of GST. In July 2017, the output of service sector has been reported at lowest level in comparison to past four years, immediately after the implementation of GST. The Nikkei India Services Purchasing Managers’ Index (PMI), has indicated 45.9 for the service output in the month July, 2017 which was lowest since 2013 September.

Petroleum Industry

The petroleum industry experienced a boost in its sales, as the GST was reduced on in comparison to the old taxes. Presently, the Petroleum products like peat, ores & concentrates, kerosene, tar, coal & ignite, petroleum coke & petroleum have a GST of 14.5%, 13.5%,12%, 7%, and 9.5% less as compared to the old tax rates, respectively.

Finally, it is important to note, the implementation of GST has posed a great challenge to the Indian government. The shift from destination based taxed to the origin-based taxed has emerged as a big challenge for business organizations. Further, for proper implementation and administration of GST, adequate Information Technology (IT) infrastructure has also become the need of hour. The IT based skilled manpower having complete knowledge and training of GST has also been needed for achieving the objectives of GST. Further, the training and development of citizens has also been required for registration, filling and payment of GST. Due to the enhancement in tax rates in many items, the Indian economy may experience the inflation. [17] [18] [19]

Comparison of Three Events

In order to examine the effects of the problems, it is necessary to compare the three events across a number of criteria and note what is most effective.

GDP

From April to June 2020, India’s GDP dropped by a massive 24.4%. According to the latest national income estimates, in the second quarter of the 2020/21 financial year (July to September 2020), the economy contracted by a further 7.4%. The recovery in the third and fourth quarters (October 2020 to March 2021) was still weak, with GDP rising 0.5% and 1.6%, respectively. This means that the overall rate of contraction in India was (in real terms) 7.3% for the whole 2020/21 financial year. [9] [5]

| India | Reference group | World | |

| GDP at constant prices 2019 (% change) | 4.0% | 3.6% | 2.8% |

| GDP at constant prices 2020 (% change) | -7.3% | -2.2% | -3.3% |

| Unemployment rate 2019 (% of total labor force) | 5.3% | 5.5% | 5.4% |

| Unemployment rate 2020 (% of total labor force) | 7.1% | 6.4% | 6.5% |

| Above-the-line additional health sector fiscal measures in response to Covid-19 (% of GDP) | 0.4% | 0.9% | 1.2% |

| Above-the-line additional non-health sector fiscal measures in response to Covid-19 (% of GDP) | 3.0% | 2.8% | 7.8% |

Table 1: Summary of key macroeconomic indicators

Demonetization

With the gross domestic product (GDP) for the April-June quarter slipping to 5.7%, the reality of the economic slowdown could not be ignored. The World Bank had reduced the India GDP growth forecast to 7% for 2017-18 owing to demonetization and GST (Goods and Service tax). The slowdown was being cited as a delayed consequence of demonetization by the World Bank and while there were various other reasons at play, the steep decline had been credited to be an effect of demonetization.

Unemployment and poverty levels

Post-pandemic, the number of poor in India is projected to have more than doubled and the number of people in the middle class to have fallen by a third (Kochhar, 2021). During India’s first stringent national lockdown between April and May 2020, individual income dropped by approximately 40%. The bottom decile of households lost three months’ worth of income (Azim Premji University, 2021; Beyer et al, 2021).

| All-India | All-India | Urban | Urban | Rural | Rural | |

| Dec 19 | Dec 20 | Dec 19 | Dec 20 | Dec 19 | Dec 20 | |

| Rs 1,000 or below | 6.0 | 9.0 | 3.0 | 5.4 | 7.5 | 10.9 |

| Rs 1,600 or below | 23.5 | 31.6 | 14.5 | 21.7 | 27.9 | 37.0 |

| Rs 2,000 or below | 38.3 | 48.3 | 25.7 | 35.7 | 44.4 | 55.2 |

| Rs 2,400 or below | 52.1 | 62.6 | 37.9 | 49.5 | 59.0 | 69.7 |

| Sample size | 433,021 | 499,879 | 278,759 | 331,809 | 154,262 | 168,070 |

| Aug 19 | Aug 20 | Aug 19 | Aug 20 | Aug 19 | Aug 20 | |

| Rs 1,000 or below | 5.0 | 10.0 | 2.3 | 5.5 | 6.4 | 12.5 |

| Rs 1,600 or below | 21.0 | 33.6 | 12.0 | 22.5 | 25.5 | 39.5 |

| Rs 2,000 or below | 34.9 | 50.3 | 21.9 | 37.1 | 41.3 | 57.5 |

| Rs 2,400 or below | 48.2 | 64.4 | 33.4 | 51.3 | 55.5 | 71.5 |

| Sample size | 570592 | 477237 | 362417 | 321100 | 208175 | 156137 |

| All-India | All-India | Urban | Urban | Rural | Rural | |

| Quintile | Aug 19 | Aug 20 | Aug 19 | Aug 20 | Aug 19 | Aug 20 |

| 2 | 32 | 60 | 72 | 73 | 33 | 58 |

| 3 | 14 | 41 | 0 | 50 | 0 | 34 |

| 4 | 0 | 25 | 0 | 29 | 0 | 16 |

Table 3 shows households in the middle of the pre-Covid-19 CPHS consumption distribution saw large drops in spending after the first wave of the pandemic, helping to create a new set of people entering poverty. The percentage of poor people in the second lowest quintile of pre-Covid-19 consumption jumped from 32% to 60% within a year. This was driven largely by rural areas, where the headcount ratio for the second quintile almost doubled. T

This sharp rise in poverty after the first lockdown is consistent with a variety of surveys that highlighted the depth of the crisis (Azim Premji University, 2021). Year-on-year urban unemployment rate jumped from 8.8% in April to June 2019 to a staggering 20.8% in April to June 2020 (Government of India National Statistical Office, 2020). [10]

Demonetization

According to IAS Score (2019), close to 1.5 million workers were left unemployed after demonetization, but the rates were left largely unchanged. The unemployment rate can be contributed to the lower rates of investments occurring in the market. Ajit Karnik (2016) also agrees that demonetization had a negative impact on employment. The labor force participation rate (LPR) was lower than forecasted in October of 2017. The Centre for Monitoring Indian Economy predicted the LPR to be 49.67%. Once demonetization movement was announced the rate grew to 46.28% (Karnik, 2016). The rate hit a low of 45.8 % in November and December of 2016. For example, the road construction sector had to lay off close to 35% of workers due to demonetization. The manufacturing sector also had to lay off approximately 29% [21]

GST

According to the current weekly status approach or CWS, the unemployment rate stood at 8.9% in 2017-2018. Among women, the rate was 9.1% – higher than in usual status approach at 5.7%. Among men, the rate stood at 8.8%, higher than 6.2% in usual status. Unemployment in urban areas was higher than in rural areas – 9.6% according to the CWS approach, as against 7% in the usual status approach. The rate was at 8.5% in rural areas as per the CWS approach, compared to 5.3% in regular status approach.

A number of sectors were also impacted by these events.

Tiles & Ply:

The tiles sector has been badly hit post demonetization, and the introduction of GST (rate of 28 percent) has further impacted growth as the price differential between unorganized and organized players increased, leading to tepid revenues. About four-fifths of tile and ply is used as new demand, with the balance being used as replacement demand. With the benign real estate activity post introduction of demonetization and RERA, the growth has been further impacted. Firms impacted include Kajaria Ceramics, Somany Ceramics, Century Ply and Green Ply.

FMCG:

Around 38-40 percent of FMCG sales happen through the wholesale channel which largely deals in cash and is not entirely tax compliant. The lower liquidity situation posts demonetization and prudent tax laws of GST have further reduced consumption. To offset the loss in demand, most FMCG players are increasing their direct reach and bypassing the wholesale channel.Firms affected include Emami, Bajaj Corp, Marico, Hindustan Unilever, Colgate.For FMCG products, the Wholesale channel was impacted due to liquidity crunch which led to increase in the market share for Modern retail. The modern trade which used to be 9 percent of overall FMCG revenue is expected to double in next 5 years. Firms affected include Future Retail, Avenue Super Mart, and V-Mart

Automobile (2 Wheelers):

Post demonetization, cash flows of rural India (majorly a cash economy) were impacted the most due to liquidity crunch. These impacted sales of 2-wheeler companies which have sizable sales in rural parts of the country. Firms affected include Hero Moto, TVS Motor and Bajaj Auto

Consumer Durables:

High ticket purchases, especially in the white goods space, were impacted post demonetization. However, sales did improve over subsequent quarters as the liquidity situation got better. Firms include Whirlpool of India and IFB industries.

Luggage:

With the luggage industry being levied by a GST rate of 28 percent, it has widened the gap between the organized and unorganized players. This has made it difficult for the large players to completely pass on prices to customers. Firms affected include VIP industries and Safari industries.

Jewelers:

Demonetization and GST have made it difficult for smaller jewelers to do business as the majority of their transaction were done with cash. As more than 70 percent of the jeweler sales used to happen through unorganized/regional players, there has been a structural shift in demand to organized players leading to strong sales growth. Titan industries, PC Jeweler and TBZ.

Brokerage houses:

As per estimates, demonetization brought back almost Rs 2-3 trillion of money into the mainstream economy, which was supposedly lying ideal. With real estate in the doldrums and uncertainty in gold prices as well as the low rates of debt instruments, equities have emerged as the only investable asset class leading to huge inflows of money towards the same. This has led to healthy growth in revenues for brokerage houses. Firms who have benefited include Motilal Oswald, Edelweiss, JM Financial

MSME Sector:

The MSME sector in particular faced two major shocks in demonetization and the introduction of GST. MSMEs largely operate in the informal sector and comprise a large number of micro enterprises and daily wage earners,” added the report while mentioning that share of MSMEs in overall GDP is around 30 per cent (GOI, 2018), and the sector accounts for about 45 percent of manufacturing output and around 40 percent of total exports of the country.

MSMEs play a crucial role in the employment generation, and contribute significantly to overall economic activity, despite which the contribution faces several bottlenecks inhibiting them from achieving their full potential. About 97 per cent of MSMEs operate in the informal sector, and their share of informal sector in gross output of MSMEs is about 34 percent. As per National Accounts Statistics 2012, the share of informal (unregistered) sector manufacturing MSMEs in total GDP is estimated at around 5 per cent.

The year-on-year (YoY) growth of bank credit to the MSME sector decelerated gradually during 2015 to 1.6 per cent in April 2016 before exhibiting some recovery till October 2016. The deceleration in credit growth during 2014-16 was partly due to overall slowdown in economic activity, rising non-performing assets (NPAs) and reclassification of food and agro-processing units from MSME category to agriculture sector (as per the revised priority sector lending guidelines, issued to banks in April 2015).

On the exports front, the report added that the MSME sector contributes around 40 per cent to India’s total exports (GOI, 2018). Among various items of MSMEs exports, gems and jewelry, carpets, textile, leather, handlooms and handicrafts items are highly labor intensive and depend heavily on cash for working capital requirements and payment towards contractual laborer. Hence, export shipments of these sectors were impacted by demonetization. [13] [22-26]

Conclusion

These three devastating events were very similar in the fashion that they disrupted the lives of the people. The magnitude of that disruption in each of the three cases was inversely proportional to the economic status of each individual which is obvious given the socio-economic structure of the Indian society. In theory, the purpose behind the implementation of demonetization and the tax regime of GST cannot be questioned, both these policies were realized with a different set of goals but the purpose, namely the control of black money and the implementation of one umbrella tax could prove to be beneficial. The problem however the fact these policies were not openly debated in the parliament meant they were almost arbitrarily introduced. A similar case could be made for the Covid 19 pandemic. The implementation of untimely lockdowns and then the mishandling of healthcare resources during the pandemic resulted in a hugely devastating second wave.

This is the reality of an economy that has been severely mismanaged by the government. While many proponents of the current government would argue that business reforms and ease of doing business has improved and the amount of capital that has flooded the nation has created jobs and opportunities, the income gap between the rich and the poor has kept on compounding because of the same reason. Demonetization, GST, Covid 19 have economically worsened the lives of the lower middle class and the lower class and the people who are below the poverty line. On the ground stories and the real impact of covid on rural India can be understood and felt by reading https://www.firstpost.com/india/how-second-wave-of-covid-19-has-decimated-indias-rural-economy-9689231.html.

Investment during this time period is a very interesting factor to observe. While GST and demonetization slowed the growth of the Sensex for brief periods, the March 2020 crash was followed by a bull cycle which is continuing despite the worrying economic indicators. This could be because the retail Indian investor got exposed to the markets during the pandemic (include broker stats) and obviously the current fiscal policy of the central bank. Whether there is an alteration in the fiscal policy and the levels of money supply is yet to be seen and thus we cannot conclusively say right now if hyperinflation in the country is bound to occur which will impact the poor even more; or perhaps will there be some moderation and how that affects the market especially with the predictions that a bear market is not that far off. [29]For the lack of a better word, the Indian economy right now is in a confusing state of affairs. On one hand, you can see foreign investment and euphoria in the markets increase quarter-on-quarter and the economic recovery from Covid 19 itself has taken hold. However, there is an immense amount work to be done to pull the MSME sector and the whole informal economy itself, which constitutes nearly 40 percent of Indian GDP, to the levels where it was pre-pandemic, pre-GST and pre-demonetization. Competent government policies are needed to restore economic growth.

References:

- Impact of Demonetization, Goods and Service Tax and Covid 19 on the Indian Economy. Article DOI:10.21474/IJAR01/11649 DOI URL: http://dx.doi.org/10.21474/IJAR01/11649

- https://www.moneycontrol.com/news/business/demonetisation-4-years-on-a-look-at-what-it-achieved-and-didnt-6086571.html

- https://www.investopedia.com/terms/d/demonetization.asp

- https://cleartax.in/g/terms/demonetization

- https://www.babson.edu/academics/executive-education/babson-insight/finance-and-accounting/indias-demonetization-what-were-they-thinking/#

- The Implementation of Demonetization by Raju Rao https://pmworldlibrary.net/wp-content/uploads/2017/09/pmwj62-Sep2017-Rao-Demonetization-in-India-featured-paper.pdf

- https://www.freepressjournal.in/analysis/indias-economy-is-ailing-and-its-not-just-because-of-covid-19-writes-a-l-i-chougule

- Understanding India’s Economic Slowdown by R. Nagaraj https://www.theindiaforum.in/sites/default/files/pdf/2020/02/07/understanding-india-s-economic-slowdown.pdf

- https://www.statista.com/statistics/1229773/india-estimated-economic-impact-of-coronavirus-on-industry/

- https://scroll.in/article/999275/the-pandemic-in-data-how-covid-19-has-devasted-indias-economy

- https://journals.sagepub.com/doi/full/10.1177/0972063420935541

- https://journals.sagepub.com/doi/full/10.1177/0972262921989126

- https://rbi.org.in/scripts/AnnualReportPublications.aspx?Id=1315

- https://journals.sagepub.com/doi/full/10.1177/0019466220983494

- https://www.ilo.org/wcmsp5/groups/public/—asia/—ro-bangkok/—sro-new_delhi/documents/publication/wcms_798079.pdf

- https://link.springer.com/article/10.1007/s41027-020-00255-0

- https://www.phdcci.in/wp-content/uploads/2020/08/Impact-of-GST-on-Economy-and-Businesses.pdf

- https://madhavuniversity.edu.in/impact-of-gst-on-indian-economy.html

- https://www.researchgate.net/profile/Mr-A-Dash/publication/318421150_POSITIVE_AND_NEGATIVE_IMPACT_OF_GST_ON_INDIAN_ECONOMY_ A_DASH/links/5968a117aca2728ca67bc406/POSITIVE-AND-NEGATIVE-IMPACT-OF-GST-ON-INDIAN-ECONOMY-A-DASH.pdf

- http://www.theijbmt.com/archive/0932/2116231109.pdf

- https://www.civilserviceindia.com/subject/Essay/what-are-the-positive-and-negative-impacts-of-GST.html

- The Impact of COVID-19 Pandemic on Different Sectors of the Indian Economy: A Descriptive Study http:// www.econjournals.com https://doi.org/10.32479/ijefi.10461

- https://www.economicsobservatory.com/how-has-covid-19-affected-indias-economy

- https://www.bloombergquint.com/business/demonetisation-impact-on-indian-economy-what-we-know-three-years-on

- https://www.moneycontrol.com/news/business/markets/top-five-sector-which-got-impacted-the-most-post-demonetisation-nitasha-shankar-2432495.html

- https://www.business-standard.com/article/news-ani/msme-worst-hit-by-gst-demonetisation-says-rbi-study-118081800287_1.html

- https://www.ijiras.com/2018/Vol_5-Issue_3/paper_44.pdf

- https://tradingeconomics.com/india/money-supply-m3

- https://economics.rabobank.com/publications/2020/september/indias-worrying-inflation-dynamics/

- https://www.indiamacroadvisors.com/page/category/economic-indicators/money-and-banking/money-supply/

- * The ‘Reference group’ refers to the closest peer group statistic under which India falls. The reference group for GDP per capita is the Emerging Market and Developing Economies (EMDEs) classification by the IMF. The reference group for the unemployment rate is the Low- and Middle-Income Countries (LMICs) classification by the World Bank. The reference group for the fiscal measures is the Emerging Market and Developing Economies (EMDEs) classification by the IMF. Source: Data on gross domestic product, constant prices (percentage change) is obtained from the World Economic Outlook Database April 2021, International Monetary Fund. India’s GDP contraction is 8% according to the IMF and 7.3% from recent national estimates. Unemployment rates (for youth, adults: 15+) are ILO modelled estimates as of November 2021 and are obtained from ILOSTAT, International Labor Organization and World Bank. Fiscal measures are obtained from Fiscal Monitor Database of Country Fiscal Measures in Response to the COVID-19 Pandemic as of April 2021, International Monetary Fund.

About the author

Ishaan Marwaha

Ishaan is a Business Economics, Finance, and Entrepreneurship enthusiast. He currently reads in Grade 12 at Spring Dale Senior School, Amritsar, India. He is a winner of national-level business competitions and debates and takes a great interest in studying equity markets and the behavioral economics behind them. He is an avid investor and occasional swing trader. He wants to study Economics and Management at the University of Oxford at the undergraduate level.