Author: Khaled Aljuraywi

Mentor: Tayyeb Shabbir, The Wharton School of University of Pennsylvania

Al-Rowad International Schools

August 15, 2021

Abstract

The purpose of this paper is to provide a finite understanding of how our world would adapt to a new form of a digital economy. We as humans have digitalizing most of our interactions, whether it’s befriending people on Facebook, speaking your words on Twitter, or even learning through Google. Therefore, Understanding the next step of our structured economies is crucial. Nothing comes close in terms of technological implications like blockchain, whom many have stated is the best technological advancement since the internet! My goal is to set the scene of how blockchain will play a huge role in how we perceive our functioning financial world. I describe its role and how it is already tied to implications in our national and commercial banks and how it will even provide a bigger role in the future. The research then shifts to how a central bank is already using blockchain and fully digital economy on full throttle in a thorough case study of the digital Yuan case. I go back home to identify and review the FinTech scene in my home country of Saudi Arabia, by assessing how big giga projects shaped up the region as a hub of technological developments for upcoming years.

Keywords: Digital Economy, Fintech, Digital Yuan, Central Bank Digital Currency

1: Introduction

In any modern economy, the role of financing infrastructure is a crucial one. The current innovative efforts towards digitizing of finance are full of promise though they are still at a relatively early stage of development. One such effort concerns the application of blockchain algorithms and the platform in general to financing functions. These functions could be at the overall economy level as well as specifically focused on certain sectors, in particular the banking sector. The purpose of this paper is to describe the nature of Blockchain technology, its impact on financing with a special emphasis on the Central Banking Policy, budding sovereign digital currencies. The paper rounds this discussion off with a detailed case study of Fin Tech in Saudi Arabia – an important developing country.

Complete digitalization of a whole functioning economy remains a distant and a difficult goal. Innovative efforts have been undertaken to overcome this challenge, the main effort being the Block-Chain Technology. In general, an effort to digitalize an economy must factor in the business need along with the human perspective regarding these transactions. Blockchain promises to be such an initiative.

Simply put, Blockchain is an advanced database, where data are stored as chained chunks or ‘blocks’ of information hence the name. Having a chained structure of information gives the advanced technology a huge advantage of having a set timeline that is irreversible and secure. Blockchain and its many applications has been the best effort accomplished by communities to fully digitalize daily applications while making them organically verifiable without a central regulator or auditor. Companies, banks, and even governments have already made significant progress by achieving technological maturity that take into factor human preferences. Applications ranging from daily transaction of peer-to-peer transactions to large organizations such as corporations and governments are starting to use such structure to improve transaction verifiability and its execution.

The effects of blockchain and other digital factors on the worldwide commercial banking scene have been crucial to developing a healthy financial ecosystem. Smaller businesses receive online payments with Stripe, which means that small businesses get paid 14 days faster on average versus businesses that do not use an online payment service. FinTech daily applications have grown incredibly in such a short period, companies like Robinhood, Square, Stripe are improving the daily experience for millions at a time. PwC in a recent study have suggested that 83% of traditional banks think that they are at risk of profitable retailer failure.

Financing is instrumental in building a healthy economy, and a technological approach has helped widen the scope for ways that an entrepreneur can go on financing a revolutionary idea. For years, economists have expressed their concern that rates of bank financing of smaller businesses are declining. This trend has hurt many economies especially those in developing countries where bank financing may be a major source of business financing. The new promising technology such as Blockchain can fix that. As Deutsche bank reported in 2016 new models of finance in the reduction of systemic risk and more diversified lending options. Established industry players are confronting the reality of alternative online platforms are improving the profitability of small business lending.

Saudi Arabia an expanding economy, shows a promising adaption towards a more digitalized economy. The Saudi experience really underlines the effect of technology towards building a healthier more innovative economy with promising projects like NEOM.Enumerating and documenting such efforts while giving a suggesting outlook for how the future state of the world economy would be set like are two of goals of such a research paper. Emphasizing on the role of central banks is also quite crucial in identifying how a country sets itself up for the future. Central bank adoption can make or break a country’s economy destroying all economical and entrepreneur infrastructure which can take a toll on the said country future for generations to come, Venezuela comes to mind regarding an unfortunate case on the other hand a country like Vietnam has taken a more futuristic role which allowed its economy to be one of the fastest growing.

The rest of the paper is organized as follows: the second section describes the nature of Blockchain, followed by section 3 which characterizes its application to Commercial Banking Systems. Section 4 focuses on Blockchain and Central Banking Policy. Finally, section describes the case study of Saudi Arabia in terms of the recent developments regarding the FinTech, Blockchain, and NEOM. The paper ends with Concluding Remarks followed by References.

2: Nature of Blockchain

The nature of blockchain, gifts us a new way of re-organizing the financial sector, in the same way that the Internet and emails to be exact transformed how we communicate. While the Internet has organized input information, blockchain will help organize at least in its first step personal, peer-to-peer finance. Let us elaborate on the functionality of Blockchain Trust.

The first application of Blockchain Trust is to perform such fundamental functions of ‘money’ as acting as a ‘medium of exchange’. For that to happen, Blockchain needs to be ‘trustworthy’ and thus ‘generally acceptable’. Blockchain generates trust because of the data it contains, eliminating the participation of a third party in trust of the system. The role of these intermediaries is to give confidence to both the parties that wish to make a transaction or enter into an agreement, but do not trust each other because they do not know each other. The software of blockchain is open source; therefore, no one should pay licenses or ask permission to use it. In the same way, anyone can participate in the network by downloading a copy of the blockchain and use it according to the previously established consensus rules. It is no longer about nation-states as trusted intermediaries. That is, it must be based on computing, on software code, on the accuracy of mathematics.

The network must not have other parties. The network is trust per se, considering that all data that goes through it is publicly known through a block explorer. The network operates distributed in different geographical locations around the world in nodes that run an exact replica of the blockchain, thus preserving, the same unanimous state, the same truth that cannot be modified by any of the nodes without there being a consensus. It does not serve the purposes of any State, or organization. Each member of the network – called a node – follows the consensus rules neutrally and, if not followed, is simply expelled.

3. Application of Blockchain to Commercial Banking Systems

In this section, we are going to focus on the nature of online banking services at the national level (3.1) with the emphasis on the U. S., followed by a case study of China in terms of global commercial banking and concluding this section with an overview of some of the challenges related to blockchain application to commercial banks (3.3).

3.1 Online banking services at the national level

Blockchains as state is decentralized and permissionless, which can lead to major disruptions in the financial sector, especially in payment clearing. Blockchain can prove crucial to the new face of FinTech, facilitating technological factors as well as being renounced as a very safe and secure technology.

Since 2015, several major international financial institutions have begun to formulate plans for the blockchain sector at the national level. Here are some of the examples of such efforts. Goldman Sachs, J.P. Morgan, UBS, and other banking giants have all established their own blockchain laboratories, working in close collaboration with blockchain platforms, and published a series of studies on this topic. Goldman Sachs even filed a patent for transaction settlement based on blockchain technology. Additionally, various national stock exchanges, such as the Nasdaq Stock Market and the New York Stock Exchange have also conducted in-depth research on blockchain technology. On December 30, 2015, Nasdaq announced that it had completed its first securities transaction using the blockchain transaction platform LINQ. Furthermore, the US Depository Trust & Clearing Corporation, Visa, the Society for Worldwide Interbank Financial Telecommunications. There has also been widespread optimism regarding the application of blockchain in the banking industry.

In May 2016, McKinsey conducted a survey on global banking executives, finding that approximately half of executives believe that blockchain will have a substantial impact within 3 years, with some even considering that this will happen within 18 months.1 Another survey of 200 global banks predicted that, by the following year, blockchain technology will be extensively implemented by 15% of banks. Furthermore, IBM has stated that, in 4 years, 66% of banks will have commercial blockchain at scale. As such, an increasing number of banks have begun to be pay greater attention and place emphasis on blockchains. Therefore, why is the current banking industry focusing on the deployment of blockchain strategies? Which specific scenarios can blockchains be applied to? What are the existing problems in the implementation process of blockchain technology? This paper discusses these questions in turn in the following chapters.

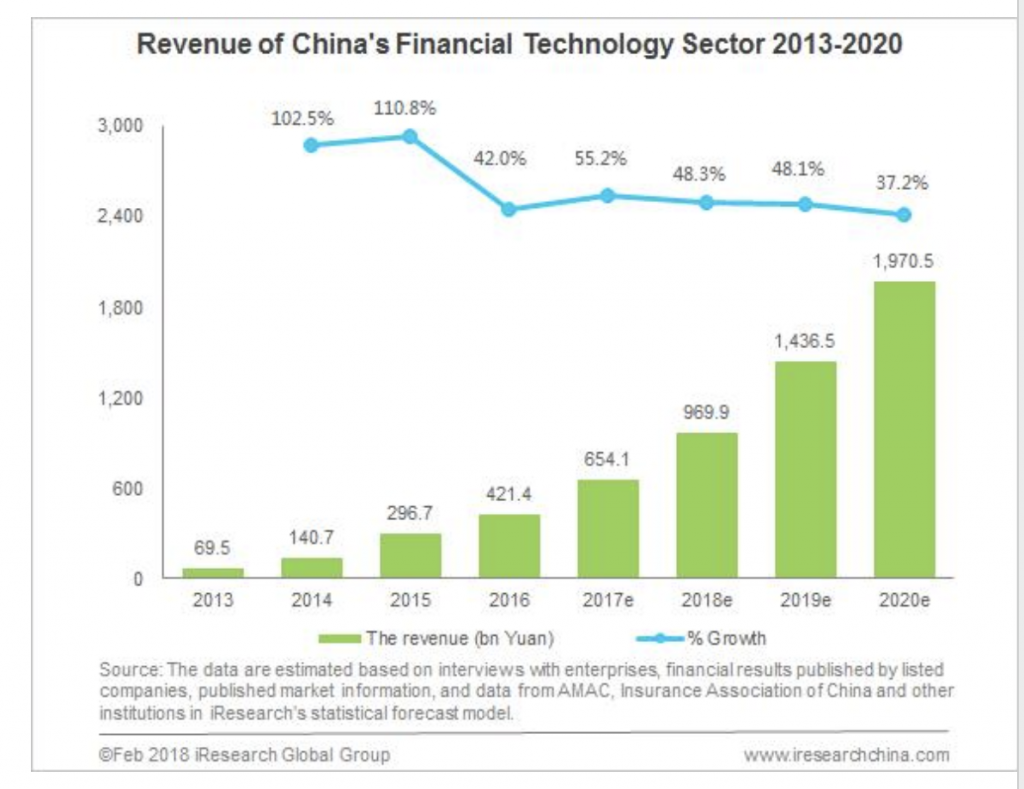

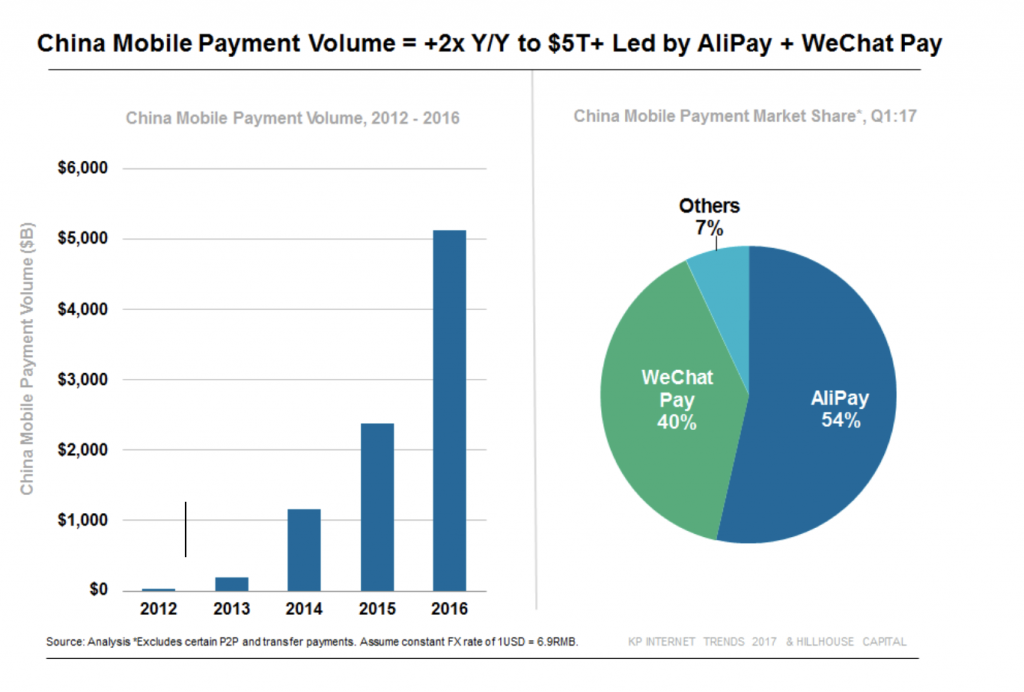

Blockchain is expected to formulate and change the banking future, in China’s case the internet finance and other aspects of FinTech have crippled the profitability of said banks, in consequence this led traditional banks to develop and cope with ongoing change. In recent years, booming Internet finance has accelerated the marketization of the financial sector. The endless emergence of Internet financial products has led to the substantial diversion of household saving deposits and increased banks’ cost of debt. According to monitoring data for national Internet FinTech platforms, as of the end of August 2016, the number of Internet financial platforms had reached 8490 and the number of active users 618 million. The latest data released by the China Internet Network Information Center indicated that, as of June 2016, the number of Internet users in China was 710 million. As such, the percentage of Internet finance users accounts for 87% of total Internet users in China. The great success of Internet finance within a short period of time is due to four vantages: infrastructure, platforms, channels, Internet finance companies are aware that finance is not an independent entity, but is embedded within numerous real-life scenarios. This goes with the mentioned human preferences that blockchain and the internet finance delicacy follow. Break the above into at least 2 maybe 3 smaller paragraphs – especially when you switch from the U. S. to China.

Since 2015, China’s macroeconomy has entered a “new normal,” wherein economic growth continues to decelerate, while interest rate liberalization is essentially complete, and their combined effects are becoming increasingly apparent. On one hand, there has been a trend towards narrowing interest-rate spread and declining the profitability of commercial banks. On the other hand, there has been increasing credit risk and nonperforming assets (Wang Wei 2016). The changes are shown in Figs. 1 and 2. Moreover, following a series of changes, including easing market access for foreign banks and the internationalization of the RMB, the survival environment of China’s commercial banks has become particularly harsh.

3.2 Implications of Blockchain to Global Commercial Banking

Aspects of blockchain technology which have been applied as forms of FinTech have hendred the profitability of massive commercial banks, the case study for this section would be China the reasoning for choosing said country is very straight forward. China has the most advanced FinTech ecosystem there is. The digital yuan and other state backed projects are also a key in determining Chinas advancement.

In recent years, there has been a boom in the financial markets, increased product varieties, and continuous financial innovations. The focus of capital markets ranges from derivatives to asset securitization, and then to P2P, crowdfunding, and others. According to statistics by the Central Depository & Clearing Co. Ltd., in 2015, the total asset securitization products issued nationwide were worth RMB 603.24 billion, equivalent to a growth of 84%; their market stock was RMB 770.395, equivalent to a growth of 129%. In 2016, the asset securitization market will progress toward the scale of trillion RMBs. The crowdfunding industry has also achieved excellent results. According to incomplete statistics, as of the end of 2015, there were 283 normally operating crowdfunding platforms. For the entire 2015, the national crowdfunding industry successfully raised RMB 11.424 billion. This was the first year in history to exceed RMB 10 billion, registering an increase by 429.38% compared to 2014. Additionally, the Securities Regulatory Commission has also announced that an equity crowdfunding pilot will be carried out this year. Financial innovations can offer capital market participants, especially small and medium sized enterprises (SMEs), more options, thus providing more convenient and personalized services. This creates significant competition with the traditional banking industry.

Source: Source Fig 3 Guo, Y., Liang, C. Blockchain application and outlook in the banking industry. Financial Innovation, Table 3

Basis for strong internet finance in China

| Infrastructure | Payment system (medium): Alipay, WeChat Pay, Tenpay Credit system: Sesame Credit Underlying asset matching platform: Renrendai |

| Platform | Service integration: Encompasses payment, financial management, fee payment, and other services Navigation: Helping customers to find the required applications Personalization: Providing services based on the personal characteristics of the customers social interaction: WeChat, Alipay Living |

| Scenario | Application scenario and product: WeChat Red Envelope, Alipay School Life |

3.3 Challenges of blockchain application to commercial banks.

This section will take note of the challenges that might face any Technological Financial scene, multiple noticed challenges that faced said Chinese case study.

- Social: From the perspective of the overall technical environment, all sectors of society still hold a cautious and even negative attitude towards blockchain technology. On the one hand, due to the lack of professional knowledge of blockchain and the news of bitcoin “roller coaster”, it is easy for the outside world to equate blockchain with encrypted digital currency. On the other hand, there is a phenomenon of overstating the function of blockchain, and it is believed that blockchain will subvert all the existing Internet. These are all biased views. In terms of technology itself, blockchain is the supplement and innovation of Internet technology application level, but it is not subversion.

- Technical; As a new technology, blockchain has some problems, such as lack of practical data, unknown market tolerance, and market education needs a certain time. As a blockchain structure, all information participants in the blockchain have a “public information account book” to ensure that the information cannot be tampered with and traceable. With the development of time, there are more and more nodes, which will lead to the increasingly serious problem of redundant storage, the dramatic increase of cost and directly lead to the problems of too long blockchain structure, slow data update and response. In addition to the performance may not be able to meet the high-frequency transactions, blockchain technology is still immature, and there are certain security risks, including whether the algorithm is reasonable, whether there is the possibility of cracking.

- High costs; The development of blockchain finance in the banking industry will consume huge human and material resources. For banks, financial innovation should not only ensure economic benefits, but also comply with regulatory requirements. At present, blockchain technology is in the research and development period, and the relevant technology and use standards are not unified. The current infrastructure of financial institutions has spent a lot of manpower and material resources after years of construction and maintenance, which is relatively perfect. The use of blockchain system will completely subvert this traditional mode and create a new transaction settlement and management system.

4: Blockchain and Central Banking Policy

Central banking policies effect the banking and financing ecosystem of said country, it effects mainly the scene of national banks and in this section, chapters will vary from discussing certain effect to discussing new central banking policies that are adept to the changing ecosystem.

4.1 Central Bank-Issued Digital Currency

What is a traditional Central Bank? Nowadays there are two forms of money issued by central banks, i.e., central bank money: cash and reserve deposits held with the central bank, where the depositor is usually a commercial bank. No currency area in the world is known to have issued any other type of central bank money, such as electronic scriptural money used by the general public. Both types of money are entered as liabilities on the central bank’s balance sheet. Most money is, however, scriptural currency created as a result of lending by deposit banks and could, in practice, be fully converted into central bank money. Central bank money is held by the general public only in the form of banknotes. It is also held by credit institutions and government in the form of reserve deposits. The central bank’s counterparties have the right to exchange reserve deposits for banknotes and vice versa. Credit institutions forward banknotes to customers, i.e., ordinary citizens, companies and entities. New central bank money is always created via central bank accounts and based on monetary policy decisions. The central bank creates new money in the central bank accounts via open market operations or refinancing operations. Deposits at commercial, savings and cooperative banks are commercial bank money. Credit institutions create commercial bank money by granting loans to the public. The bank granting a loan records a deposit on the customer’s account and on its receivables a loan of the same amount. The deposit recorded on the customer’s account is a valid payment instrument, for example as a credit transfer. The majority of consumer credit granted in Finland is in the form of housing loans. The majority of payment transactions by the general public are executed with commercial bank money created in the banking system, by transferring money between deposit accounts, e.g., when purchases in a shop are paid with a debit or credit card.

In terms of CBDC this is how a projected outlook would look so:

- The central bank issues it in digital form.

- Anyone has the right to hold it. It is not a privilege reserved to e.g., credit institutions.

- It is the same currency as banknotes and central bank deposits. The conversion rate of banknotes and zero-interest bearing digital cash would always be one-to-one, and at least some economic entities, e.g., banks, could convert it freely into other types of central bank money.

- It can be used as a payment instrument in retail payments.

- When two parties engage in a transaction, there is no third party – at least not a private one – that verifies or executes the payment as a central counterparty. The same principle applies to banknote payments.

For the new payment instrument to be a substitute for cash, it should share many of its properties. Cash, in its current form, has many characteristics that users may find important but cannot be found in current electronic payment instruments. These features include anonymity, immediate finality and transaction clearing without third parties. To be able to examine the characteristics of the various payment instruments and the need for such instruments in future, we must first classify and analyze the structural characteristics of the payment instruments. Only then can we systematically analyze what characteristics digital cash issued by central banks should have. As the first criterion, we examine real time settlement. One of the benefits of cash is that as soon as the authenticity of a banknote or coin is established and the banknote or coin is accepted, the execution of the payment transaction is validated as such. It is important because immediate settlement minimizes counterparty risk and funds are transferred to the payee in real time. Payment validation is, in principle, also independent of electronic systems, even though retailers’ point-of-sale terminals record cash and card payments into the same system. In card payments, the payment terminal checks availability of funds (validation of funds) for the required payment. The actual settlement takes place only in batch runs between banks, typically overnight. The new instant payment systems provide real-time settlement of payment, in a couple of seconds. This type of system has been launched at least in the Nordic countries.

Another natural characteristic of cash is anonymity of payment. In many payments situations identification of the parties to the payment transaction is neither necessary nor important. However, a payment transaction rarely requires anonymity. Cash payment machines, parking meters and most retail payments operate without identification, in cash. In Bank of Finland surveys, only a few consumers (some 2% of respondents) cited anonymity as a criterion for selecting a payment method. For example, in Germany, anonymity of payment is of significantly larger importance to the consumer. In a recent euro area payments survey, 13% of consumers cited anonymity as an important reason for using cash in retail payments. In electronic payment methods, the user is usually identified via their bank account. With loyalty cards, the payer’s identity may also be revealed to the merchant.

The third factor distinguishing between payment methods is whether the payment instrument itself is also an asset. Cash is a liquid asset, and it is often used in saving ‘for a rainy day’. Card payments, credit transfers and direct debits are not assets as such; they only provide access to the payment system where settlement takes place. Like card payments, credit transfers and instant payments, in turn, are only tools for controlling and using the consumer’s purchasing power which is deposited on bank accounts, in the electronic systems of deposit banks. In the case of cash, anonymity, immediate settlement and independence of central counterparties are all based on the fact that cash is a bearer instrument, i.e., the person who is physically in possession of the banknotes and coins is legally their owner. In addition, banknotes and coins include all the information required for authentication and settlement finality. In practice, settlement means entering the transaction into a ledger, and in the case of cash payments, it also involves transferring the payment instrument to its next owner. In the case of scriptural money, all transactions and balances are recorded in the account bank on an ongoing basis. In the case of cash, there is no central authority responsible for bookkeeping; each holder of cash essentially keeps their own records. In such a situation, the ledger is distributed. The digital implementation of a bearer instrument does not fully correspond with cash money. For a digital currency to fulfill the criteria of a bearer instrument, it should be convertible into a sequence of number, the holding of which would be necessary and adequate verification of ownership. For example, in the case of Bitcoin and other cryptocurrencies, this type of sequence of number that is a sign of ownership is called a private key. The distributed ledger of the Bitcoin system, in turn, includes real-time information on the amount of purchasing power owned by the holders of each private key. To make this type of a system independent of a central authority, the amount of purchasing power held by each private key is recorded in a distributed ledger, instead of a centralized ledger. Another important characteristic of money is that it cannot be counterfeited. In the case of cash, non-counterfeit ability is tangibly based on security features that can been seen and felt. Banknotes also have several machine-readable optical and electromagnetic security features that ensure that they are checked for authenticity in a mechanical sorting process. In electronic record-keeping, non-counterfeit ability of money is based on verified transaction records and double-entry bookkeeping.

In the case of Bitcoin, non-counterfeit ability is based on the openness and transparency of the distributed ledger (blockchain). For both cash and Bitcoin, production is technically so difficult that counterfeiting would be very expensive. One of the keys required features of a payment instrument is confidence in the acceptability and continuity of the instrument. In the euro area, only euro cash has the status of legal tender, but the scriptural money of commercial banks is fully convertible into cash. According to recommendations adopted by the European Commission in 2010, euro cash must be accepted for its full-face value for payment of debt, without surcharge. Some euro area countries have, however, set limits on the size of payment, with the aim of preventing such things as the grey economy ‘selling under the counter’, as it were. The continuity and acceptability of cryptocurrencies as payment instruments are not as certain as with currencies issued by central banks.

Cryptocurrencies have also been more vulnerable to fraud and stealing of funds, e.g., if a private key is lost or in connection with hacking. Money always involves the issue of stability of value. Key national central banks have inflation targets that have an impact on the value of their currency over time. The inflation target applies particularly to cash money, because account deposits are often subject to an interest rate which, at least in principle, is higher than the rate of inflation. Moreover, cash is not dependent on technology or equipment; in other words, anyone can use cash, irrespective of the size or color of their wallet. Digital money as an intangible phenomenon can never be fully independent of technology or devices, even though this should be the ultimate goal. Digital cash would thus not be in the form of deposits in the central bank’s account system; it would be located in the counterparties’ own systems. In theory, households and companies could be offered deposit accounts in the central bank, but this alternative would not introduce any new technical features into the monetary system, and it is therefore excluded from our examination for now. In contrast, a system based on a distributed ledger could be interpreted as digital cash. There are a number of ways to implement central bank digital currency. The central bank could provide a system in which the digital currency is stored, transferred and authenticated. Another possibility is to create a standard for digital currency in which the private sector would be responsible for creating the storage and transaction applications. The third alternative is to limit the central bank’s role to the creation of money in respect to balance sheet and debt relationships. The private sector would be responsible for the technical arrangements. A private entity would open an account with the central bank, and the funds on the account would be earmarked as funds of the holders of payment instruments issued by a private issuer. The amount of funds on the account should be equivalent to the amount of payment instrument issued by the service provider. A private entity would issue certificates of ownership in deposits with the central bank, which would be used as payment instruments. The arrangement could also be compared to a bank deposit, which is subject to a 100% reserve requirement. To ensure neutral treatment of the different payment instruments, the central bank should impose on the providers of digital money conditions that do not give banknotes or digital money an artificial cost advantage or other competitive advantage. This type of arrangement in which the deposit is made with a commercial bank has been discussed above in the research paper.

4.2 The future of Sovereign Digital Currency and the Digital Yuan

The Central Bank of China is testing its Digital Currency Electronic Payment in the cities of Shenzhen, Suzhou, Chengdu and Xuan with the involvement of four large state-owned banks in the issuing of the digital asset including, the Agricultural Bank of China, Industrial and Commercial Bank of China, Bank of China and China Construction Bank. China’s DCEP could be launched as early as next year. Already mobile transactions accounted for four of every five payments in China during 2019 and the Chinese population habitually use Alibaba’s Alipay and Tencent’s WeChat Pay as a preferred method of payment. The Central Bank, DCEP is one of latest FinTech developments, technology-enabled innovation in financial services that include the application of cloud computing and Big Data analytics to the finance economy and to the process of financialization. The World Bank Group’s (2020) report ‘Payment aspects of financial inclusion in the fintech era’ from the Committee on Payments and Market Infrastructures emphasizes a balance of challenges and opportunities:

‘Fintech can be leveraged to improve the design of transaction accounts and payment products, make them ubiquitously accessible, enhance user experience and awareness, and achieve efficiency gains and lower market entry barriers. At the same time, these benefits come with certain risks in terms of operational and cyber resilience, the protection of customer funds, data protection and privacy, digital exclusion and market concentration’. The report also makes clear that a fifth of world banks are likely to introduce DCEP systems within the next five or so years. Some commentators have suggested that the Chinese digital currency system is more about control over the cash economy than a progressive decentralization first promised by visions of the introduction of cryptocurrencies. Wired’s Barclay Bram (2020) indicates the original techno-utopian vision: Bitcoin, which was released into the world by the mysterious Satoshi Nakamoto in 2009, is based on a techno-utopian vision of a decentralized global currency that would provide anonymity and security, while allowing users to subvert the established financial system and its gatekeepers. Underpinning this technology is the blockchain. There are likely to be several fundamental differences between Bitcoin and the Chinese system because the blockchain ledger will be controlled by the government rather than distributed across the system giving government unprecedented control over the cash economy. The goal has been to protect our monetary sovereignty and legal currency status. Yet the biggest, and possibly the most important, objective of e-RMB could be a shot in the arm to RMB internationalization which has stalled since the China–US trade war started two years ago. One of the major implications is whether the current US–China tensions will spread to a FinTech race and the weaponization of currency wars. during times when there is less willingness to lend in safe-haven currencies like the US dollar, risk-off environments (such as those created by global pandemics) lead to greater demand for US dollars. Moreover, shock and uncertainty have led to risk aversion within key funding markets that have exacerbated dollar shortages within the international monetary system (IMS). Within the framework of an international dollar shortage, the age of Covid-19 has represented a boon to China’s decades long efforts to avoid the ‘dollar-trap’ on its quest towards RMB internationalization. DCEP is the cornerstone of the development of digital economy. Digital economy in the future will definitely be an encrypted digital economy rather than a plaintext digital economy. In this regard, DCEP should be crypto-currency from a technical perspective. Cryptographic technology is the key to the technical security and credibility of DCEP. To be specific, cryptography should be used in the design of DCEP presentation format to ensure that it can be circulated and stored and cannot be forged, double-spent or repudiated. The transaction of DCEP requires the use of cryptography, DLT, trusted cloud computing and secure element (SE) to ensure peer-to-peer security in order to prevent the DCEP from being stolen, tampered or imitated. In terms of DCEP user experience, while peer-to-peer payment service different from traditional electronic payment is provided to users, privacy protection technology and DLT should be integrated to ensure safety of user data and to prevent leakage of sensitive information without compromising usability. In terms of DCEP regulation, since DCEP adopts the mechanism of “voluntary anonymity at front-end and real-name at back-end”, security and privacy protection technologies can be used to manage data access, so as to make best use of RegTech such as big data analysis. Theoretical innovation and practice of crypto-currency have burgeoned in recent decades with relevant theories becoming increasing mature. Chaum was the first to propose an anonymous and untraceable e-cash system. Dai presented an anonymous distributed e-cash system called B-money, and Jakobsson and Jules brought up the concept of POW. Szabo invented Bit-Gold. In 2008, Nakamoto published the classic paper of Bitcoin: a peer-to-peer electronic cash system where he proposed a decentralized e-cash system completely based on peer-to-peer technology. In fact, the DLT adopted by Bitcoin was an integration of the latest achievements of various crypto-technologies at that time. The digital currency sector abounds with practical achievements. Ever since Bitcoin, alternative cryptocurrencies have emerged one after another. By 2016, there have been all together more than 600 types of digital currencies. Those crypto-currencies have evolved based on Bitcoin by making further use of crypto-technologies, and many of those attempts have made impressive academic innovation.

5: Saudi Arabia’s venture with FinTech, Blockchain, and NEOM

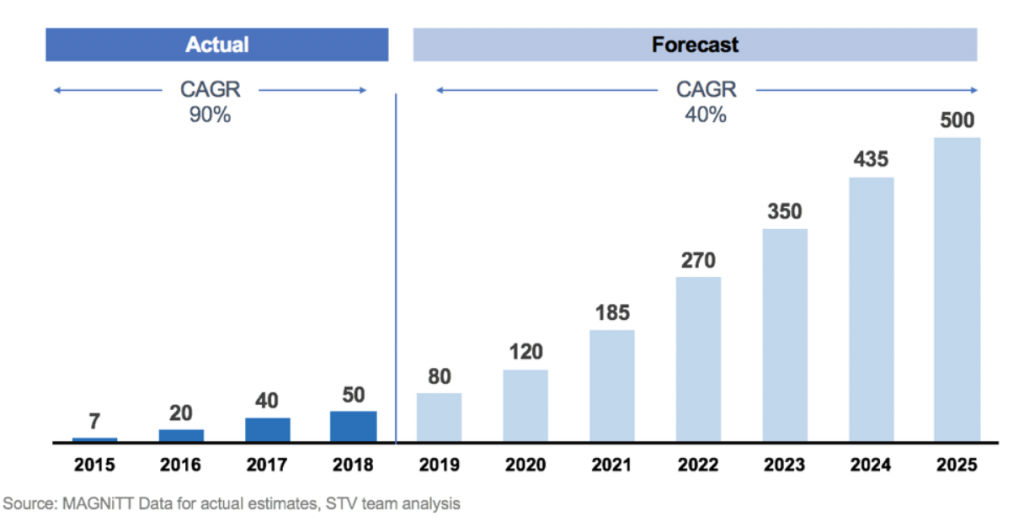

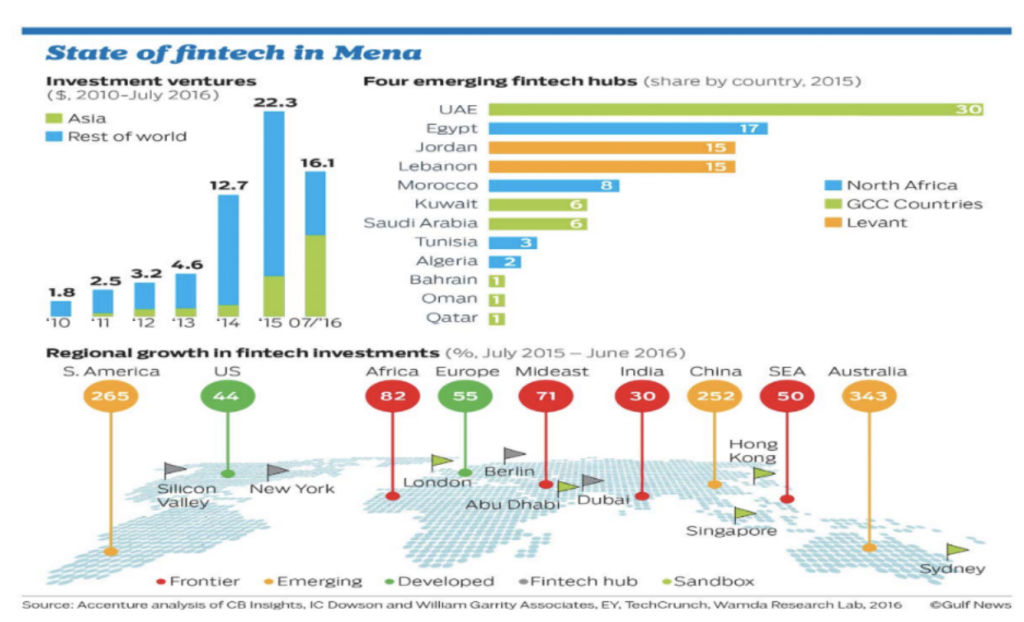

In this section, as a case study for an emerging economy, I will highlight Saudi Arabia’s experiment of Internet Finance. In this respect, I will address, in general terms, Saudi Arabia’s venture involving FinTech and Blockchain and point out how this exercise has that affected the country’s financial ecosystem.

5.1 FinTech Expansion in Saudi Arabia

In Saudi Arabia, the development of FinTech is literally at a nascent stage. As can be imagined, starting ventures involving FinTech requires an ecosystem involving innovation, training and institutional support. To Saudi Arabia’s credit, as part of its Vision 2030 initiative, Saudi Arabia have set ambitious goals to tackle such a challenge. However, it is widely recognized that building a FinTech ecosystem from scratch with a limited number of FinTechs and with first time efforts to define clear paths for regulation as well as training and education presents a major challenge.

So, what are the first steps they have taken to build a FinTech industry from scratch.

For an industry to thrive, it needs a supportive ecosystem to help it grow. Saudi Arabia looked to establish this by creating a network of government organizations, universities, corporates, banks, venture capitalists and local FinTech companies, all working together to drive innovation, investment and to create a support system. This network is overseen by a new organization: FinTech Saudi.

By targeted action in education, regulation and building a supportive ecosystem, FinTech Saudi believes it can deliver the necessary knowledge, skills and support for a competitive FinTech sector.

Education

For a FinTech start-up to succeed, a person or group of people need an initial business idea. That idea most often arises from a frustration with a system or product combined with the knowledge and know-how to create a better alternative.

Without a pre-existing FinTech sector to draw upon, Saudi Arabia has lacked insight and knowledge on how to take ideas and turn them into a reality in the region. On top of this, those who have the inspiration and drive to start their own FinTech business have been faced with a lack of technical and commercial talent to drive local business growth.

There has therefore been a big focus on how Saudi Arabia can begin to develop these skills, starting with the education system. Initiatives have initially been centered around creating a FinTech-style curriculum, targeting university career fairs and offering internship opportunities. FinTech clubs and general co-working spaces have also been established, designed to inspire potential entrepreneurs and build a robust talent pool FinTech’s can access.

Regulation

London has over 4,000 FinTech start-ups. Saudi Arabia has just 15. Why?

Historically, Saudi Arabia has been challenged by FinTech start-ups relocating operations elsewhere once they need to scale. A key driver of this has been lack of infrastructure and regulation to support them.

Therefore, a huge focus on creating the right environment for the nascent FinTech industry in Saudi Arabia is to not only encourage more start-ups to be created in the first place, but to encourage them to stay.

Establishing a regulatory framework, including two sandboxes with the Saudi Arabian Monetary Authority (SAMA) and the Capital Markets Authority (CMA) – drawing lessons from the UK FCA’s sandbox established in 2016 – has been seen as paramount in creating an environment in which FinTechs could stay, thrive, and scale.

What does success look like?

Saudi Arabia has high aspirations for what it wants to achieve over the next five years. The strategic vision is categorized into three elements: community, education and Small-Medium Enterprises (SMEs).

The government is integrating the vision firmly in the community, through running a number of events and creating significant new jobs within the sector. Education will be embedded in the plans, with targets to reach thousands of students across the country. For SMEs, there are initiatives underway to grow the number of Saudi Arabian FinTech companies significantly – generating a substantial amount of new funding.

The initial expectation is that the majority of FinTech start-ups that emerge from this program will focus on the growing domestic market, but in time Saudi Arabia could ultimately be a great point of entry for international FinTechs looking to scale in the country.

Across the world, we’ve seen a diverse forest of FinTech sectors grow in different shapes and sizes, with occasional nurture and support from governments. In contrast, Saudi Arabia wants to prepare the soil, plant the seed and spur its growth.

5.2: Local FinTech expansion

Despite the challenges of COVID-19 in the first half of this year, 2019 / 2020 has been a pivotal period for the fintech industry in Saudi Arabia. Significant progress has been made in payments with the launch of Apple Pay, establishment of Saudi Payments and the release of the payments regulation; SAMA and CMA have continued to issue regulatory testing licenses and develop regulations to support fintech activities; Fintech Saudi has launched a number of initiatives to support the fintech industry including the Fintech Ecosystem Directory and Fintech Jobs Portal to support fintech companies, the Fintech Regulatory Assessment Tool to provide greater regulation clarity and the Fintech Data & Research Initiative to support data driven innovation in fintech. The industry in the kingdom is growing at a rapid rate. ‘’Between 2017 and 2019, the value of fintech transactions increased at a rate of over 18%each year, reaching over USD 20 billionin 2019’’. Payments account for two-third of the market and almost 98%2 of the userbase. It is followed by personal finance which comprise over 30%3 of the fintech transaction values. The number of payments made through SADAD has increased by a CAGR of 11% between 2016-19 to reach 270 million4 transactions in 2019. The value of these transactions has grown by a CAGR of 24% in the corresponding period to reach SAR 445 billion.5 ‘’The number of smart phone payment transactions in Saudi Arabia increased by 352% to 19.7 million in April 2020’’,6 compared to 4.4 million in April 20197. ‘’The fintech market in Saudi Arabia is expectedtoreachtransactionvaluesofover USD33billionby2023’’.8Payments are likely to continue to lead the market share followed by personal finance. Online insurance sales account for a relatively small proportion of the market in Saudi Arabia. However, with new regulations on insurance aggregation coming in force, the insurrect sector is poised for higher growth in Saudi Arabia.

Fintech Saudi Annual Report

Fintech Saudi Annual Report

There is an active community of banks, universities, corporates, government agencies and investors working for the development of the fintech sector in Saudi Arabia. From e-wallets to lending and insurance aggregation to investing, the services of fintech’s have redefined the way in which businesses and consumers carry out routine transactions. The increasing adoption of these trends bodes well for Saudi Arabia, especially in the post-Covid world where physical contact is likely to be minimized for financial transactions. Going forward, there is a keen interest from fintech’s to use more technology innovation in their solutions. FinTech’s in Saudi Arabia are interested in utilizing Application Program Interface (API), machine learning, artificial intelligence and blockchain technologies. Fintech companies are changing the financial landscape globally and in Saudi Arabia. They are increasing competition and driving innovation for traditional banks, insurers and asset managers. The rise of fintech activity is also spurring regulatory change. Regulatory bodies in countries around the world are investigating and implementing banking policy modifications in order to attract established fintech players and encourage the growth of local fintech’s. In order to help transform Saudi Arabia into a smart financial hub, SAMA launched its regulatory sandbox environment in 2018 that allows local and international financial technology firms to test new digital solutions they intend to launch in the Kingdom. Services and products currently being tested or have been successfully tested include e-wallets, peer-to-peer (P2P) transfers, lending and direct international transfers. There are currently 26 applicants that are undergoing sandbox testing with SAMA. In January 2020, SAMA launched the regulations governing the provision of payment services in Saudi Arabia. The proposed regulations would allow payment service providers or licensed banks to offer payment services and electronic money issuance. The regulations are aimed at establishing a supervisory and oversight framework that ensures the safety and efficiency of transactions in the payments sector. Additionally, SAMA announced the issuance of the first license for an Electronic Wallet Company and the first license for a Payment Services Company in January 2020, after the successful completion of their testing in the regulatory sandbox environment.

5.3: ABER

The Saudi Central Bank (SAMA) and Central Bank of United Arab Emirates (CBUAE) are pleased to present this report on Project Aber: Joint Digital Currency and Distributed Ledger proof of concept Project. This report reflects our journey in the project that aimed to contribute in the body of knowledge in CBDC and DLT technologies filed. In the light of the new experiments and researches both central banks led this project as an innovative driven initiative. The initiative sought to explore whether distributed ledger technology could enable cross-border payments between the two countries to be reimagined: using a new, dual-issued digital currency as a unit of settlement between commercial banks in the two countries and domestically. The name Aber was selected because, as the Arabic word, for “crossing boundaries”, it both captures the cross-border nature of the project as well as our hope that it would also cross boundaries in terms of the use of the technology. Over the course of a year, use cases were designed, implemented, and operated; with the solution, results, and key lessons learned documented in this report. The project confirmed that Distributed Ledger Technology (DLT) can provide central banks with the ability to reimagine both domestic and cross-border payment systems in new ways. We believe that it represents a significant contribution to the body of knowledge in this field and lays the foundation for future work that we plan to explore in the future. We are pleased by the promising results, insights, and learnings described in this report and trust that they will benefit the central banking community and broader financial ecosystem in visualizing the potential of this new technology to transform the GCC financial markets and indeed our industry.

Project Aber was an initiative launched by the central banks of Saudi Arabia and United Arab Emirates to explore the viability of a single dual-issued digital currency as an instrument of domestic and cross-border settlement between the two countries. The high-level objectives of the initiative were:

- To explore, experiment, and gain a deeper understanding of distributed ledger technology (DLT) and analyze its maturity;

- To explore an alternative DLT-based cross-border payment solution that can overcome inefficiencies in existing cross-border interbank payment approaches;

- To understand and experiment with the dual issuance of a central-bank digital currency;

- Benchmark findings against those of other central banks.

The project was structured into three distinct phases or use cases: – Use case one to explore cross-border settlement between the two central banks; – Use case two to explore domestic settlement between three commercial banks in each country – Use case three to explore cross-border transactions between the commercial banks using the digital currency. Following an extensive assessment of the current payment systems, prior work in the application of DLT in the field, and informed by the current state of the art in DLT technologies, a number of key principles were agreed by all participants to guide the execution of the project. Firstly, commercial banks must be active participants, running local nodes on the network and engaging the fullest from a technical and business perspective throughout the lifecycle of the project. This was to ensure that the employees of both central and commercial banks would benefit from the acquisition of knowledge around this new technology and also so that the project could be better informed as to challenges, risks, or improvements, from a commercial bank perspective, that would need to be addressed if the full value of the technology was to be realized in this context.

Secondly, real money would be used in the project. This was important because it forced greater consideration of the non-functional aspects, such as security, that Project Aber Final Report 9 would need to be addressed moving forward; and also, how the system would interact with existing payment systems, such as the domestic RTGS system. Thirdly, rather than simply replicate the way in which conventional payment systems work, the project sought to explore how such systems can leverage the unique characteristics of DLT to drive greater levels of distribution. By doing that, it sought to develop a system that was more resilient to single points of failure. The project confirmed that a cross-border dual issued currency was technically viable and that it was possible to design a distributed payment system that offers the two countries significant improvement over centralized payment systems in terms of architectural resilience. The key requirements that were identified were all met, including complex requirements around privacy and decentralization, as well as requirements related to mitigating economics risks, such as central bank visibility of money supply and traceability of issued currency.

The performance objectives that were originally set for the project were exceeded, proving that DLT technologies could offer high levels of performance whilst not compromising safety or privacy. As such, the project has confirmed the viability of DLT as a mechanism for both domestic and cross-border settlement and confirmed the technical viability of a single digital currency issued by both central banks.

The project has also identified further areas that need to be explored in the future if the approach of a single digital currency is to be implemented: key amongst these is the need to understand impacts to the monetary policy of participating states and to address, in particular, the means by which interest is calculated and disbursed to the commercial banks in each jurisdiction and how this can be applied with a single digital currency. In terms of future work, there are many directions that this project can evolve towards. Firstly, it could provide the basis for a backup to domestic and regional RTGS; providing a more distributed and potentially resilient alternative to the centralized systems that are implemented or being implemented today. Secondly, by offering a DLT-based payments rails, there is the possibility to expand to Delivery versus Payment (DvP) scenarios such as using the Aber network as a means of settlement for other forms of transaction, such as the sale of bonds or other dematerialized assets. Thirdly, there is the possibility of extending it geographically to include regional or other international central banks or linking heterogeneous networks together. In summary, the project was successful in meeting its objectives, demonstrated possible incremental benefits of this new approach to payments, identified important Project Aber Final Report 10 lessons learned that can benefit other central banks exploring the field, and has identified several areas of future expansion that can be considered by either the participants in this project or other central banks. As such, we believe this project has made a material impact on industry understanding of the field and is a substantial contribution to the body of knowledge in how the emerging technology of DLT can be applied to cross-border and domestic payments.

Background Saudi Central Bank (SAMA) and Central Bank of the UAE (CBUAE) announced a joint digital currency initiative in January 2019. It was named Project Aber, which literally translates to ‘one who crosses boundaries’ highlighting the cross-border focus of the project. The unique aspects of Aber the following key objectives were outlined before the start of the project:

- To explore, experiment, and gain a deeper understanding of distributed ledger technology and analyze its maturity;

- To explore an alternative DLT based cross border payment solution that can overcome inefficiencies in existing cross-border interbank payment approaches;

- To understand and experiment how to dually issue a central-bank digital currency;

- Benchmark findings against those of other central banks.

The central banks laid out several principles which formed the basis for deriving the objectives and requirements of the project. Whilst there have been other central bank digital currency experiments around the world, the unique elements below made Project Aber a “first of a kind”. Active commercial bank participation an important aspect of the project was active business and technical involvement of commercial banks from a very early stage. A total of six commercial banks (three from each jurisdiction) participated in all phases of the project. This allowed an opportunity for commercial banks — key stakeholders of any wholesale CBDC project — to have a first-hand experience of using and operating a distributed ledger based interbank payment solution. The deployment architecture was highly distributed and provided complete flexibility to banks in hosting their environments.

Simplify Cross Border Payments The vision of Project Aber was to create a central bank digital currency that could be used for settlement of cross-border payment obligations between commercial banks. Such an instrument could be especially useful in a region like the Gulf Coordination Council (GCC) states where there is substantial intra-region trade and movement of citizens and residents. This could address an inefficiency in the existing correspondent banking-based payment systems that often results in delays and required commercial banks to maintain substantial Nostro accounts with their correspondent banks. This has been characterized as “trapped liquidity” in some studies [McKinsey, 2016] as, for some commercial banks, there is an opportunity cost in maintaining these balances and it creates material compliance overheads. In contrast, in Project Aber, the movement of funds would be done in real time, without the need for the commercial banks to have correspondent bank Nostro account in each country. While there have been other CBDC experiments involving two central banks, the requirement of having a single network and single digital currency for settlement of cross-border payments was a unique aspect of Project Aber. Real Money in Operations Phase Another unique aspect was the use of “real money” in the pilot project. This was achieved by commercial banks pledging real money from the deposits that they held with the central bank; using these funds to then fund their digital currency accounts on the distributed ledger. These funds would then be subsequently returned to the commercial banks’ accounts once the project had completed. Having a three-month operations phase and the use of real money had the following tangible benefits:

- Use of real money motivated both commercial and central banks to think about how the digital currency will be managed in their books and which core banking systems would be impacted if such a system was to be implemented in production and scaled. This led to a series of lessons learned and observations that would have been unlikely to have been made if real money had not been pledged and used;

- Having three months of operations phase, including several knowledge transfer sessions for banks, provided business and IT operations teams of the banks with invaluable hands-on experience in managing a DLT based payment system;

- The project team received valuable feedback from the banks on additional features and tooling that would be required or would be useful in managing and using a CBDC of this type in the future; The experience gained and lessons learned from the operations phase is expected to help streamline issues in the eventual rollout of a DLT based interbank payment system as an alternative to traditional RTGS and international wire transfers.

5.3: NEOM

NEOM ( ‘city of the future’) is a new vision of what the future could be. It’s an attempt to do something that’s never been done before and it’s coming at a time when the world needs fresh thinking and new solutions. Put simply, NEOM will not only be a destination, but a home for people who dream big and who want to be part of building a new model for sustainable living. NEOM will be a hub for innovation, where established global businesses and emerging players can research, incubate and commercialize groundbreaking technologies to accelerate human progress.

Commerce and industry will be integrated into community centers to build supply chains that facilitate all human needs, making it a fully functioning area. The Financial Services sector aims for universal access to financial services by achieving seamless end-to-end solutions, fully digital payments, advanced interfaces, biometric identification systems and other cutting-edge technologies.

Goals of NEOM:

- Aim for 100 percent financial inclusion through seamless technologies and services

The Financial Services sector will aim for universal access to financial services by achieving seamless end-to-end solutions, digital payments, advanced interfaces, biometric identification systems and other cutting-edge technologies.

2. Create a robust financial hub that encourages innovation of ideas and products

The Financial Services sector aims to infuse the best practices with pioneering technologies to make NEOM a hub for entrepreneurial talent, creative financial solutions and new business models.

3. Become the global champion for green and ESG financing by creating the world’s leading green finance trading platform.

The Financial Services sector aims to infuse the best practices with pioneering technologies to make NEOM a leading facilitator and accelerator for emerging markets and a hub for entrepreneurial talent, creative financial solutions, fintech, and new business models.

6. Concluding Remarks

The research paper started with identifying blockchain and how much of an impact it could make to the financial ecosystem as a well-developed technology.

Case studies of the Chinese market as a major FinTech adapter and how its adaptation and government supported paved the way for it to become a mature market. CBDC and a case study for the most impressive well implemented project of the digital Yuan and its major shadowing of the retail Chinese market followed by a deep dive into how other major countries would try and implement the same methodology at some time.

Saudi Arabia has identified itself through the last couple of years as a heavy FinTech adapter due to the banking scene and its financing issues, as FinTech tries to solve the markets issue by being more lucrative towards individuals. Saudis have been expanding locally at a slow yet promising rate we took to analyze the numbers at greater depths. Aber-Bridge- an outstanding achievement between Saudi Arabia and UAE and a certified solution to free-trade aches.

NEOM-the city of future- but this time at a deep economical point of view, as the city seems to have must-see solutions to all modern-day troubles. The South Asian and MENA market are defiantly ones to watch for the five upcoming years as the growth rate economically looks to continue so does the financial technological solutions scheme.

References:

Reference 1:

https://link.springer.com/article/10.1186/s40854-016-0034-9

Reference 2:

https://ink.library.smu.edu.sg/cgi/viewcontent.cgi?article=6910&context=lkcsb_research

Reference 3:

http://dstore.alazhar.edu.ps/xmlui/handle/123456789/96

Reference 4:

http://dstore.alazhar.edu.ps/xmlui/handle/123456789/96

Reference 5:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3528068

Reference 7:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3528068

Reference 8:

https://helda.helsinki.fi/bof/handle/123456789/14952

Reference 9:

https://fintechsaudi.com/wp-content/uploads/2020/03/Fintech_Saudi_Annual_Report-Eng.pdf

About the author

Khaled Aljuraywi

Khaled is the valedictorian to the graduating class of 2021 at Al-Rowad International Schools. He prides himself on being a hands-on learner. Specializing in Finance, he has worked in various financial positions – Investments Analyst at Annova, an Investments desk intern at Saudi Investment Bank, as well as a costing analyst at Mayyar. He has written various articles for publications like Elaph and Sada and he is now pursuing his own personal blog directed towards everything economics and business.