Author: Zimeng (Helen) Liu

Skyline High School

August 20, 2020

Introduction

The Covid-19 pandemic is caused by coronavirus, an infectious disease that could be easily spread through people’s close contacts. It was first detected in Wuhan, China then spread to cities across China, and was brought by people to numerous countries including the US. Based on the data, there are already over 4 million confirmed cases in the US in July of 2020 with a total of over 16 million cases worldwide (Coronavirus in the U.S.: Latest Map and Case Count, 2020).

During the pandemic, the US GDP was decreasing due to the decrease in consumption, investment, and net export. The cost of living also decreased over time, which helped people out during the economic downcast. The productivity decreased dramatically since millions of people got sick and countless factories were closed. Although the public policies positively influenced the US economy in the short term, they led the economic growth rate to fall in the long run due to the heavy deficit. The stock market also reflected this recession, but it gradually recovered and remained firm. The unemployment rate was very high because of the closure of industries, but the unemployment insurance helped people who lost their jobs. The monetary system worked sustainably during the crisis under the central banks’ policies of injecting money into the banking system.

The Republican Party and the Democratic Party proposed different policies to help the US recover from the pandemic. I will share my opinions on these policies and give the reasons in the discussion. I will also discuss the policies of stimulus checks and unemployment insurance and share my insights.

Discussion

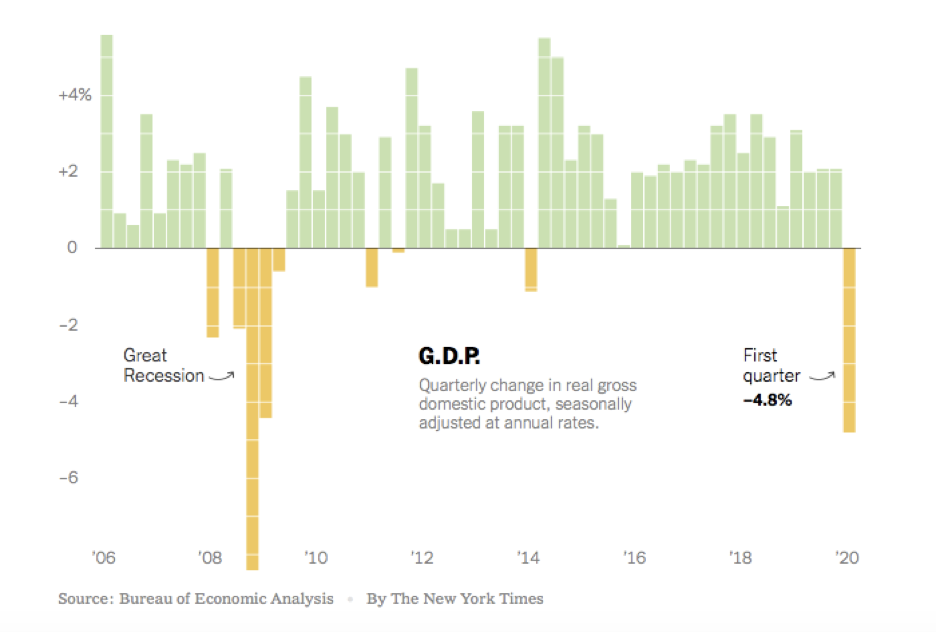

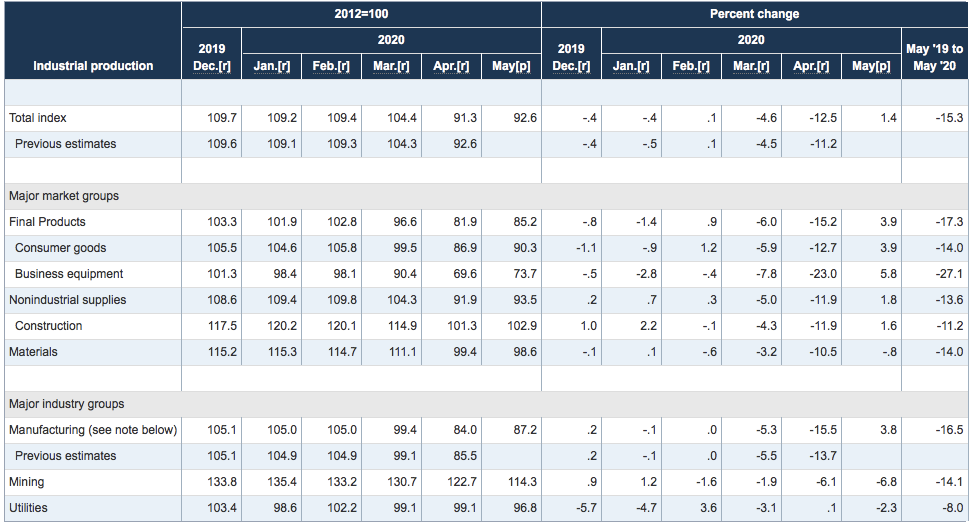

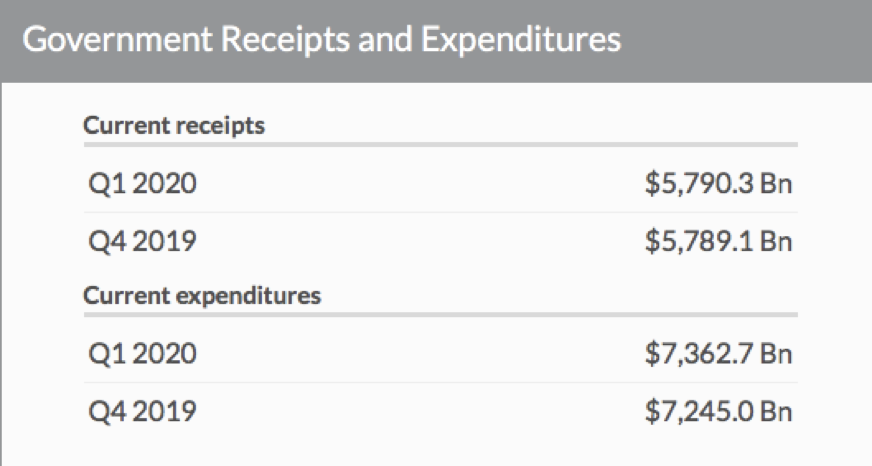

The Covid-19 pandemic had a significant negative impact on the US GDP. Figure 1 shows that the US real gross domestic product had an overall upward trend from 2006 to 2019, but the Covid-19 outbreak caused a sharp decline in it during the first quarter in 2020. The opposite trend in US GDP compared to that of the previous decade indicates that the US faced the worst economy since 2008. The real GDP showed in the graph is the type of GDP that is corrected for inflation, whereas the nominal GDP is not corrected for inflation. The significant components that add up to GDP are consumption, investment, government purchases, and net exports, and these components are all impacted by Covid-19. Figure 2 shows that US consumer spending declined during the first quarter in 2020 due to the closure of businesses, such as restaurants, movie theaters, and hotels. Table 1 reveals that the investment also had a downturn during the pandemic since many industries closed and stopped their manufacturing production. In Table 2, you can see that the US government purchases slightly increased in the first quarter of 2020 because the government sent out stimulus checks to individuals. Finally, Table 3 and Figure 3 show that the net export declined during the first quarter of 2020 dramatically since export fell at a higher rate than import, and the deficit of the United States in international trade was up to $49.4 billion in April of 2020.

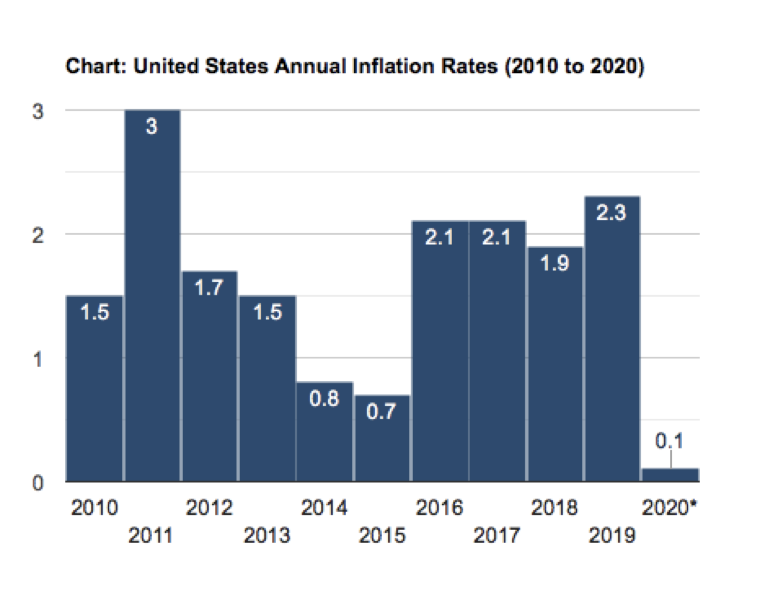

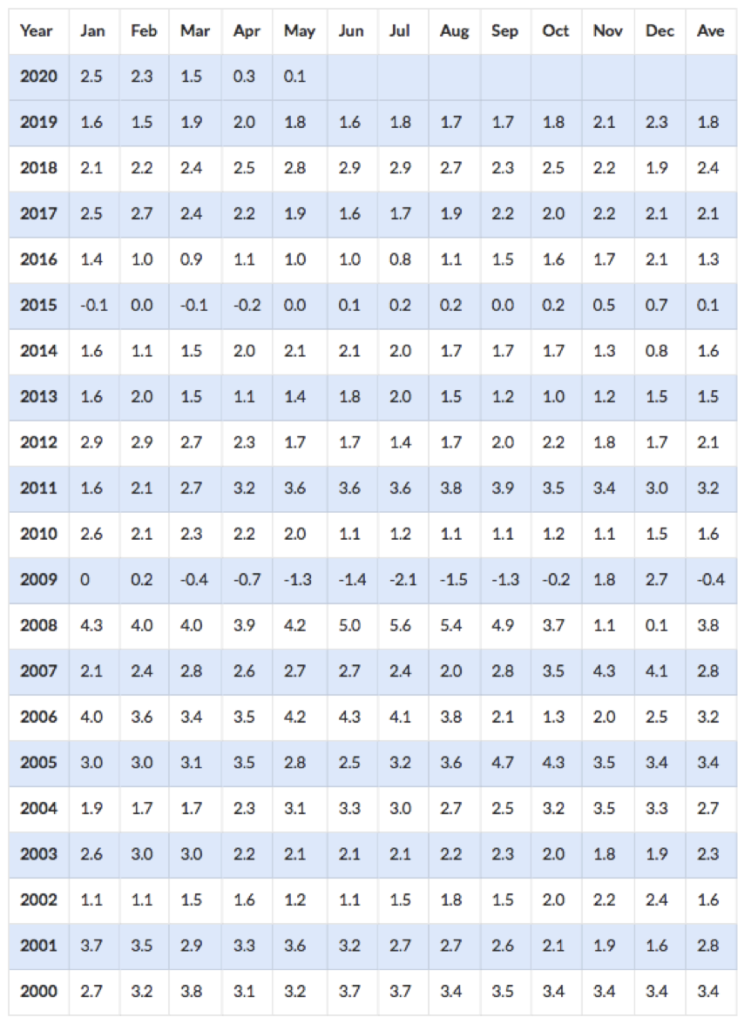

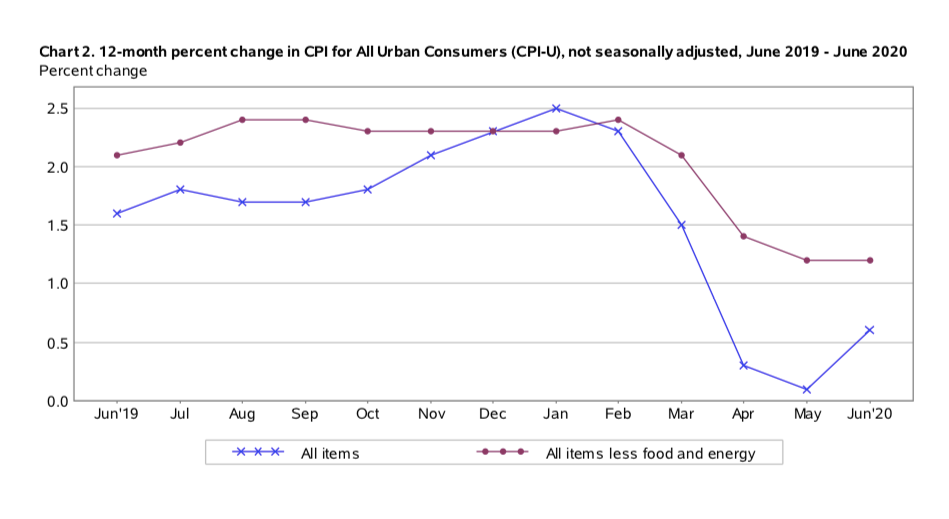

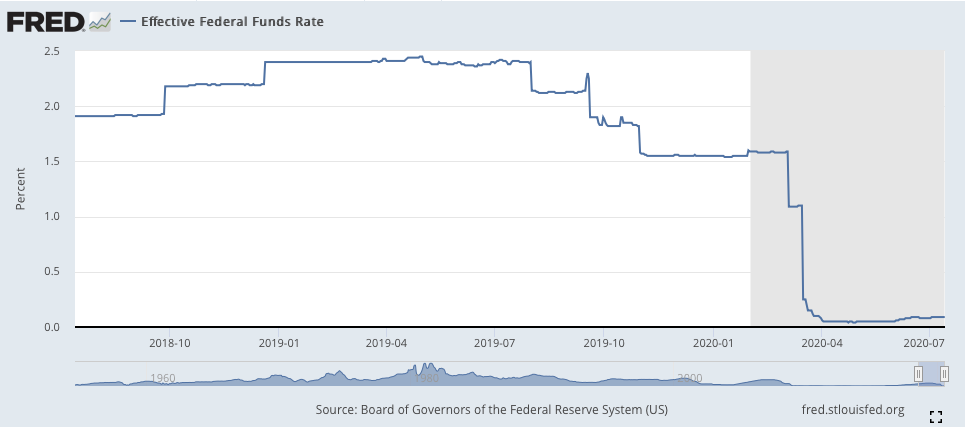

Fortunately, the cost of living in the US decreased, and the policies of banks helped the economy during the pandemic. Both Figure 4 and Table 4 convey that the inflation rate started to fall in February and reached its lowest level of 0.1 in May. In Figure 5, the CPI percent change went down during the Covid-19 pandemic, which indicates that the cost of living decreased. This helped people out since many people lost their jobs during the pandemic. In the press released by the Federal Reserve on March 3, 2020, the Federal Open Market Committee announced the decision of starting to lower the target range for the federal funds rate (Federal Reserve issues FOMC statement, 2020). Figure 6 shows that the real interest rate of Federal Funds dramatically decreased from about 1.5 percent in March to almost 0 percent in April of 2020. By lowering the interest rate, the Federal Reserve stimulated the economy since it transferred people’s incentive from putting money into the bank to consuming during the economic breakdown.

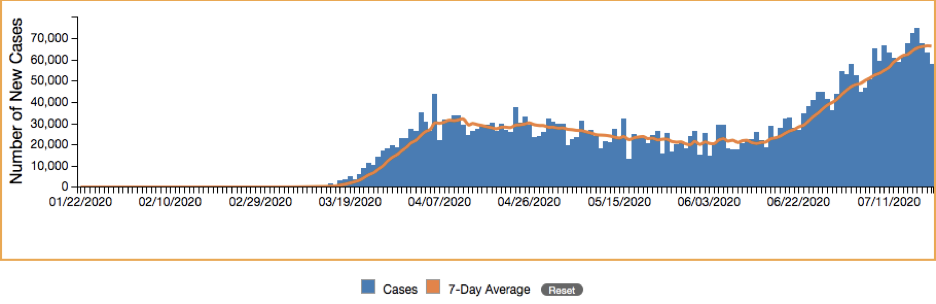

Nevertheless, productivity decreased during the Covid-19 pandemic, which negatively impacted the US economic growth. Figure 7 shows that the number of new cases by day was up to 70,000 in July, and the total cases of Covid-19 increased rapidly. With an increasing number of people getting sick or even dying from the virus, the productivity in the US decreased significantly. Besides, in order to prevent the coronavirus from spreading, the US restricted the trades from foreign countries as shown in Table 3. These restrictions were harmful to the US economic growth since international free trade can promote the development of new technologies. In addition, policies that promote consumption led to a decrease in saving, which affected the economy negatively. Although the lower real interest rate announced by Federal Reserve helped to stimulate the economy in the short term, it reduced the investments and the capital per worker in the long run. Lastly, due to the closing of factories, the physical capital per worker decreased, which led to a low productivity rate during the pandemic as Table 1 displays.

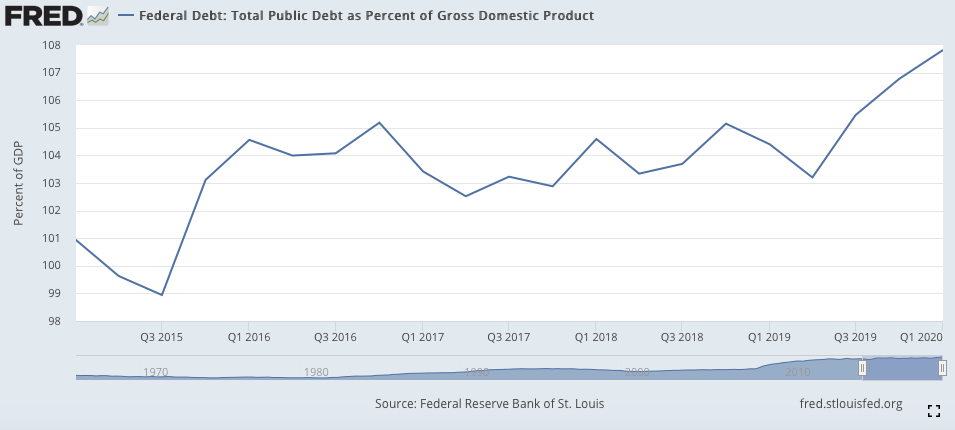

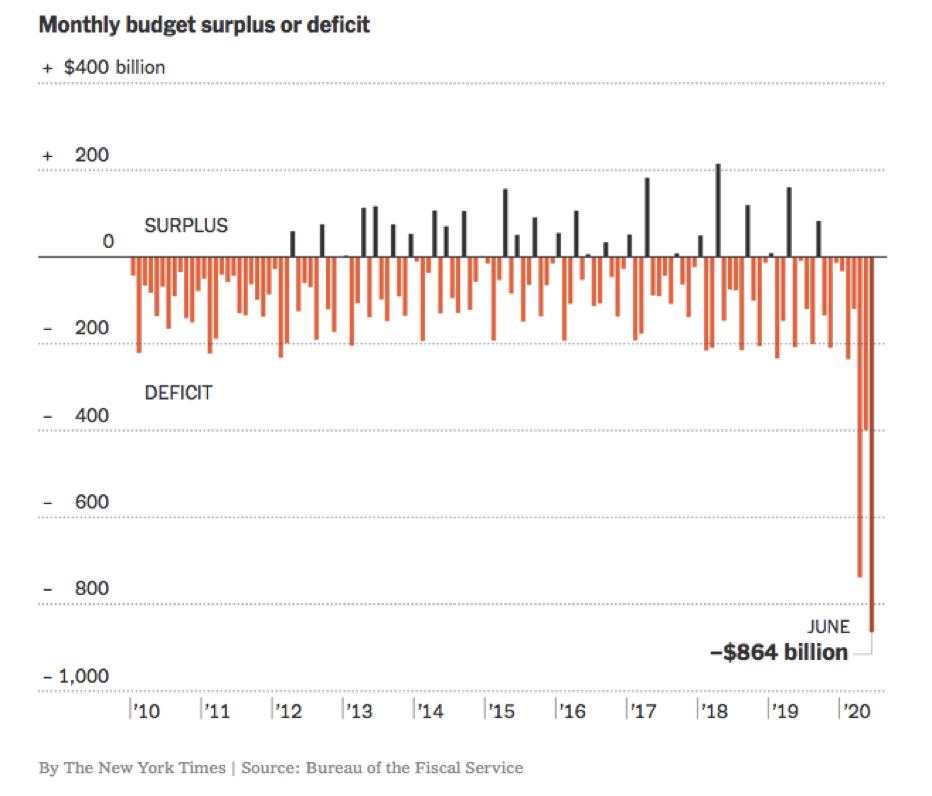

Various policies during the coronavirus pandemic negatively impacted the economic growth rate. During the pandemic, the government’s policies of providing stimulus checks helped numerous people who lost their jobs in the short term, but they also led to a heavy deficit on the government’s budget. Figure 8 shows that the public debt in the first quarter of 2020 was up to 108 percent of the US GDP. In Figure 9, the huge amount of government deficit during the pandemic caused a negative public saving, which reduces the national saving, thus diminished the supply of loanable funds in the market. In theory, the deficit also caused the interest rate to increase, which crowded out the investment, leading to the future economy’s growth to decrease. However, since the Fed cut the interest rate in the short term, the heavy deficit will lead the interest rate to rise in the future.

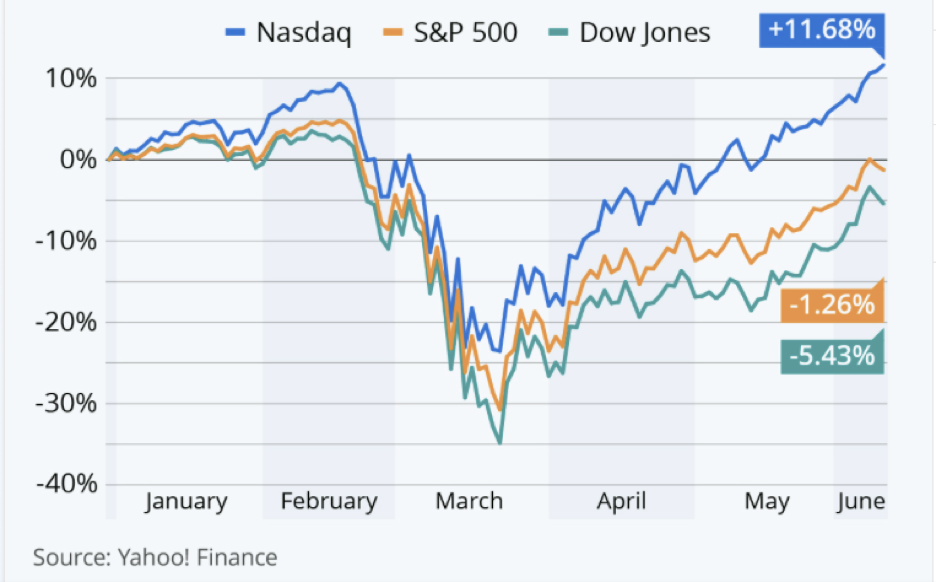

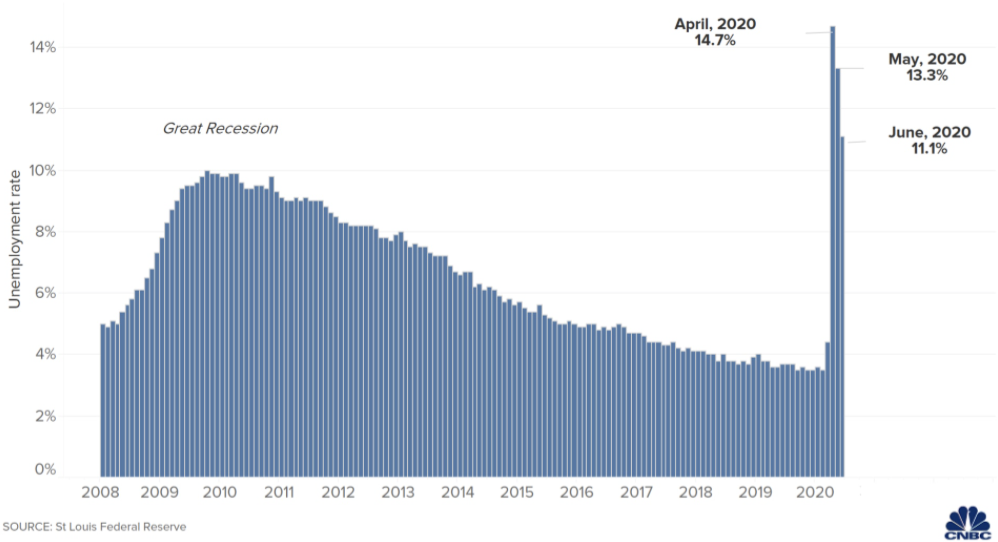

The Covid-19 pandemic led a sharp decline to the financial market, but the stock market recovered from it rapidly and remained relatively firm. The stock market reactions show the psychological irrationality of the market. Figure 10 shows that the major indices of the US stock market hit the bottom in March since people become pessimistic when the number of confirmed cases dramatically increased. The figure also reflects that although the cases still increased, the stock market gradually recovered and returned to normal in June 2020, which was due to people’s optimism during the time. The stock market reacted positively when the unemployment rate dropped and the news related to coronavirus vaccine came out. In July of 2020, the US government invested $1.95 billion in Pfizer to produce a coronavirus vaccine (Noah Weiland, Denise Grady, and David E. Sanger, 2020). In Figure 11, the unemployment rate decreased both in May and June of 2020, which also led to a positive trend in the stock market. The stock market reflects a future state of the pandemic, so it went up rapidly when people assumed that the US will rapidly recover from the pandemic. The stock market follows the Efficient Markets Hypothesis, which implies that the stock market reflects all publicly available information and follows a random walk, thus it is impossible to systematically beat the market. In February, some senators and their families sold their stocks that were worth millions of dollars after the coronavirus insider briefing (Mangan, 2020). In this case, the Efficient Markets Hypothesis does not apply since the senators avoided losses through insider trading.

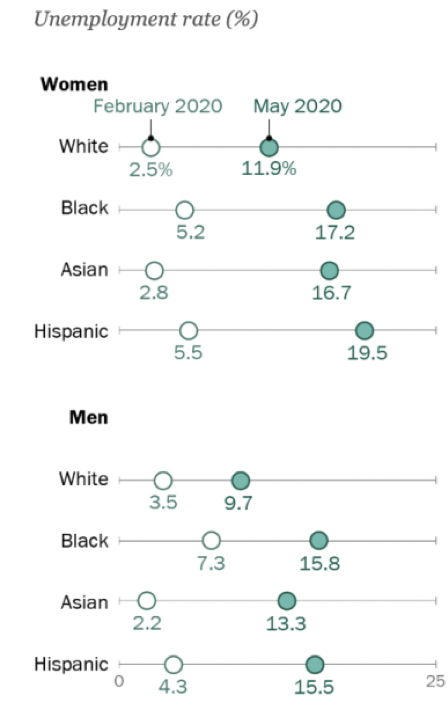

The unemployment rate during the pandemic was very high, which is an important factor that negatively affected the US economy. Figure 12 shows that the unemployment rate of women was higher than that of men in May of 2020, which was probably a result of the online schooling of their children. From Figure 13, white people had a lower unemployment rate both before and during the pandemic than black people, and black people’s unemployment rate increased greater than that of white people. From this, the problem of racial justice can be reflected since the figure shows how white people and black people are treated differently. Since some industries such as hotels shut down, people had to look for jobs in other industries, which caused frictional unemployment. One way to reduce frictional unemployment is the government can post more information about jobs available, and the other way is to train people on new skills so that they can adapt to the new industries.

The US government signed the CARES Act in March of 2020, providing unemployed citizens an extra $600 every week to help them during the economic shutdown (Stewart, 2020). There was a debate on whether the government should extend the period of this unemployment insurance until January since the insurance may diminish people’s incentives to work. From my perspective, the unemployment insurance should be extended to January since it makes a real difference to those who lost their jobs during this hard time. If the government stops releasing unemployment benefits, it would push people to go out for job searching and increase the number of people getting sick. The productivity would also be low since people have less time for job searching and would have worse job matches. I believe that the government can cut the amount of unemployment insurance but should still provide it for the people who need it. There is also a debate on whether schools should reopen in the fall, which some argue that it is helpful to reduce the frictional unemployment rate. In my opinion, schools should reopen when it is safer. The reopening of schools would make cases of coronavirus increase rapidly and cause more deaths. There is no reason to risk all the teachers’ and students’ health for economic recovery.

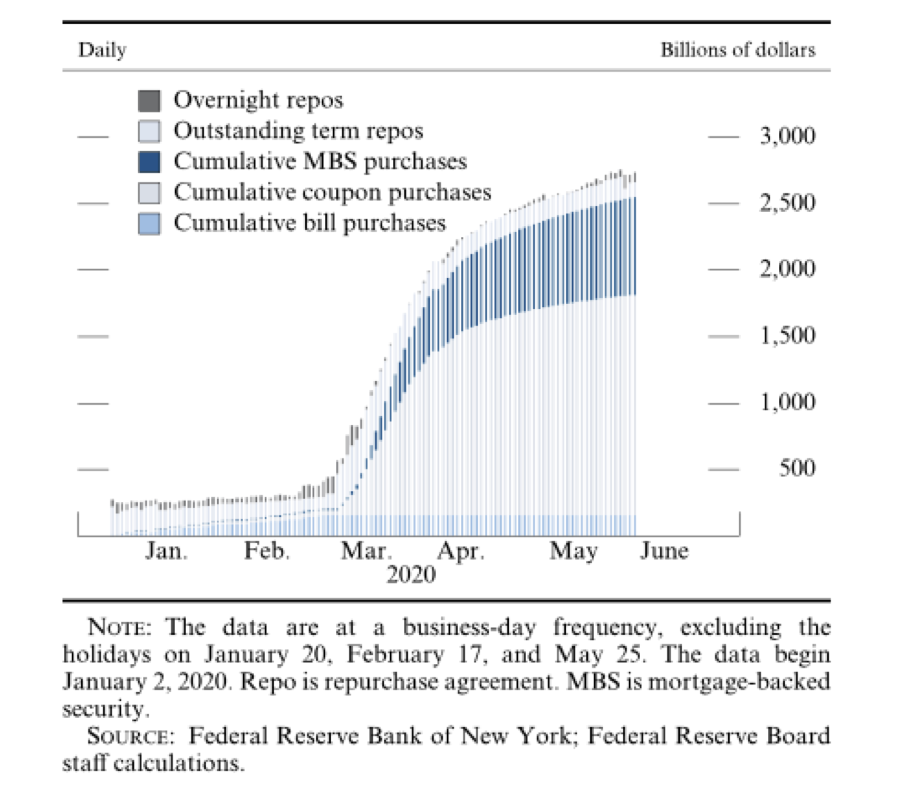

Additionally, the US monetary system worked sustainably under the regulations of the Federal Reserve during the crisis. Compared to the four bank failures in 2019, only 2 banks failed since the beginning of the pandemic (Failed Bank List, 2020). Figure 14 shows that the Federal Reserve increased its purchases on government bonds from banks, which helped to increase bank reserves, thus raised the bank supply (Monetary Policy Report, 2020). This increase in bank reserves also worked to reduce the interest rate so that the firms have more incentives to borrow money to make investments, which improved productivity and helped the economy. Although some people became nervous about their money in banks, the federal deposit insurance effectively prevented bank runs, which also helped the banks to function well.

The economic policies during the pandemic are also debated by presidential candidates in the 2020 elections. Joe Biden criticized President Trump’s focus on the stock market, proposing a $4 trillion in tax increases, which is completely different from President Trump’s tax cuts in his payroll tax plan (Shane Goldmacher and Jim Tankersley, 2020). Mr. Biden also proposed an increase in government spending on the development of network technology and products manufactured in the US. I agree that President Trump could have regulated and directed people to wear masks and to practice social distance earlier to avoid deaths, but his decision to invest in the vaccine is effective. Since cutting the tax during the pandemic led to a deficit, I believe that the government should carefully trade-off between stimulating the economy and managing the budget. From my perspective, the US should invest in the development of network technologies, but more importantly, the development of medical technologies to develop the vaccine.

Conclusion

Overall, the Covid-19 pandemic caused an economic breakdown in the US. On the one hand, the GDP went down, productivity decreased, and the unemployment rate increased during this downcast. On the other hand, the cost of living decreased to help people out, the stock market remained firm, and the monetary system was still sustainable.

There were numerous policies put in place during the pandemic, and this experience will help us when we need to tackle a similar problem in the future. The government sent out stimulus checks to help people during this hard time, but the heavy deficit it caused would negatively impact the economy since it decreased the supply of loanable funds and investments. The government should send out stimulus checks, but it can diminish the value of them so that the debt would decrease. The unemployed insurance also helped people who lost their jobs during this downcast, but it reduces people’s incentives to work. The government could diminish the value of the unemployed benefits so that people would have time to look for jobs that match their skills instead of rushing to accept any open position. Additionally, the school opening policy shows that the government should balance health and economy and always prioritize citizens’ health in the future. The government should also try to balance between recovering the economy and controlling the budget all the time. Lastly, it is significant for the government to invest in new technologies in the future to be better prepared for more difficulties.

Appendix

Figures and Tables

Figure 1: US GDP Changes Over Time

Figure 2: United States Consumer Spending

Table 1: US Industrial Production Change

Source: Federal Reserve

Table 2: Government Receipts and Expenditures Comparison

Source: US Bureau of Economic Analysis

Table 3: US International Trade in Goods and Services Deficit

Figure 3: Goods and Services Trade Deficit

Figure 4: United States Annual Inflation Rates (2010 to 2020)

Source: US Inflation Calculator

Table 4: Annual Inflation Rates by Month and Year

Source: US Inflation Calculator

Figure 5: 12-Month Percent Change in CPI for All Urban Consumers (CPI-U), Not Seasonally Adjusted, June 2019-June 2020

Source: US Bureau of Labor Statistic

Figure 6: Effective Federal Funds Rate

Figure 7: Covid-19 cases by day

Source: Centers for Disease Control and Prevention

Figure 8: Federal Debt: Total Public Debt as Percent of Gross Domestic Product

Figure 9: Monthly Budget Surplus or Deficit

Figure 10: Year-to-Date Performance of Major US stock Market Indices

Figure 11: Unemployment Rate Over Time

Figure 12: Unemployment Rate of Women and Men During Covid-19 Pandemic

Source: US Bureau of Labor Statistics

Figure 13: Unemployment Rate Among Different Demographics

Source: US Bureau of Labor Statistic

Figure 14: Federal Reserve Open Market Operations

Works Cited

Mentor: Dr. Lai Jiang, NYU Stern

(2020, March 3). Federal Reserve issues FOMC statement. Federal Reserve. Retrieved from Federal Reserve: https://www.federalreserve.gov/newsevents/pressreleases/monetary20200303a.htm

Noah Weiland, Denise Grady, and David E. Sanger. (2020, July 22). Pfizer Gets $1.95 Billion to Produce Coronavirus Vaccine by Year’s End. The New York Times.

Mangan, D. (2020, March 23). SEC warns on coronavirus insider trading after stock sales by NYSE chair, his wife Sen. Loeffler, 3 other senators. CNBC.

Coronavirus in the U.S.: Latest Map and Case Count. (2020, July). The New York Times.

Stewart, E. (2020, April 28). The debate about whether expanded unemployment insurance is too generous, explained. Vox.

(2020). Failed Bank List. FDIC.

(2020). Monetary Policy Report – June 2020. Federal Reserve.

(2020). Monetary Policy Report. Federal Reserve.

Shane Goldmacher and Jim Tankersley. (2020, July 31). In ‘Buy American’ Speech, Biden Challenges Trump on the Economy . The New York Times.

About the author

Zimeng Liu

Zimeng is an 11th grader at the Skyline High School. Her academic passions are business and economics. She wrote this paper to share her insights on the Covid-19 pandemic.