Author: Anusha Vangala

Princeton High School

August 20, 2021

1. Introduction

During a time where social media use has become part of a daily routine, the latest and most viral trends can have further implications beyond interactions with friends and family. On social media sites such as Instagram, Twitter, and Reddit, users have the freedom to create their own content and post it for millions of people to see. Wanting to fit in with peers, many young users replicate the viral content they consume on social media without thoroughly researching it. Recently, social media’s widespread influence has even been used to advertise financial success and manipulate the stock market.

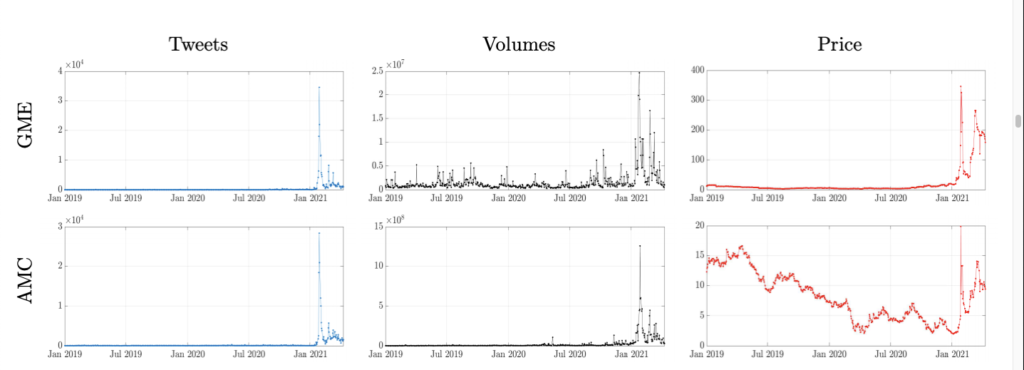

In 2021, the stock prices of video game company, GameStock, unexpectedly skyrocketed more than 1700%. This was due to a community of amateur investors on Reddit, posting on the message board r/WallStreetBets, who joined together to buy shorted stocks which drastically increased the stock price. Although experienced investors advised against purchasing GameStop shares, investors on Reddit rebelled. In addition to GameStop, Reddit investors also popularized investing in companies such as AMC and Robinhood, using catchy sentiments that appeal to the younger generation like “to the moon” to convince other Reddit users to invest. Like other social media trends, users on sites such as Reddit see the positive messages associated with investing in the stock market and feel inclined to partake in investing themselves in fear of missing the opportunity to become successful. Since those currently growing up using social media are accustomed to gaining their information from various social media platforms, events such as the GameStop short squeeze may become more common in the future.

As the global economy becomes more interconnected, recognizing these social media trends with regard to investing in not only the U.S. stock market but other countries’ stock markets as well is extremely important. Although considered a novelty in the U.S., South Korea’s growing music industry, “K-Pop,” has had surprising effects on the stock prices of large entertainment companies such as YG Entertainment, JYP Entertainment, and SM Entertainment. K-Pop stars, also known as “idols” are trained under a strict regime from young ages and making even the smallest infractions cause great controversy. Similarly, to the GameStop short squeeze and other phenomena, events in the K-Pop industry spread widely through social media and can significantly change stock prices.

The rest of the paper is organized as follows:

Section 2 discusses the nature of social media and its relation to stock market investing. Section 3 delves into the creation of “meme stocks” and its rising popularity among investors while comparing this emerging phenomenon with the previous returns seen in the U.S. stock market. This section will also consider if this phenomenon is evidence of irrational stock market behavior, psychology behind investing, and future investors’ involvement in investing in the stock market. Section 4 builds upon social media’s growing influence on the stock market, focusing more specifically on how events in the Korean Pop industry affect the Korean stock market and making a comparison to the “Robinhood Phenomenon.” Section 5 contains concluding remarks followed by references.

2. Nature of Social Media with Reference to Stock Market Investing

2.1 Definition of Social Media

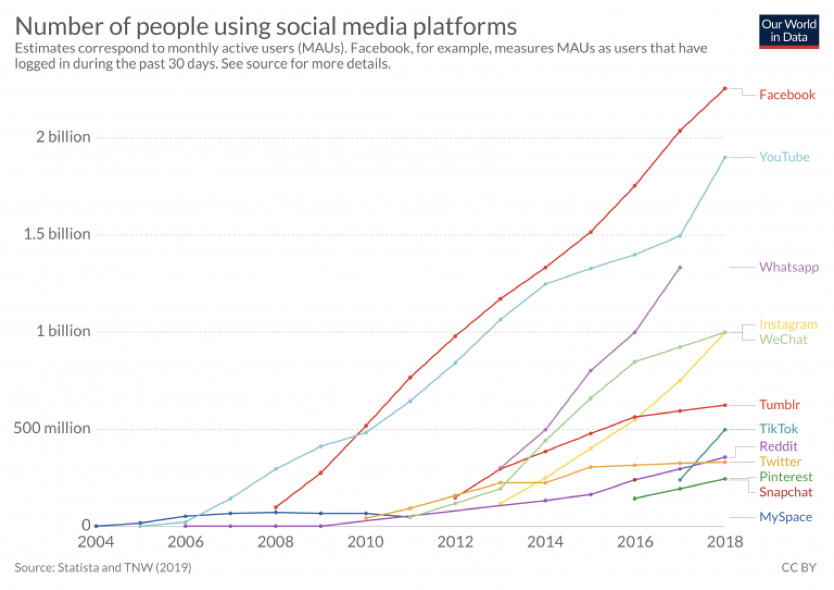

Social media is a web-based communication method that allows users to create content that others can view and interact with on the site. On these social media sites, users create profile pages, where they can personalize their account settings and share posts with their “followers,” or those who subscribe to their content. This content comes in the forms of pictures and videos that other users can interact with in the form of comments and “likes.” To “like” a post conveys that the user is interested in or enjoys certain content. In addition to “liking” posts, social media users can convey their interest in certain content by “following” other users. “Following” someone on social media signifies that the user would like to see another user’s posts in their feed, a section of the site that displays content and advertisements from various creators. Many people use social media to keep up with, or “follow,” their close friends and family but others may use it for advertising purposes or stay updated with news. Additionally, people can send each other direct messages and group messages as well as share the posts that they see on their feeds. Users can sign on to social media sites from almost any device that has access to the Internet, such as laptops and smartphones, making it easily accessible to billions of people. In addition to individuals, companies and brands also use these social media sites as a form of marketing. Using algorithms, social media companies cater paid advertisements from companies toward those who are more likely to purchase that company’s products. Social media sites also usually include a section where users can view new content from anyone, regardless of following status, that are generated by the sites’ algorithms. Some of the largest and most popular of these social media platforms are Facebook, Instagram, YouTube, TikTok, and Reddit, which have 2.85 billion, 1.07 billion, 1.86 billion, 689 million, and 52 million users respectively. The number of users on these sites has exponentially grown since their beginning and due to the upwards trend seen in the below graph, can be predicted to continue their growth and influence in the future (R12).

2.2 Nature of Viral Messaging

On social media, messages and posts can be shared instantly and because of this, can spread quickly to the millions of people that use it. For a post to go “viral,” that means it has gained a large amount of attention from social media users over a short period of time. One of the key components of virality is its spread specifically as a post is shared from person to person. As engagement with the post increases and it is shared more, more people will also begin to view it on their feeds as a result of the social media algorithm. Social media algorithms utilize factors such as location, interests, and previous content interacted with to show personalized and relevant content catered to each user. As these short-term trends spread, the young users on social media sites become more likely to participate as they see their peers partaking as well. Businesses particularly benefit from the virality of their posts because new viewers mean new customers and increased profits. Although there is not an exact formula to creating a viral post, those who partake in social media trends are often more likely to gain increased engagement on their post.

2.3 Relation to Stock Market and Investing

Although social media’s virality is known for benefitting individual social media users, it has also had recent effects on the stock market and has the potential to have effects in the future as well. Social media users are largely influenced by herd mentality: the mindset that encourages following one’s peers rather than making decisions for themselves. This makes social media sites the perfect environment for propagating certain messages to a broad audience. Once a message or trend becomes popular on social media, it spreads quickly, and many social media users tend to follow these trends. Recently, a popular trend across various social media platforms such as Reddit and Twitter is investing in the stock market. Positive sentiments regarding certain stocks have caused stock prices to rapidly increase within a short period of time. As positive messages regarding these stocks spread, more social media users join in on the trend of buying a certain stock, therefore increasing its demand and the stock price (R3).

In early 2021, a new type of social media called BitClout emerged, one that combined celebrities’ influence with stock market investing. Using BitClout, people can bet on celebrities’ and creators’ reputations rather than stocks. Each creator is assigned their own unique cryptocurrency that they can then use to purchase other coins on the site. Just as people use money to invest in stocks they believe will perform well, users on BitClout can purchase creator coins of those they think will maintain a good reputation in the public’s eye (R21).

3. Traditional Stock Market Investing: Magnitude of Returns

3.1 Historical Returns in the U.S. Stock Markets

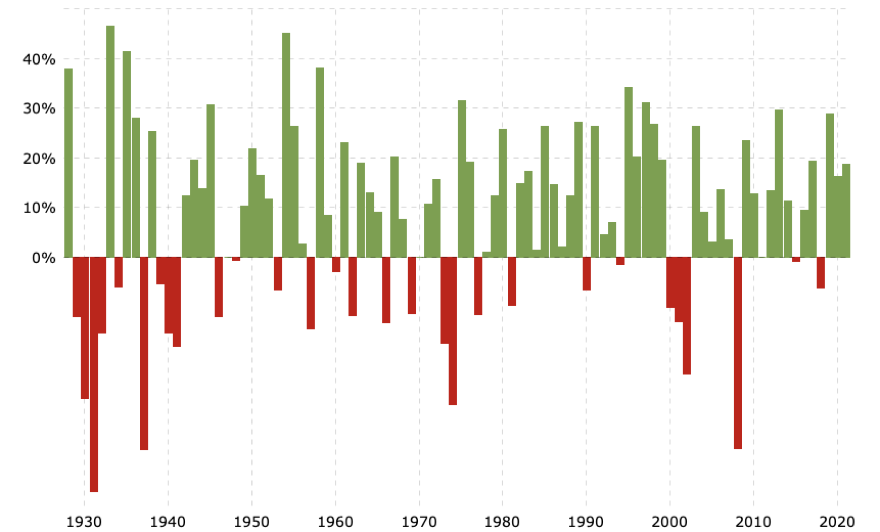

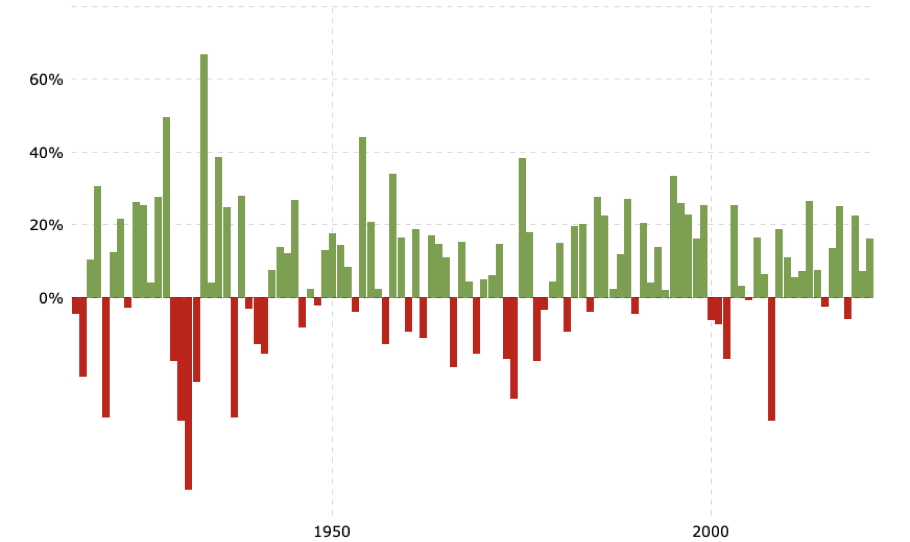

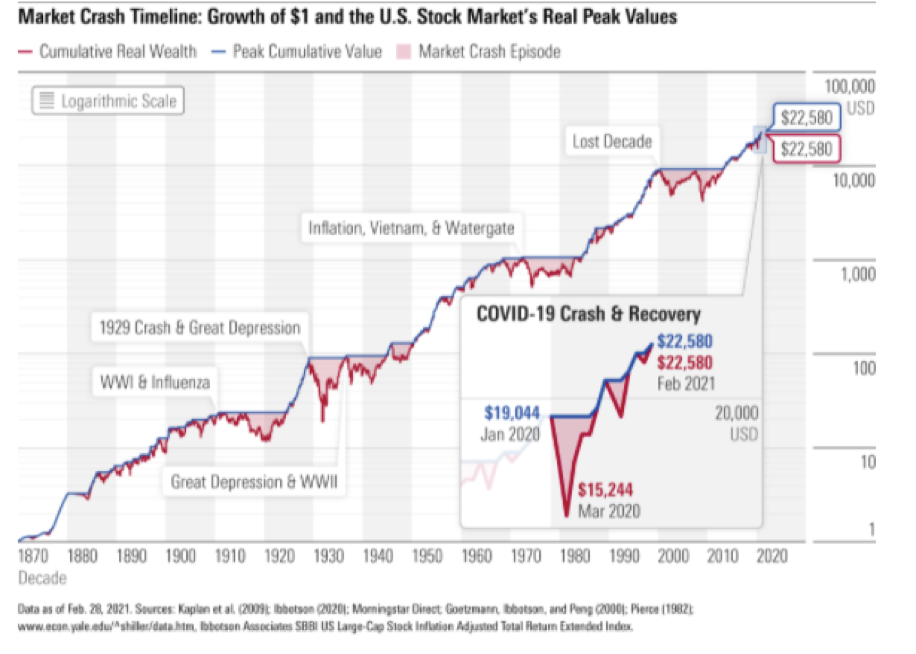

The S&P 500 Index has had an average annual return of around 10-11% since its beginning in 1957, which is around 6% when accounting for inflation. However, in more recent years, the average annual return has been closer to 8%. Compared to the S&P 500 Index, the Dow Jones Industrial Average’s average annual return is lower, closer to around 6% without accounting for inflation. Whereas the Dow Jones Industrial Average only comprises 30 companies, the S&P 500 consists of 500. Since the S&P 500 and DJIA consist of various stocks intended to reflect the entire stock market, their average annual return (measure of the money gained or lost from an investment) is representative of the returns of the whole stock market. It will be equivalent to the returns on holding a well-diversified portfolio over a longer period of time. (R10).

Historical annual returns of the S&P 500

Historical annual returns of the DJIA

3.2 “Meme Stocks”: The Curious Case of GameStop and AMC (Robinhood Phenomenon)

As the coronavirus spread across the globe in early 2020, many businesses closed and unemployment levels increased, causing people to have less disposable income to invest in unnecessary expenses such as stock market investing. As a result, the stock market reached a low point which it began to recover from during April to November 2020. However, with travel restrictions in place, more people stayed home and spent less money on traveling and outdoor entertainment expenses such as going to the movies and eating out. Additionally, the government provided stimulus money to millions of American households. As a result, they had more time and money to explore new areas of interest, one of the most popular ones being investing in the stock market

More people interested in investing in stocks sparked more social media discussion surrounding the stock market. The most influential of these social media interactions was posts on the subreddit r/WallStreetBets. In the case of the 2021 GameStop short squeeze, positive sentiments regarding GameStop and the idea of raising the stock price “to the moon” garnered extreme social media attention. Wanting to participate in this meme-centric trend that also evoked a sense of nostalgia, many inexperienced young investors used the easily accessible trading platform, Robinhood, to invest in GameStop. Robinhood, a no-fee and easy-to-use trading platform, made stock trading accessible to a wider audience. Spite from the younger generation against the wealthy hedge funds was the main cause for beginning the “to the moon” campaign in the first place. As a result, Reddit users joined together to save the dying stock.

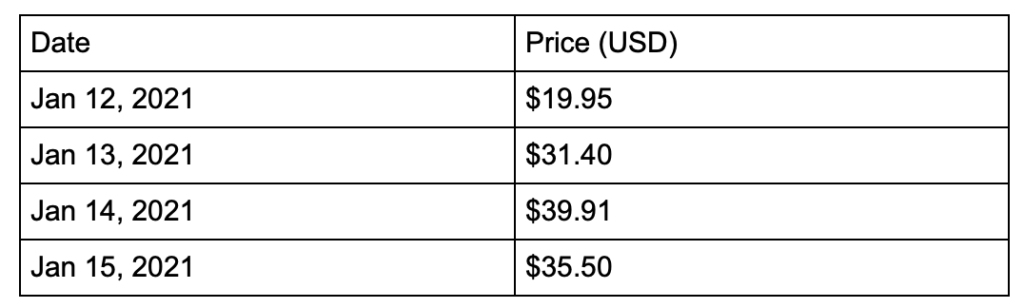

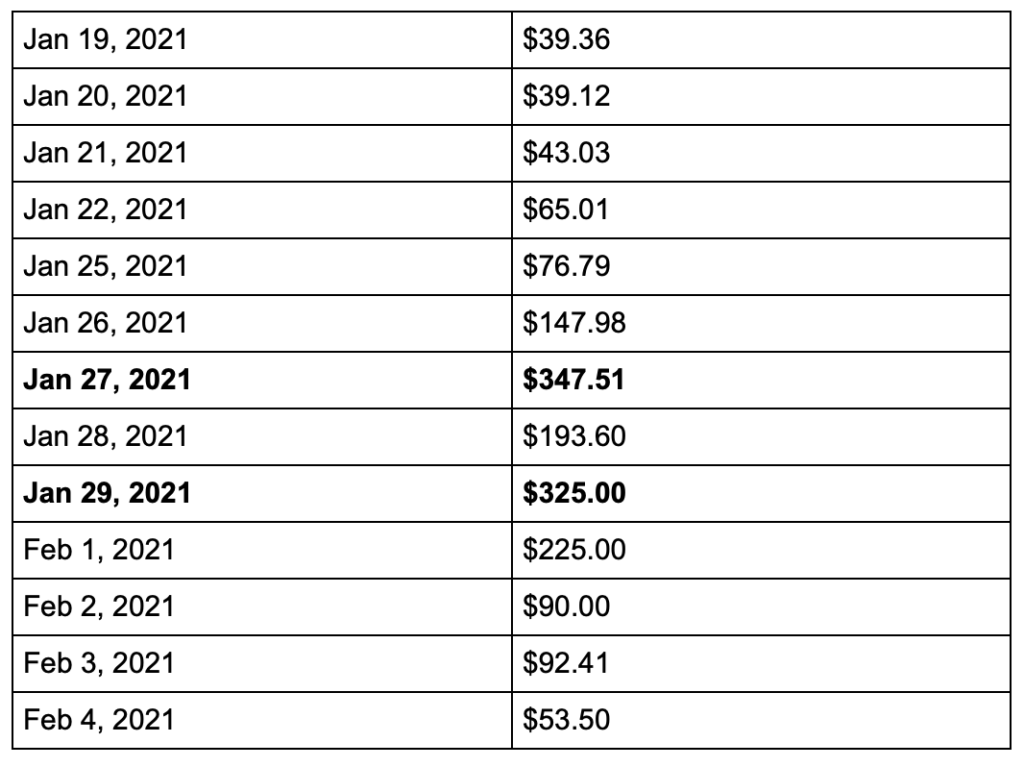

The demand for physical video games has significantly decreased in recent years due to the emergence of online video game platforms such as Steam. With the pandemic at its peak, traveling outside to shop became unnecessary. Because of these factors, many institutional investors such as hedge funds took on short positions, meaning that they would profit if the stock price dropped. Former Chewy CEO, Ryan Cohen, joining GameStop’s board of investors is what initially sparked the interest in GME. Believing the company was undervalued and seeing the large number of short positions taken, r/WallStreetBets users spread messages that created an overwhelming demand for the GME stock, raising the stock price significantly and causing those who took on short positions to lose millions of dollars. Reddit investors used the same positive sentiments to apply this to other stocks such as AMC during this time. As a result of the high volatility in the market, Robinhood paused all purchases of the volatile meme stocks, making traders angry. They felt betrayed as if Robinhood was siding with the hedge funds, the main target. With all volatile stocks, the high gains are met with high losses, and GameStop’s stock price decreased steeply, causing uneducated young investors to incur heavy losses. (R1).

GME Stock Price Peak

AMC Stock Price Peak

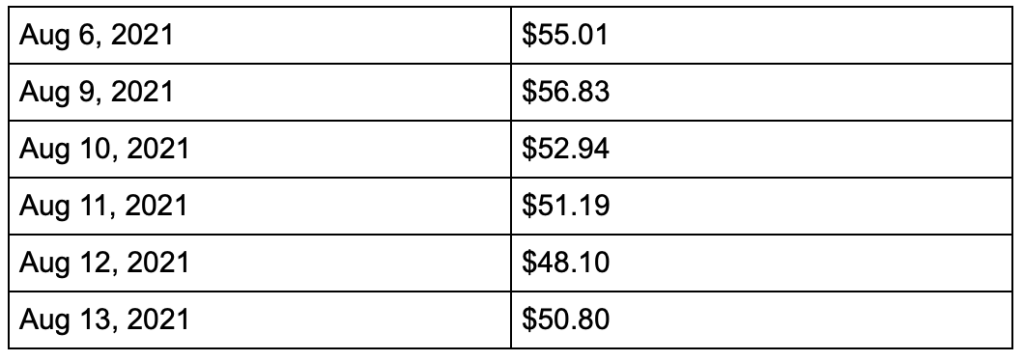

Late July 2021, Robinhood went public, pricing its IPO at $38. This reignited the diminishing passion for meme stocks across social media since Robinhood’s democratized trading platform served a pivotal part in trading these highly volatile stocks. Robinhood both facilitated these trades and restricted them, causing them to receive backlash from their users. When Robinhood announced on social media that they would go public, vengeful users on r/WallStreetBets hoped for the stock’s failure. Although it was originally uncertain if Robinhood would continue in the steps of its meme stock predecessors, the stock recently experienced the same short-term price surge that characterizes a successful meme stock. From August 3rd to August 4th alone, the stock rose around 50%. While that may not seem noteworthy compared to GME’s 1700% growth, it is well over the S&P 500’s and DJIA’s annual average of 10-11%. Shortly after its rapid growth, the stock price decreased by 28% to $50.97 but rose back up to $55.01 shortly and seems to be plateauing at around $50 (R20).

This case is very similar to an earlier phenomenon that occurred during the 1600s, later known as “Tulip Mania.” Because of excessive speculation, the price of tulip bulbs increased to extreme values. Since tulips were new to western Europe, they garnered much attention and were considered a luxury good. Many people bought them simply as a symbol of high wealth. Tulips were in high demand but keeping them undamaged during transportation became a problem. Since these concerns were abundant, tulip cultivators created methods to grow the tulips locally. As a striped variation of the traditional solid-colored tulips developed due to viral infection, the demand for these rare tulips increased, leading to a high market price. In modern currency, rare tulips cost $750,000, whereas the more common variations traded for around $50,000 to $150,000. By late 1637, the market bubble burst. The prices of tulips rapidly decreased because there were no longer any buyers who were willing to pay the extremely high prices for tulips (R22). The Tulip Mania of the 1600s serves as a basis for future events of excessive speculation such as the Robinhood Phenomenon.

3.3 Psychology Behind Investing

3.3.1 Herding

Phenomena such as the Robinhood Phenomenon have psychological explanations, the most prevalent of which being herding. Herding behavior is when people tend to follow groups and popular trends rather than relying on individual knowledge or analysis. When people are under the influence of herd behavior, they tend to ignore logic and reason and simply follow the actions of the group. Large market crashes, driven by episodes of high buying and selling, are caused by herding behavior. As more people buy a certain stock, its scarcity and demand both increases, causing the price to increase. Investors depending on the masses to buy and sell stocks causes markets to become extremely volatile, which may come with high returns but high losses as well. Additionally, people tend to advertise their successes over their failures. On social media, living a successful life is enviable, and others will take the same steps advertised to them, seeking to achieve the same success (R14). Just as people follow social media trends, they also follow stock market trends because humans are naturally susceptible to herd behavior. To avoid falling victim to herding and its downfalls, people can conduct their own analysis of stocks and companies rather than assuming that others have done appropriate research and following them.

3.3.2 Sunk Costs

A sunk cost is a past cost that does not have any potential to recover its losses in the future (R15). While sunk costs should not affect future decision-making, they often do. The sunk cost effect explains that people are more likely to continue an activity after investing time or money into it. This is often justified by not wanting to be “wasteful” even if continuing the activity may not be the best decision. Many investors do not want to admit their poor investment choices and stay committed to an investment just to convince themselves that their initial investment was a good decision (R15). Inexperienced investors who bought GameStop or AMC stocks fell victim to the sunk costs trap. Although the stock prices rapidly increased over a short period of time, they also decreased rapidly, causing many investors to lose more than their initial investment. Rather than selling the stock after its decline in value, these inexperienced investors held onto it in hopes of seeing a recovery. They were reluctant to cut their losses and wanted to feel like their investment wasn’t all for nothing, which is a common feeling for those who have experienced the sunk costs trap. To avoid the sunk cost trap, investors should identify their sunk losses as soon as possible and reevaluate their investing strategies often.

3.3.3 Irrational Exuberance

Popularized by Alan Greenspan in 1996, irrational exuberance explains that the high level of investor enthusiasm in a certain asset leads it to be priced higher than its justifiable value (R16). As video games have become more accessible through online platforms such as Steam, there has become less of a need for physical video game stores like GameStop. Because of the low demand for physical copies of video games, GameStop was not a very profitable company, making it a target for short sellers. The rise of no-fee trading platforms along with the popularization of the Reddit r/WallStreetBets have increased the number of people interested in investing in the stock market, especially since there are no upfront costs. Although experienced traders anticipated the stock’s price to fall, new traders from younger generations wanting to spite the older generation bought the shorted stocks, increasing the value. The movement that sparked excitement for the stock, enforced through appealing memes on Reddit, garnered enough support for GameStop. The reason this exuberance is known as irrational is because these gains will not last forever like investors may want it to. As investors become greedy for profits, they tend to overlook the actual worth of the asset (R17). The excitement in investing can contribute to market bubbles which will eventually burst, causing widespread selling and the stock’s price to drop. When encountering heavy exuberance, it is important to always be mindful of an asset’s value and that its price may not always continue to increase.

3.4 Are the Young Getting the Wrong Message About the Nature of Stock Markets?

As technology progressed, reliance on using social media platforms to maintain connections has increased. Because information can be spread quickly and conveniently on social media, it is tempting to follow the sentiments regarding stocks instead of spending time analyzing charts and assessing risk. The Robinhood Phenomenon has especially heightened the expectations for returns in the stock market as a result of following a group because this was the first major market bubble burst for young investors. Many young investors are driven by greed and act as “noise traders,” making uninformed decisions regarding the buying and selling of stocks because they seek to make a large amount of money quickly, which has previously been reinforced by the rapid price increase of the GameStop stock where the value increased by over 1700% in just one week. However, the rapid decrease in prices that shortly followed the increase proved to many investors to not blindly follow other inexperienced investors and will cause them to be more cautious in the future (R13).

Noise traders contribute to the irrationality in the market because they trade without logic, causing the market to act abnormally. Compared to professional traders, noise traders make up the majority of users on trading platforms and can cause professional traders to lose money due to the high level of unpredictability they cause in the market (R6). In a world where commission-free trading accounts, like a Robinhood account, can be created in mere minutes with no skill required, investing has become extremely accessible to those from any background.

4. K-Pop’s Influence on the Fluctuations in the Korean Stock Market

4.1 Korean Pop Music and the Culture Behind it

K-Pop (Korean Pop Music) is a genre of music originating in South Korea that has become a global phenomenon in recent years. K-Pop not only includes pop music, but it is also used as an umbrella term for other genres of songs sung in the Korean language such as rock, rap, and R&B. What makes K-Pop songs so popular among audiences from various countries is the memorable choreographies that highlight each song. Dance moves from PSY’s “Gangnam Style,” Blackpink’s “DDU-DU DDU-DU,” and Sunmi’s “Gashina” are widely known and have even become part of social media dance challenges such as the “Random Play Dance” where dancers try to recreate as many of these dances as possible in a short time frame.

Those seeking to debut as a K-Pop artist, also known as a K-Pop “idol,” must audition for a South Korean entertainment company and if accepted, they must participate in rigorous daily training. From young ages, these trainees strengthen their singing, dancing, rapping and foreign language abilities and eventually debut either as a member of a group or as a solo artist. During this training period, which may last from as little as one day to over 15 years, trainees also attend school. It is also preferred for trainees to be young so that when they debut, they are more marketable to fellow young people, the target audience. In addition, K-Pop artists follow a strict no-dating rule, and they must always present themselves with a pure image to appeal to South Korean role model standards. This also allows fans to form a strong attachment to the artist (R11).

In addition to developing their talents, trainees may also undergo physical changes, such as plastic surgery and dieting, to appeal to the Korean beauty standard of pale faces and low weights (R18) Out of the millions of K-Pop trainees, only 0.1% of them get to debut as an artist and achieve the glory of a K-Pop idol while the rest may work different jobs in the entertainment industry. To even be selected to become a trainee is a thorough process. Applicants must pass several rounds of auditions and camera testing before being offered a contract to train under specialists at an entertainment company. Although there are hundreds of K-Pop entertainment agencies that train idols, the most influential are JYP Entertainment, SM Entertainment, YG Entertainment, and HYBE Corporation. These companies are known as the most well-respected and influential due to the popularity of their artists, whose music videos garner hundreds of millions of views leading to high profits.

4.2 Correlation Between Returns of Entertainment Companies and K-Pop Commentary

4.2.1 Tzuyu Taiwanese Flag Incident

In a 2015 online show, 16-year-old Taiwanese Twice member Tzuyu Chou was seen waving the Taiwanese flag. Although it may seem like an insignificant event, this incident caused major backlash from Chinese fans as tensions were high between China and Taiwan due to an imminent presidential election. During a time when other big entertainment agencies were expanding into the Chinese market, it was important for JYPE to have a positive reputation in China to remain competitive. In response to the uproar, Tzuyu issued an apology through JYP Entertainment, denouncing Taiwanese independence from China and agreeing to pause her promotions and activities in China (R9). This controversy was not only detrimental to Tzuyu’s image but also to her company’s stock price. The JYP Entertainment stock price dropped from 4,540 won ($3.96) to 4,140 won ($3.61), losing around 9% of its value and 13.6 million won ($11,868) across all shares (R9).

4.2.2 EXO’s Kris Wu Sues SM Entertainment

On May 15, 2014, EXO-M leader Kris Wu announced his leave from the group and filed a lawsuit against his company, SM Entertainment. He argued that his contract was unfair due to its uneven profit distribution, harmful working conditions, and excessive length. In 2016, he reached a settlement with the company so that he can freely pursue his music career in China and Canada. However, his contract with SM Entertainment is still valid until 2022, so if he wishes to promote in Korea or Japan he must do so under the company’s management. When this news was announced, SME’s stock price decreased 34% from 53,200 won ($46.43) to 35,000 won ($30.54) over the course of the month, causing the company to lose 356 billion won ($310 million).

4.2.3 B.I. LSD Scandal

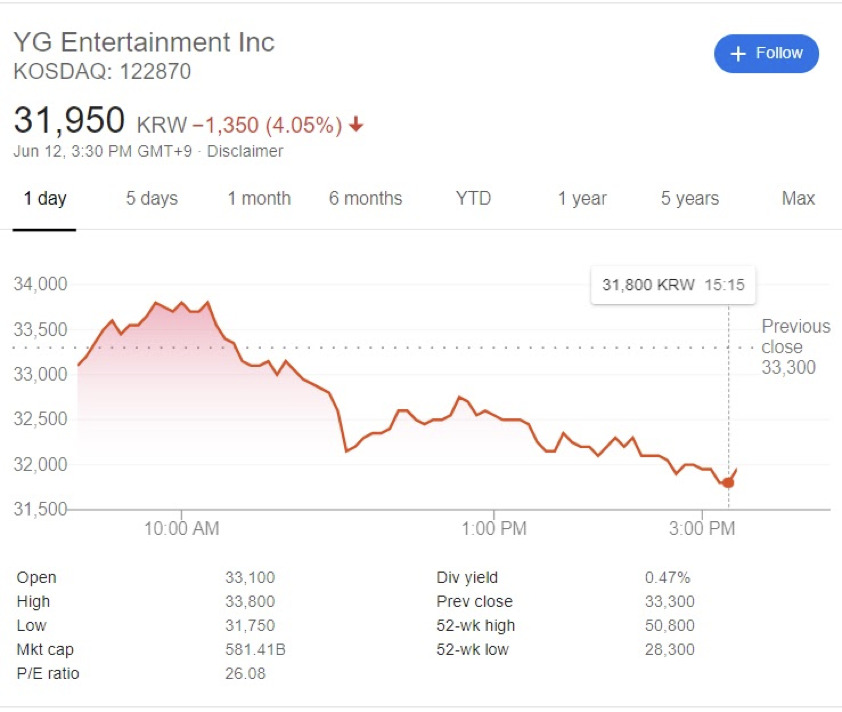

In 2019, messages from 2016 between iKON rapper Hanbin Kim (B.I.) and his acquaintance were revealed in which the artist inquired about purchasing LSD. Because of the expectation for K-Pop idols to act perfectly, this report caused B.I.’s pure image in the industry to become corrupted. As a result, he was forced to issue an apology, leave the group, and get edited out of promotions and variety shows despite writing most of iKON’s music. This controversy, which evoked a sense of anger among fans, caused YGE’s stock price to drop 4.05% from 33,299 won ($29.06) to 31,950 won ($27.88) just as it started to recover from the Burning Sun scandal earlier the previous year (R19).

4.2.4 Burning Sun Scandal

The Burning Sun incident, the most infamous scandal in K-Pop, shattered the innocent image of the industry as a whole. The scandal, named after the Burning Sun club in Gangnam, virtually ended the career of everyone involved. In early 2018, allegations of famous K-Pop stars drugging and raping women in the Burning Sun club and then sharing recordings of these incidents in a chatroom spread across the nation. Seungri, former member of BigBang under YG entertainment, was at the forefront of these crimes as he was a director of the Burning Sun club who engaged in illegal prostitution. Idols from many other popular groups such as F.T. Island, Highlight, and CNBLUE were also part of the chatroom where videos were exchanged. This prompted a protest on International Women’s Day to put an end to objectifying women. Furthermore, South Korean President Moon ordered investigations into the police force because of the accusations of covering up information related to not only the Burning Sun case but other crimes as well. Due to the Burning Sun controversy, fans sold their shares in YGE, making the company lose around 105 billion won in shares and also lost 55 million won from previous investors (R5).

4.3 Comparison Between K-Pop Stock Market Events and the Robinhood Phenomenon

When observing the circumstances surrounding both the Robinhood Phenomenon and stock market events related to the K-Pop industry, parallels can be seen. The main connection between the two are the psychological effects of social media on their respective stock prices. These various events have the commonality of being a major discussion topic across multiple social media platforms, reaching millions of people. Its widespread influential rhetoric caused many social media users to expand their horizons to try stock market investing for the first time, seeing the successes advertised on social media. These inexperienced investors are extremely influenced by their emotions and connections to a specific stock, whether that be the nostalgia from GameStop or the activities of their favorite K-Pop groups.

In both instances, there is also a general undertone of revenge. The GameStop short squeeze served as a movement for younger investors to make their voice heard among the older and wealthier generation. While experienced financial analysts bet against the stock price increasing, Reddit users pushed against them, raising the stock price and causing wealthy hedge funds to lose billions of dollars. With K-Pop scandals, overly attached fans sought revenge against the actions of certain artists and their companies. Since the fans are the backbone of the K-Pop artists, both in terms of merchandise sales and stock market shares, their opinions and support can shape the futures of entertainment companies’ finances.

Additionally, these events show the power of the general public as opposed to wealthy investors who traditionally have the most influence on the prices of shares. Robinhood’s no-fee trading platform is widely known to have “democratized” trading, allowing those with little money and experience to participate in trading, an activity previously associated with only the wealthy. With Korean entertainment companies going public in the 2010s and 2020s, K-Pop fans were able to take their dedication to the next level and make their voices heard by previously untouchable CEOs through buying and selling shares.

5. Concluding Remarks

By connecting major social media events with stock market volatility, we can conclude that there is a correlation between the two variables. The more a stock is mentioned on social media, the more noise traders will invest in it, causing high volatility in the market. In recent years, investing in the stock market has become more based on trader’s emotions rather than fundamental company analysis. K-Pop entertainment companies use their artists’ pure images to reflect back on company values, creating a direct connection between the two. Similarly, social media users create a positive association with a brand. This creates company loyalty which in turn leads to success in its stock market investments. When this image goes astray, losses are incurred.

When deeply examining the causes of the Robinhood Phenomenon, led by Reddit users, and K-Pop entertainment stock fluctuations, driven by dedicated fans, it can be seen that the psychological impacts of using social media platforms play a significant role. To avoid these psychological traps, it is important to keep in mind that most social media investors are inexperienced and solely serve to propagate a message for a short period of time. Another key point to remember is to avoid extreme biases, especially since social media users tend to only advertise their successes and make it seem as though investing in a certain stock will only bring rapid success.

Social media-related stock market events have opened doors for young investors to gain experience in the market. The major losses incurred from the GameStop and AMC short squeezes may have discouraged them from investing altogether, but their realization that investing in the stock market comes with as great of risks as returns should serve as a caution rather than an inhibitor. The pattern in findings from observing stock market behavior in relation to social media events will continue as technology progresses. As this progression occurs, future generations of investors will become even more connected to using social media to discuss their personal financial successes regarding stock market investing. Given the high volatility that this has caused, trading platforms may be more prepared to handle that type of situation in the future. In this shift to accessible trading accounts, more social media users may fall victim to the various psychological impacts of using both of these types of platforms, which can be easily avoided by being aware of them.

References

R1) Costola, Michele, et al. “On the ‘Mementum’ of Meme Stocks.” SSRN, 8 June 2021, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3861779.

R2) Long, Cheng, et al. “’I Just like the Stock’ versus ‘Fear and Loathing on Main Street’ : The Role of Reddit Sentiment in the GameStop Short Squeeze.” SSRN, 30 Apr. 2021, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3822315.

R3) Nguyen, Thien Hai, and Kiyoaki Shirai. “Topic Modeling Based Sentiment Analysis on Social Media for Stock Market Prediction.” ACL Anthology, July 2015, https://aclanthology.org/P15-1131/.

R4) Hu, Danqi, et al. “The Rise of Reddit: How Social Media Affects Retail Investors and Short-Sellers’ Roles in Price Discovery.” SSRN, 2 Apr. 2021, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3807655.

R5) “Stocks Held by K-Pop Agency Owners Plummet.” INQUIRER.net, 23 July 2019, https://business.inquirer.net/275197/stocks-held-by-k-pop-agency-owners-plummet.

R6) Eaton, Gregory W., et al. “Zero-Commission Individual Investors, High Frequency Traders, and Stock Market Quality.” SSRN, 1 Feb. 2021, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3776874.

R7) “Historical Returns on Stocks, Bonds and Bills: 1928-2020.” Welcome to Pages at the Stern School of Business, New York University, Jan. 2021, http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html.

R8) Messerlin, Patrick A., and Wonkyu Shin. “The K-Pop Wave: An Economic Analysis.” SSRN, 17 July 2013, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2294712.

R9) “JYP May Fall Further on Flag Incident.” Koreatimes, 17 Jan. 2016, https://www.koreatimes.co.kr/www/news/biz/2016/01/488_195614.html.

R10) Maverick, J.B. “What Is the Average Annual Return for the S&P 500?” Investopedia, Investopedia, 27 July 2021, https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp.

R11) Arnaud, Jourdan. “A Brief History of K-Pop.” The Los Angeles Film School, Jourdan Arnaud Https://Www.lafilm.edu/Wp-Content/Uploads/2020/03/Lafilm-Logo-2.Png, 7 Apr. 2021, https://www.lafilm.edu/blog/a-brief-history-of-kpop/.

R12) Dollarhide, Maya. “Social Media Definition.” Investopedia, Investopedia, 13 Sept. 2021, https://www.investopedia.com/terms/s/social-media.asp.

R13) “How a New Wave of Retail Investors Is Redefining Stock Pricing.” Knowledge@Wharton, July 2021, https://knowledge.wharton.upenn.edu/article/new-wave-of-retail-investors-is-redefining-stock-pricing/?utm_source=kw_newsletter&utm_medium=email&utm_campaign=2021-07-13.

R14) “Psychology and Investing.” Morningstar, 2004, http://news.morningstar.com/classroom2/course.asp?docId=145104&page=2&CN=sample.

R15) Downey, Lucas. “Sunk Cost Trap Definition.” Investopedia, Investopedia, 13 Sept. 2021, https://www.investopedia.com/terms/s/sunk-cost-trap.asp.

R16) Hayes, Adam. “Irrational Exuberance.” Investopedia, Investopedia, 4 Aug. 2021, https://www.investopedia.com/terms/i/irrationalexuberance.asp.

R17) Amadeo, Kimberly. “Irrational Exuberance, Its Quotes, Dangers, and Examples.” The Balance, Jan. 2021, https://www.thebalance.com/irrational-exuberance-quotes-dangers-and-examples-3305937.

R18) Adolph, Tamia. “The Destructive Side of Korean Beauty Standards.” The Tempest, 8 Oct. 2020, https://thetempest.co/2020/10/16/news/breakdown/korean-beauty-standards/.

R19) King, Ashley. “YG Entertainment’s Stock Plunges Following IKon’s Drug-Fueled Scandal.” Digital Music News, 13 June 2019, https://www.digitalmusicnews.com/2019/06/12/yg-stock-falls-after-ikon-drug-scandal/.

R20) Tepper, Taylor. “Should You Invest In The Robinhood IPO?” Forbes, Forbes Magazine, 25 Aug. 2021, https://www.forbes.com/advisor/investing/robinhood-ipo/.

R21) Lester, Caroline. “The Dark, Democratizing Power of the Social-Media Stock Market.” The New Yorker, 9 June 2021, https://www.newyorker.com/tech/annals-of-technology/the-dark-democratizing-power-of-the-social-media-stock-market.

R22) Hayes, Adam. “History of the Dutch Tulip Bulb Market’s Bubble.” Investopedia, Investopedia, 15 Sept. 2021, https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

About the author

Anusha Vangala

Anusha is a senior at Princeton High School with a passion for exploring the interconnectedness of the global economy, stock market investing In her free time, she enjoys leading her school’s fencing team, teaching Indian dance, and learning new languages.