Author: Stefanos Salas

Mentor: Dr. Isaac Dilanni

The Bronx High School of Science

Abstract

As companies look for the most efficient ways to deliver products to customers, the hub and spoke model of supply chain management has emerged as a determinant of success for companies operating in the retail and distribution and logistics sectors. This paper examines the supply chains of Walmart, Kmart, Target, Amazon, FedEx, and DHL, and argues that there is a direct correlation between the hub and spoke model of supply chain management and profitability. Walmart, the largest retailer in the world, has one of the largest and most efficient hub and spoke supply chains globally. When combined with its technological investments to improve efficiency, Walmart’s supply chain is the main contributor to its consistent profits. Furthermore, through the use of their hub and spoke networks, both FedEx and DHL have been able to maintain significant profits. Supply chain management is an important aspect of a company’s business model due to its role in ensuring operational efficiency and cost effectiveness by managing inventory and streamlining distribution; particularly the hub and spoke model of supply chain management is a determinant of the ultimate profitability for successful companies such as Walmart, FedEx, and DHL.

Introduction to Supply Chains

As e-commerce and consumer demand for physical products grow, companies look for the most efficient ways to deliver products to customers. This means that supply chain management has emerged as a critical determinant of success for many companies, especially those operating in the distribution and logistics, retail, and e-commerce sectors. A supply chain is characterized as the movement of goods and products along the stages of production and distribution. A good and effective supply chain often involves complicated planning and coordinating to ensure that these goods are produced and transported efficiently to meet customer demand. As a result, supply chain management, due to its role in ensuring operational efficiency and cost effectiveness by managing inventory and streamlining distribution, is an important aspect of the business model for these companies. Overall, a well-managed supply chain leads to greater customer satisfaction, higher profit margins, and in general, leads to successful performance for a company.

The Hub and Spoke Model

One of the most common and successful models of supply chain management used within the package delivery and retail sectors is the hub and spoke model. The hub and spoke model relies on a centralized “hub” location, which serves as the consolidation point within the supply chain. Products and packages come from their manufacturers, or senders, and arrive at consolidation centers which are the hub locations for the companies that utilize this method. At these hubs, advanced technological solutions and manpower are employed to sort, organize, and prepare packages to be sent to their destinations, usually by truck or plane. Once a package has passed through the central hub, it is loaded with other packages headed for the same geographical area; each individual geographic region is considered the “spoke.” There are numerous spokes, and each is a secondary location which is connected to the hub location and generally serves one geographic region. These spokes can take the form of fulfillment centers, distribution centers, or retail stores. In the case of package delivery companies, the packages are taken from these spokes and loaded onto trucks to be delivered on their “last mile” to people’s homes.

Thesis

Throughout this paper, we will examine the supply chains of some of the most successful and unsuccessful companies in the retail, e-commerce, and logistics industries, to answer the following question: Which is the most effective and efficient supply chain management model for companies in the retail, e-commerce, or logistics industries? From our analysis of these companies, we will argue that there is a direct correlation between the hub and spoke model of supply chain management and profitability.

Case Study 1: Walmart

Walmart was founded as a discount goods store by Sam Walton in 1962 in Rogers, Arkansas as ‘Walton’s 5 & 10’. Walton’s goal with his store was to provide the lowest possible prices for his customers. By 1967, there were 24 Walmart stores bringing in over $12 million in revenue, and in 1970, Walmart went public on the New York Stock Exchange at $16.50 per share. During the 1970s and 1980s, Walmart underwent massive expansion, operating in small towns throughout the United States, mostly catering to the low and middle class families who could benefit from Walmart’s low prices. In 1988, Walmart opened the first Walmart Supercenter which operated as a supermarket and sold general merchandise, providing customers with a one-stop-shop for anything they could need. More supercenters opened and were a key factor in Walmart’s rapid expansion. Today, in 2023, Walmart is the largest retailer in the world, employing over two million people and operating 10,545 stores in 20 different countries, 4,684 of which are in the United States.

The greatest contributor to Walmart’s success is its low pricing. Since its founding, Walmart has always provided its customers with the lowest prices available, and Walmart always took every step it could to ensure its customers got the best deal. The cornerstone of Walmart has been what it calls “Everyday Low Prices.” “Everyday low prices” means that Walmart consistently gives customers the lowest prices without having to worry about or rely on sales or coupons like other large retailers. As a consequence of its low prices, Walmart has an extremely low profit margin, causing the company to rely on the volume of its sales to ensure profitability. This means that an efficient supply chain is even more important for Walmart than for other companies.

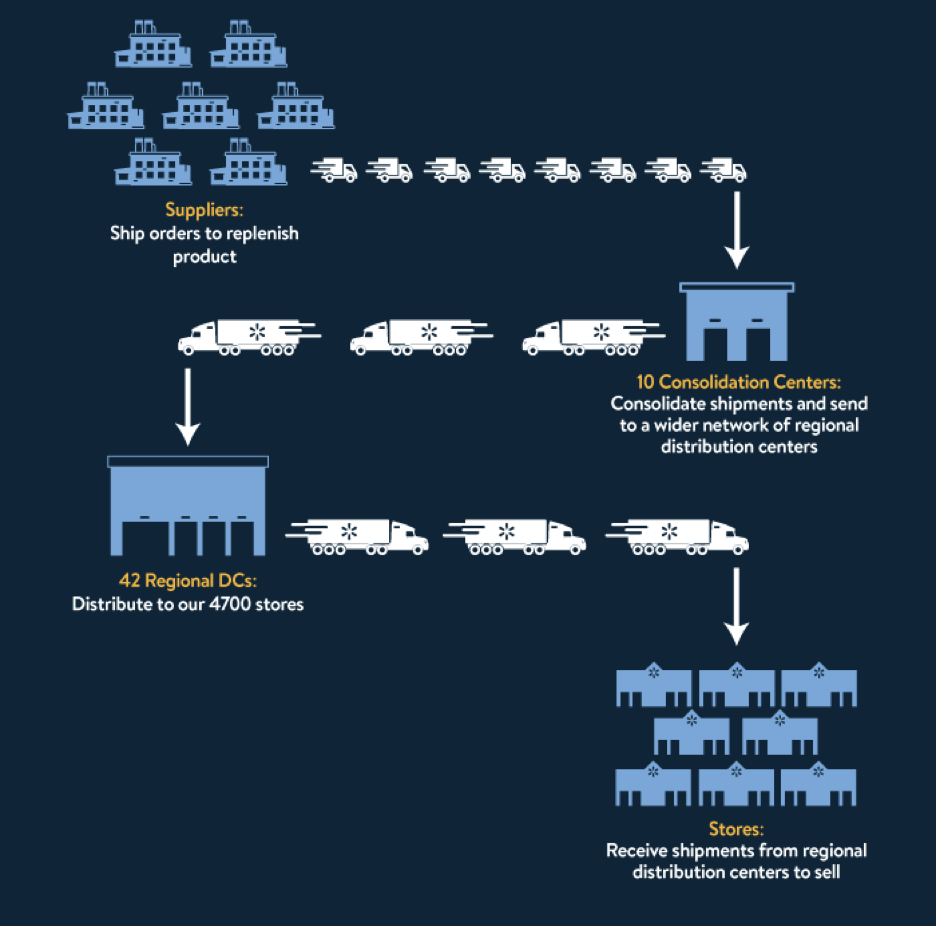

One of the most significant reasons Walmart is able to keep the prices on all of its goods so low is due to its efficient supply chain. Having a productive and effective supply chain allows Walmart to save as much money as possible. Walmart has accomplished this by using the hub and spoke system. Walmart utilizes a centralized hub in each region of the United States, where products, shipped by their suppliers, are brought to the centralized distribution center. From the centralized hub, products are consolidated and organized by employees and machines and brought to a more regional distribution center, where packages are once again organized and loaded onto trucks. From these distribution centers, Walmart utilizes its fleet of thousands of trucks to transport products to Walmart’s supercenter stores, where they are available for purchase by the customer. Walmart stores and distribution centers are strategically located so that every store is within a maximum of one day’s driving distance from a distribution center, which allows for maximum efficiency.

The hub and spoke system, along with the company’s heavy investments in their distribution centers and new technologies, allow it to manage its inventory with precision, minimizing excess stock and reducing costs associated with carrying extra inventory. These technological investments include the Retail Link System, which shares live inventory data with suppliers, allowing them to make more accurate and informed decisions related to restocking and inventory planning. Another technological investment made by Walmart to improve its supply chain was the adoption of RFID (radio frequency identification) tags, which track products through their distribution network and make sure the network works as efficiently as possible. It is estimated that Walmart saved $500 million per year due to the RFID system. In addition, Walmart is able to leverage its vast network of stores and their efficient and centralized system of distribution, leading to better deals with suppliers and reduced transportation costs. The hub and spoke model also enables swift replenishment of products, maintaining well-stocked shelves. The Walmart distribution system and supply chain, backed by data-driven decision-making from Walmart’s technological investments, is able to optimize inventory and respond to demand shifts. These benefits, which result in greater customer satisfaction and decreased expenses, ultimately lead to Walmart’s ability to make a profit (Mark & Johnson, 2019).

Case Study 2: Distribution, Delivery, and Logistics Companies – FedEx, DHL

FedEx and DHL are two of the largest transportation and logistics companies in the world. Together, the two companies control 65% of the American market with FedEx controlling 44% and DHL controlling 21%. These companies provide many shipping and logistics services to both businesses and individuals. One of their most important services is their package shipping and delivery service. Given that their main business is shipping packages, the most important aspect of their business model is an efficient supply chain. These companies use similar styles of supply chain, both using the hub and spoke model.

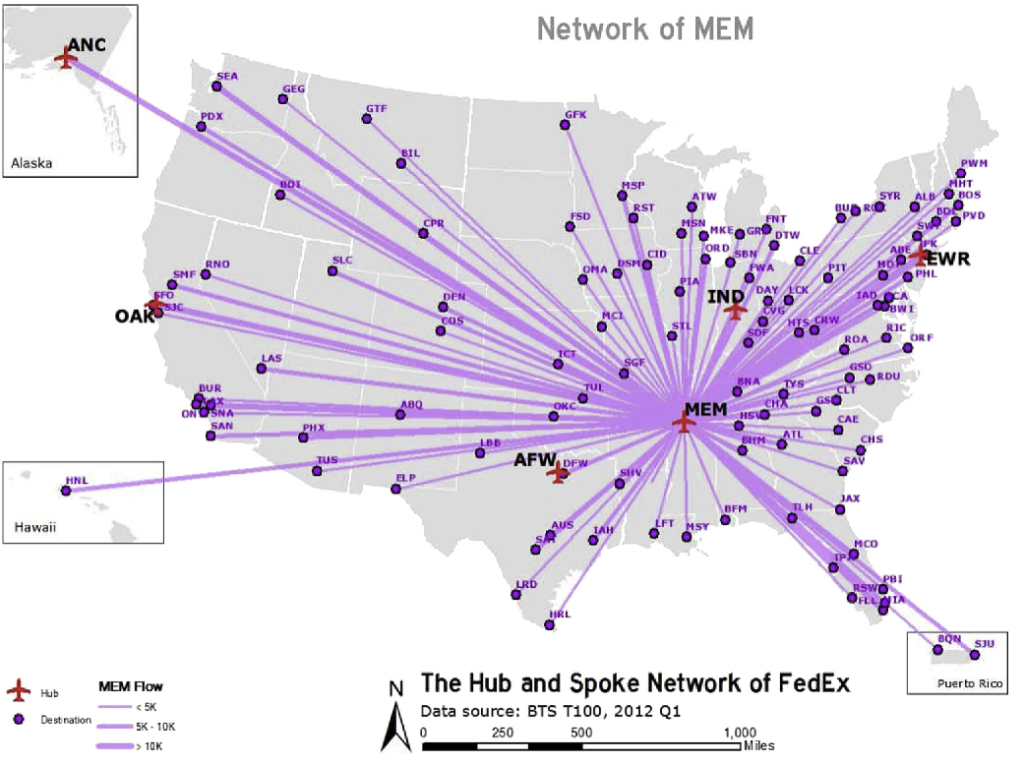

FedEx Memphis (MEM) Hub Flight Map (FedEx 2022)

Fedex Express uses a large network of hubs and distribution centers around the United States to deliver packages between customers. When the package is received, it is brought to one of Fedex’s local hubs and sortation centers, where the packages are organized and flown to one of Fedex’s eight central hubs, the biggest and most important of which is located in Memphis, Tennessee. From these large hubs, equipped with technology and hundreds of employees, the packages are flown to their destinations on one of Fedex’s over 700 cargo aircraft, where they are delivered by truck or van for the last mile to the final destination (FedEx 2022).

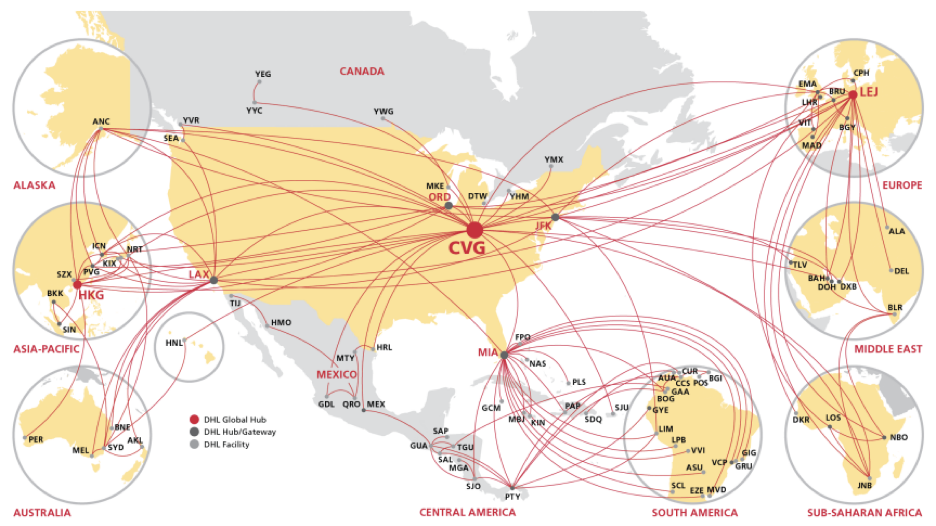

DHL Express, the DHL service that delivers packages between people, uses a hub and spoke system of distribution, primarily through its use of airplanes and airports. When DHL first receives a package from a customer, it goes to one of DHL’s 111 US sortation facilities for organization, and then is brought to one of DHL’s hubs in either New York, Miami, Los Angeles, Chicago, or Cincinnati. At these hubs, there are larger and more efficient sortation centers, and from here, packages are flown to the facility closest to the intended destination. From these facilities, they are loaded onto trucks and driven the last mile to their final destination (DHL 2018).

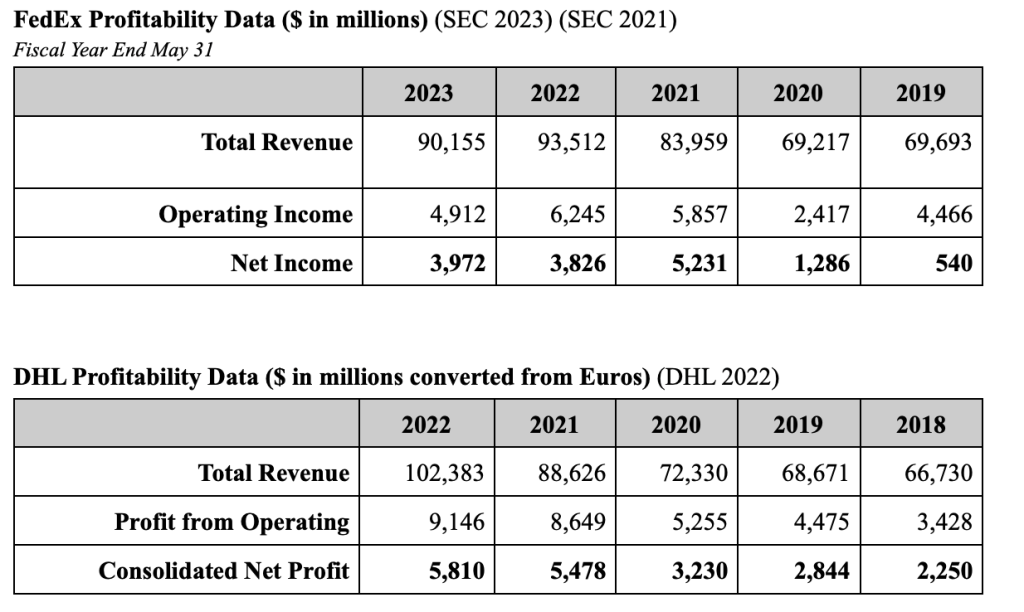

Both FedEx and DHL’s core businesses are based on package delivery; consequently, the supply chain strategy, distribution, and delivery networks are the basis of their business operations. Their use of the hub and spoke model in their delivery system allows FedEx and DHL to be two of the largest delivery companies in the world. Thus, the efficiency and effectiveness of their hub and spoke-based supply chain strategy directly contributes to the success and profitability of these two companies, as shown in the tables below.

Case Study 3: Kmart

Kmart, founded by Sebastian S. Kresge in 1899 as the S.S. Kresge Company, started as a small variety store in Detroit and soon expanded into a national discount goods chain. As the store gained popularity, it changed its name to Kmart and the first Kmart-named store was opened in 1962. Kmart continued to expand, and within the first year, had more than $483 million in corporate sales; by 1981, Kmart had opened 2000 stores (The New York Times 2002). Despite its success, Kmart began to face a decline in the late 1980s, and was overtaken by Walmart which became the largest retailer in the country. As Walmart continued to expand and have consistently lower prices than Kmart, Kmart continued to decline, closing hundreds of stores throughout the 1990s and early 2000s and declaring bankruptcy in 2002. Kmart then merged with Sears, another declining American retailer, however they faced continuous financial difficulties and were never able to revive their business.

Kmart was once the most popular discount retail store in the United States. During its height, Kmart was known for its Blue Light Special, which was the retailer’s way of implementing its low pricing strategy. This is when a company initially has a product listed at a higher price, but lowers the price through sales and promotions; in contrast, the EDLP strategy that retailers like Walmart use always lists every item at its lowest possible price. During the “Blue Light Special,” Kmart used a blue light in the store to inform customers which products would be going on sale (Porter 2022).

Ultimately, however, Kmart failed because it was unable to compete with Walmart’s low prices. This was largely due to a lack of a real distribution system and strategy. While both companies were in the process of transitioning to a supercenter-style store, Walmart with its supercenters and Kmart with its Super Kmarts, Walmart was able to organize its stores in clusters around one of its distribution centers in the hub and spoke system, allowing Walmart to create an efficient distribution process. Kmart, however, not only had far fewer Super Kmarts, but these Super Kmarts were scattered throughout the country, making it difficult to create a distribution network. In addition, in Kmart’s supermarket/grocery business, which was the most significant part of both Walmart and Kmart’s supercenters, Kmart tried to compete against Walmart on both price and quality through a partnership with Fleming Foods. This caused Kmart to not build a private distribution network, something that was a necessity for a company trying to become a national leader (Graff 2006). As a result of Kmart’s lack of a distribution network and strategy, the retailer was unable to compete with the low Walmart prices that resulted from its efficient hub and spoke supply chain and distribution model. This ultimately led Kmart to lose money and eventually declare bankruptcy.

Counterargument Case Study 1: Amazon

Amazon was founded in 1994 by Jeff Bezos as an online bookstore to offer an alternative to traditional brick and mortar bookstores such as Barnes & Noble. In 1997, Amazon went public on the NASDAQ and in 1998, Amazon expanded from selling books, to selling everything online. In 1999, Amazon reached a high stock price of $113 at the height of the dot com era, however it would soon crash down to a low of $5.50 per share. Despite this, Amazon was able to survive the crash and continued to expand; in 2005, Amazon introduced Amazon Prime, a subscription service which promised free two-day shipping, and further expanded Amazon’s growing market share. As of 2023, Amazon dominates the e-commerce market with a 37.8% market share.

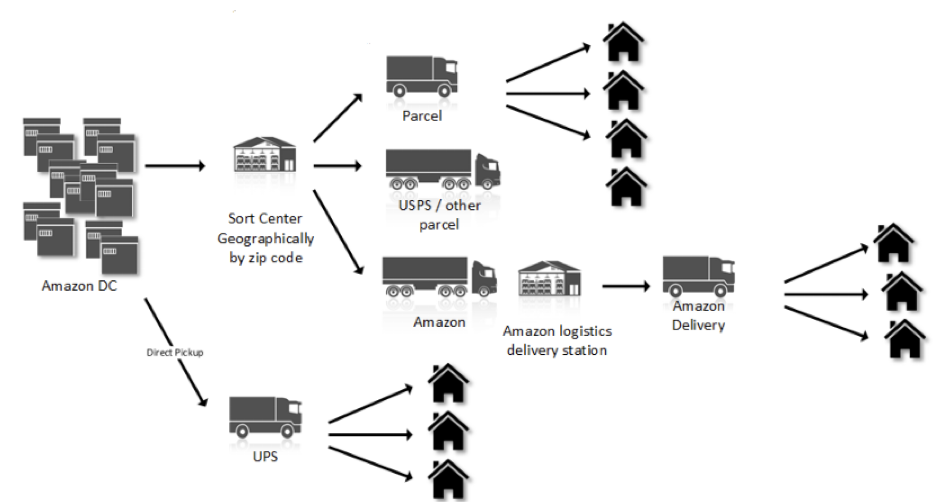

Until recently, Amazon had also used the hub and spoke supply chain management strategy. In this system, after a package was ordered online, it was picked by the combination of Amazon employees assisted by high tech robots in the Amazon distribution center closest to the location of the order. After the product was picked, it was packaged and shipped to an Amazon fulfillment center where products were organized, sorted, and prepared for shipment. These large fulfillment centers were Amazon’s hubs. Packages were then transported by truck or airplane to smaller regional distribution centers, which were the spokes in Amazon’s supply chain. From here, Amazon used multiple different methods to deliver packages to a customer’s house, including using their own trucks as well as using independent contractors through the Amazon Flex program.

Amazon Logistics Process:

Diagram of Amazon’s Hub and Spoke Infrastructure and Distribution System (Avelar 2020)

Despite continuing to use much of the already established infrastructure from their hub and spoke distribution system, in 2022 and 2023, Amazon shifted away from the hub and spoke system and toward a more local approach, dividing the country into eight regions, each with its own local distribution facilities. Since this switch, Amazon has experienced a dramatic increase in its delivery speeds due to a 15% reduction in distance driven between the distribution center and the customer, and a 12% reduction in the amount of times the package is handled. Since this shift, Amazon says that it has delivered the majority of Prime packages within one day or less in the large metro areas Amazon serves. In addition, Amazon says that these increased delivery speeds are causing customers to increase the amount they choose to buy from Amazon over another retailer (Palmer 2023).

Prior to its shift in supply chain strategy, Amazon’s online retail business did not directly contribute to its profit. In fact, Amazon loses money on most Amazon Prime orders due to the high cost of shipping (Byrnes 2020). Since this switch in strategy, Amazon continues to be unprofitable; the entire company reported a negative net income in 2022 (Amazon Inc. 2022). However, Amazon’s retail business is extremely useful to the retailer because it allows the company to run advertisements on its website, which is one of the most profitable parts of its business (Dennis 2022). Despite having a complicated and efficient supply chain in both its use of the hub and spoke method and its shift to a more regional system, the supply chain has not had a direct impact on Amazon’s profitability and success as a company. However, its regional approach has shown to be a more effective option for Amazon’s business model, as it produces faster delivery speeds, causing more customers to return to Amazon, and thus increasing the size of Amazon’s advertising business.

Counterargument Case Study 2: Target

Target was founded in 1962 as a subsidiary of the Dayton’s Department Store empire. During this time, Dayton’s was expanding into many different sectors such as jewelry and bookstores, and was constantly opening new stores within malls. Target was opened as a discount goods retail store and unlike other discount stores like Walmart, Target always had access to capital since Target was backed by Dayton’s. Target quickly proved to be the most successful of Dayton’s subsidiaries, so Dayton’s began to buy more and more department and general stores while divesting from the other subsidiaries. Eventually, Target surpassed Dayton’s and the company changed its name to the Target Corporation and sold all of its other stores, allowing it to have more capital to invest in the Target stores. In 1979, Target had its first year with over $1 billion in sales and by 1989, it had 400 stores across the United States (Target).

In 1995, Target expanded into selling everything including groceries, and shifted to adopting a supercenter-style store similar to Walmart and Kmart called SuperTargets. Despite the fact that Target experienced slower growth than Walmart, Target still had 100 SuperTargets opened by 2006. With fewer retail locations, Target did not have the concentration of stores to build its own distribution system the way that Walmart did (Graff 2006). Instead, Target offered higher quality discount goods compared to Walmart and Kmart, and focused more on middle to upper class consumers. Even without a distribution system, by targeting a different customer demographic from that of Walmart and Kmart, Target was still able to remain profitable.

More recently, Target has invested heavily in its distribution network due to the rise of the internet and Target’s expanding e-commerce business. Over the next three years, Target said it would invest $100 million into improving its next day delivery service by building more sortation centers and warehouses. Part of Target’s strategy also includes using its stores as distribution centers, with employees picking out the products from the store to be delivered to the customer (Young 2023). Despite Target’s use of different distribution and supply chain strategies compared to Walmart’s hub and spoke system, Target has been able to remain profitable and competitive because it targets a different demographic customer base and continues to provide a higher quality of discount goods.

Conclusions

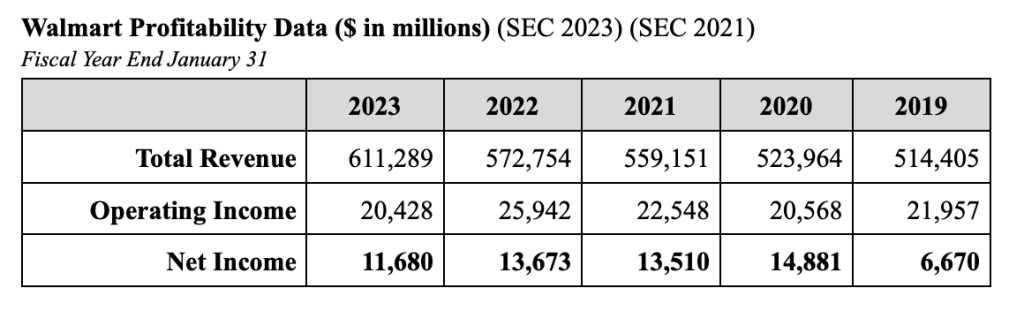

This study and exploration of the supply chain and distribution networks of numerous companies concludes that the hub and spoke system is the most reliable and efficient method. Walmart, the largest retailer in the world, has one of the largest and most efficient hub and spoke supply chains in the world. When combined with its technological investments to improve efficiency, Walmart’s supply chain is the main contributor to its consistent profits as illustrated by its profitability data. Walmart’s supply chain is also superior to that of other large retailers such as Target, or failed retailers such as Kmart. During Kmart’s expansion, it was unable to build a network of supercenters around a common distribution center the way that Walmart has successfully done. Due to its lack of an organized supply chain network, Kmart was unable to compete with the low prices offered by Walmart. In the case of Target, the retailer has been able to maintain profitability despite not using a hub and spoke distribution model. However, this is not because of the superiority of its network. Target’s success is a result of the fact that it is not actually in direct competition with Walmart and Walmart’s supply chain. Target has been able to avoid direct competition by marketing its products as a higher quality product, attracting more middle to upper class customers who would be less interested in Walmart’s cheaper products; this allows Target to charge slightly higher prices but still maintain its consumer base.

In the case of Amazon and the delivery companies FedEx and DHL, while FedEx and DHL may not be companies that are as large as Amazon, the supply chains of these package delivery companies have contributed more directly to their success and profitability. Because they do not have an online platform the way Amazon does, FedEx and DHL are almost completely reliant on their supply chain and distribution networks to make money. Through the use of their hub and spoke networks, both FedEx and DHL have been able to make significant and consistent profit. Amazon, on the other hand, loses money on most orders it fulfills through Amazon Prime. While Amazon’s delivery system has improved since it has moved toward a more local and regional supply chain approach, Amazon still continues to rely completely on advertisements on its e-commerce website to make up for the money lost by its supply chain and delivery costs. Supply chain management is an important aspect of a company’s business model due to its role in ensuring operational efficiency and cost effectiveness by managing inventory and streamlining distribution; particularly the hub and spoke model of supply chain management is a determinant of a company’s ultimate profitability as evidenced by the financials of successful companies such as Walmart, FedEx, and DHL.

Bibliography / Sources Cited

Amazon Inc. (2022). Form 10-K. https://www.sec.gov/ix?doc=/Archives/edgar/data/1018724/000101872423000004/amzn-20221231.htm#icc32c5c732854b7f9975929c57cd5bd4_88

Avelar, P. (2020, April 4). Talking about the Amazon Logistics Network. Advanced Solutions. https://www.advsolutionpros.com/amazon-transportation-network

Byrnes, N. (2020, April 2). How Amazon loses on prime and still wins. MIT Technology Review. https://www.technologyreview.com/2016/07/12/158869/how-amazon-loses-on-prime-and-still-wins/

Dennis, S. (2022, February 11). What we get so very wrong about Amazon’s retail profitability. Forbes. https://www.forbes.com/sites/stevendennis/2022/02/07/what-we-get-so-very-wrong-about-amazons-retail-profitability/?sh=52f93b3321aa

Deutsche Post DHL Group. (2022) Annual Report https://www.dpdhl.com/content/dam/dpdhl/en/media-center/investors/documents/annual-reports/DPDHL-2022-Annual-Report.pdf

DHL. (2018). DHL Express in the U.S. – dhlpro.com. https://dhlpro.com/media/37004/dhl-express-usa-overview_en.pdf

FedEx Corporation. (2023). Form 10-K. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001048911/000095017023033201/fdx-20230531.htm#item_8_financial_statements_supplementar

FedEx Corporation. (2021). Form 10-K. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001048911/000156459021037031/fdx-10k_20210531.htm#ITEM_8_FINANCIAL_STATEMENTS_SUPPLEMENTAR

Graff, T. O. (2006). Unequal competition among chains of supercenters: Kmart, Target, and Wal-Mart. The Professional Geographer, 58(1), 54–64. https://doi.org/10.1111/j.1467-9272.2006.00511.x

Mark, K., & Johnson, P. F. (2019). Walmart: Supply Chain Management. Ivey Business School Foundation.

Palmer, A. (2023, July 31). Amazon says it’s delivering more packages in one day or less after overhauling delivery network. CNBC. https://www.cnbc.com/2023/07/31/amazon-says-its-delivering-more-products-than-ever-in-one-day-or-less.html

Porter, D. (2022, April 11). Kmart was once a retail powerhouse. Now just a handful of stores remain in the U.S. PBS. https://www.pbs.org/newshour/nation/kmart-was-once-a-retail-powerhouse-now-just-a-handful-of-stores-remain-in-the-u-s

Smith, M. (2019, January 14). High-Tech Consolidation Center set to open in July, adding efficiency to Walmart’s supply chain. Corporate. https://corporate.walmart.com/newsroom/2019/01/14/high-tech-consolidation-center-set-to-open-in-july-adding-efficiency-to-walmarts-supply-chain

Spot on USA – FedEx. (n.d.). https://www.fedex.com/content/dam/fedex/eu-europe/downloads/US_infographic_2021_en.pdf

Target. (n.d.). Target history timeline. Target Corporate. https://corporate.target.com/about/purpose-history/History-Timeline?era=2

The New York Times. (2002, January 21). A History of Kmart. https://www.nytimes.com/2002/01/21/business/a-history-of-kmart.html

Walmart Inc. (2021) Form 10-K. https://www.sec.gov/ix?doc=/Archives/edgar/data/0000104169/000010416921000033/wmt-20210131.htm#iaaf0cabf1f7048c9b7e317b3e9c1cfc5_115

Walmart Inc. (2023) Form 10-K. https://www.sec.gov/ix?doc=/Archives/edgar/data/104169/000010416923000020/wmt-20230131.htm#ic0762e37664541589e0e296d7f31d4ab_115

Young, L. (2023, June 2). Target investing $100 million to expand next-day delivery. The Wall Street Journal. https://www.wsj.com/articles/target-investing-100-million-to-expand-next-day-delivery-291269c

About the author

Stefanos Salas

Stefanos is a senior at The Bronx High School of Science in New York City. He is interested in economics and entrepreneurship, a competitive swimmer, and captain of the Bronx Science swim team.